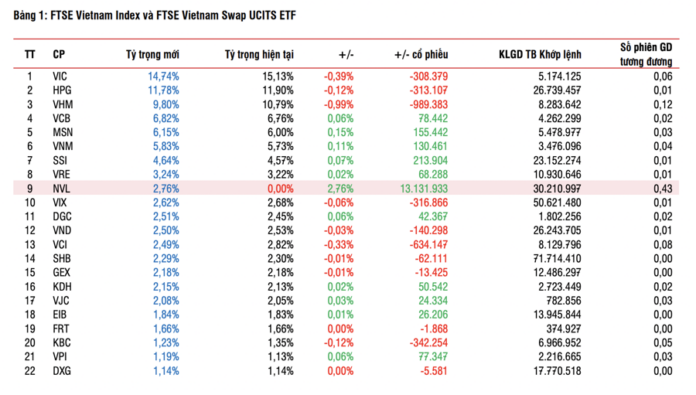

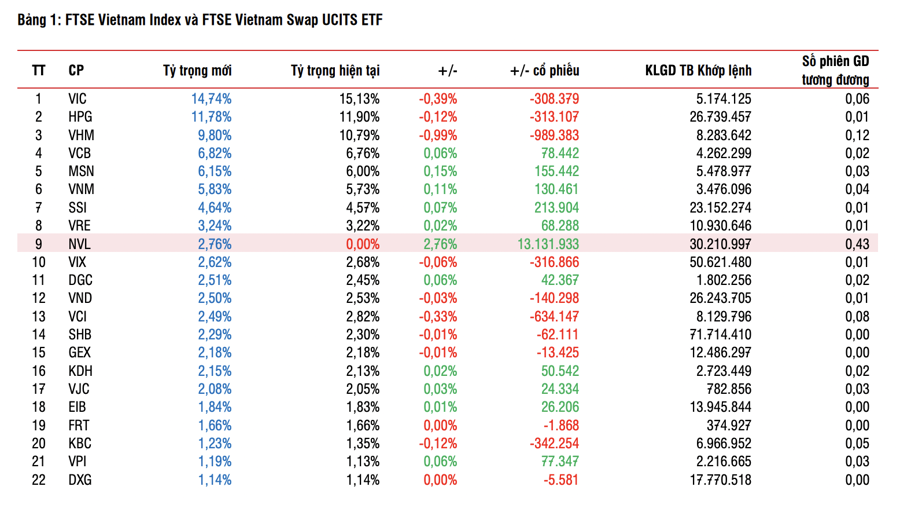

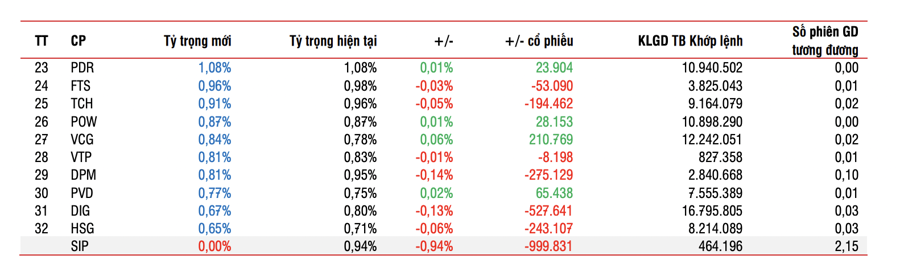

FTSE Russell and MVIS recently announced the results of their new index constituents. The new portfolio will take effect on June 23, with related ETFs expected to complete their portfolio restructuring by Friday (June 20).

Here are the specific changes: FTSE Vietnam Index adds NVL and removes SIP from the index.

FTSE Vietnam All-share Index: Adds NVL and BSR, removes CMG, DGW, and KDC from the index. As there are no ETFs directly using this index, these changes will not impact the stocks.

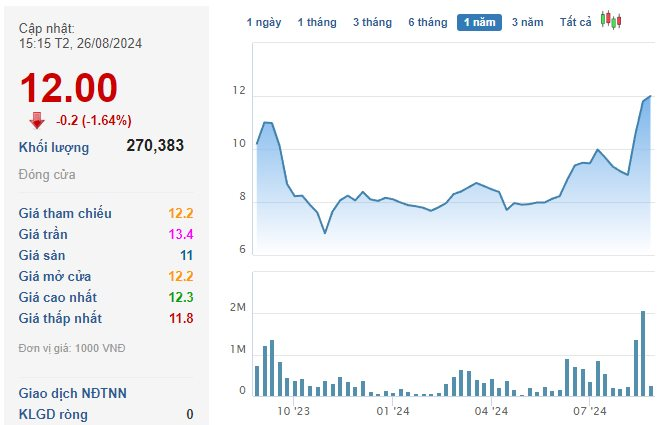

The FTSE Vietnam Swap UCITS ETF has a total asset value of VND 6.8 trillion (USD 261.4 million) as of June 12. Based on the new index portfolio results, SSI Research estimates that the FTSE Vietnam Swap UCITS ETF will trade as follows: On the buying side, the fund will purchase 13 million NVL shares and additionally buy 295,000 VRE shares.

On the selling side, the fund will offload 308,000 VIC shares, 989,000 VHM shares, and 999,000 SIP shares. Additionally, the fund may significantly buy SSI and VCG, and sell VCI and DIG, according to calculations.

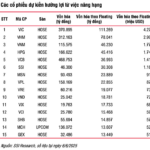

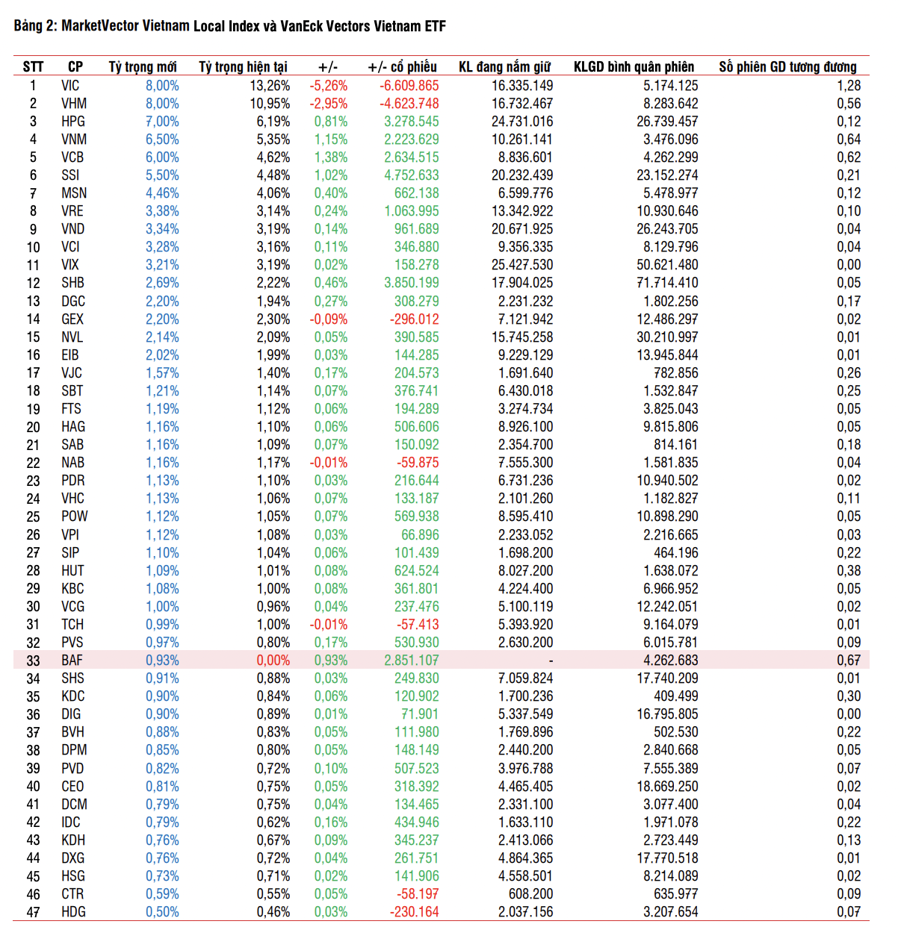

For the MarketVector Vietnam Local Index, the index constituent changes are as follows: Add BAF stock with no deletions. The index portfolio now includes 47 stocks.

Explaining BAF’s inclusion in the index, SSI Research attributes it to the company’s strong performance as of May 30, 2025. Its float-adjusted market capitalization increased by 39.7% since the previous stock screening, rising from VND 3.7 trillion to VND 5.1 trillion. This improvement propelled BAF into the top 85% of float-adjusted market capitalization among eligible stocks.

The increase in float-adjusted market capitalization can be largely attributed to the private placement of 65 million shares on March 25, 2025, which significantly boosted the number of outstanding shares and market capitalization. As a result, the number of free-float shares increased by 39 million, causing the free-float ratio to rise to 48% from 47% pre-issuance. Additionally, the positive stock price performance during this period also contributed to the increase in market capitalization.

As of June 12, the VanEck Vectors Vietnam ETF had a total net asset value of VND 10.7 trillion (USD 411.7 million), slightly lower than our previous report on June 3. SSI Research estimates that the VanEck Vectors Vietnam ETF will adjust its stock portfolio as follows: On the buying side, the fund will purchase 2.8 million BAF shares and 1 million VRE shares. On the selling side, the fund will offload 6.6 million VIC shares and 4.6 million VHM shares.

Additionally, according to SSI Research calculations, the fund may significantly buy SSI, SHB, HPG, and VCB, while on the selling side, apart from VIC and VHM, the selling pressure on other stocks is estimated to be insignificant.

The Soaring Oil Prices: A Wave of Opportunities in the Energy Sector?

The energy sector witnessed a remarkable surge amidst a sea of red in the stock market, defying the prevailing concerns over escalating geopolitical tensions.

Two Foreign ETFs Are Expected to Offload 15 Million VIC and VHM Shares

According to MBS’s forecast, Vingroup’s stocks (VIC and VHM) are expected to witness significant selling pressure during the upcoming rebalancing of the two foreign ETFs. This is due to their strong performance in the second quarter, which has pushed their weights beyond the allowable limits in both the FTSE and VNM ETFs. On the buying side, EIB, HPG, and NAB are expected to be among the prominent stocks in terms of purchase volume.