On June 13, 2025, AgriS disclosed detailed information on the matters for which it sought shareholders’ approval in writing, following the Board of Directors’ approval at their meeting on June 11. The Company proposed two key agenda items for shareholder consideration and approval: adjusting certain business lines to ensure 100% foreign ownership, and an employee stock ownership plan (ESOP).

The first agenda item regarding the adjustment of certain business lines aims to comply with new legal regulations and ensure the maintenance of 100% foreign ownership in the context of evolving laws related to foreign investment limits.

AgriS’s Board of Directors remains committed to maximizing foreign ownership and proactively reviewing and removing any technical barriers that may impact foreign investors as industry-specific regulations evolve. This move also aligns with the Company’s long-term strategy to attract additional high-quality capital from international financial institutions ahead of Vietnam’s stock market upgrade.

For the second agenda item, AgriS proposed the issuance of 40,727,251 shares, equivalent to 4.87% of the Company’s charter capital, under the ESOP. The program is expected to create long-term incentives, enhance employee engagement, and provide the necessary resources for the Company’s critical transitions in its new development phase (2025-2030).

AgriS Accelerates Expansion and Collaboration, Anticipating Foreign Capital Ahead of Market Upgrade

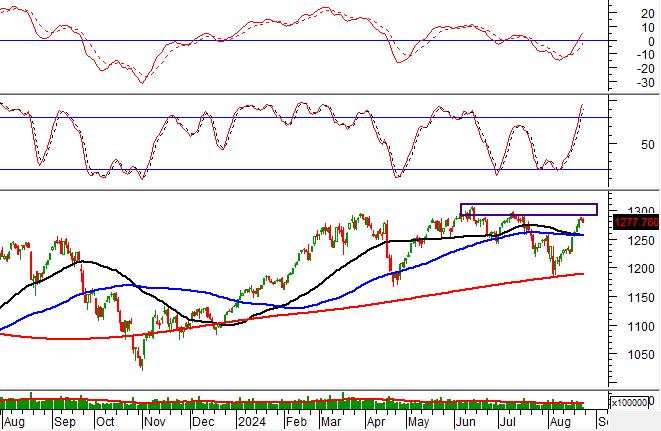

Vietnam’s stock market is approaching a significant milestone in its journey from frontier to emerging market status. Global organizations such as FTSE Russell and MSCI have acknowledged the country’s positive progress in terms of transparency, liquidity, and institutional reforms. Specifically, FTSE is expected to upgrade Vietnam’s status in September 2025, while MSCI may include the country on its watchlist for a potential upgrade this year.

In this context, AgriS has taken a proactive approach by expanding its international collaborations and facilitating foreign investment inflows, implementing a long-term strategy to seize opportunities arising from the market upgrade. This vision is also consistently guided by the Company’s leadership, as reflected in the recent statement by the Chairwoman of the Board of Directors, Ms. Đặng Huỳnh Ức My: “In our development strategy for the period of 2025–2030, AgriS will actively expand our international presence, not only in terms of market reach but also by focusing on the application of agricultural science and technology in production in foreign markets. This demonstrates our orientation towards becoming a globally integrated agricultural enterprise, proactively transferring technology, enhancing product value, and strengthening AgriS’s position in the international agricultural value chain.”

Ms. Đặng Huỳnh Ức My, Chairwoman of AgriS’s Board of Directors, shares insights on the strategy to elevate Vietnamese agriculture in the global value chain during the 2025-2030 period

AgriS is actively pursuing a global integration strategy by expanding collaborations with international partners across various domains, ranging from attracting high-quality capital to technology transfer and sustainable development.

Recently, on May 7, 2025, a subsidiary of AgriS, Bien Hoa Consumer Goods Joint Stock Company (BHC), successfully raised investment capital by selling a 12% stake to UOB Venture Management (Singapore). Additionally, during May, AgriS established green credit relationships with Mizuho Bank (Japan) and First Bank (Taiwan, China) and collaborated with IFC to implement an environmental and social management system, targeting net-zero emissions by 2035.

In terms of scientific and technological advancements and market expansion, AgriS is partnering with Austrade (Australia), Nanyang Technological University (Singapore), and Sungai Budi Group (Indonesia) to establish R&D centers and deploy advanced circular agriculture models in raw material regions and manufacturing facilities, enhancing the value of the agricultural supply chain on a global scale.

Bien Hoa Consumer Goods Joint Stock Company, a subsidiary of AgriS, successfully raises capital from UOB Venture Management Pte Ltd.

As of the end of May 2025, foreign ownership in AgriS exceeded 21%, nearly doubling compared to the same period in May 2024. This growth reflects foreign investors’ confidence in the Company’s solid fundamentals, clear development strategy, and long-term growth potential.

By proactively refining the legal framework to maintain maximum foreign ownership and expanding strategic collaborations with global partners, AgriS is actively strengthening its fundamentals, enhancing its competitiveness, and increasing its appeal to international capital.

With Vietnam’s stock market approaching significant upgrade milestones, these well-planned steps and long-term vision position AgriS to seize emerging opportunities and solidify its standing as a high-tech agricultural enterprise capable of adapting and thriving in the global marketplace.

“Bidiphar Locks in 20% Dividend, Prepares for ESOP Issuance at VND 10,000 per Share”

“Bidiphar Joint Stock Company of Pharmaceutical and Medical Equipment (Bidiphar), listed on the Ho Chi Minh Stock Exchange (HOSE: DBD), has announced a generous cash dividend for its shareholders. For the year 2024, the company plans to distribute a dividend of 20%, totaling over VND 187 billion. In addition, the company is preparing to offer nearly one million ESOP shares at a price of VND 10,000 per share, showcasing their commitment to rewarding investors and fostering growth.”

“AgriS Proposes 100% Foreign Ownership to Shareholders, Accelerating International Partnerships”

The Ho Chi Minh City Stock Exchange-listed company, Thanh Thanh Cong – Bien Hoa Joint Stock Company (AgriS), is seeking shareholder approval for its strategic initiatives. With the Vietnamese stock market on the cusp of a potential upgrade, AgriS (HOSE: SBT) is poised to expand its international cooperation and seize new opportunities.

The VNG’s Predicament: Facing Fourth Consecutive Year of Losses, Offers ESOP Shares at a Bargain

After three consecutive years of losses, VNG is planning to continue its losing streak with an expected loss of 561 billion VND in 2025. The company intends to issue 418,807 ESOP shares at a price point a staggering 91% lower than the market value.