The recent regulations regarding electronic invoicing have been a hot topic for tens of thousands of businesses lately. Decree 70/2025/ND-CP, effective from June 1st, mandates that businesses with an annual revenue of VND 1 billion and above, across various industries such as catering, restaurants, hotels, supermarkets, and retail, must issue electronic invoices created from cash registers with data connectivity to the tax authority, instead of the previous lump-sum tax payment.

This is an important step in the digitalization journey, promoting transparent transactions and simplified tax management. However, small businesses often lack deep technological knowledge and skills in using electronic invoicing software, so many retailers, restaurants, and shops have faced challenges in implementation, from information gaps to procedural errors. These mistakes not only waste time but also potentially lead to legal risks.

Grappling for Solutions

One common issue faced by business owners is uncertainty about how to register for electronic invoicing. Many are confused about where to start, leading to delays or incorrect procedures. To prevent this, seeking information from the portal of the General Department of Taxation or consulting reputable units will ensure a smoother process.

Another challenge is choosing software that is incompatible with the current point-of-sale (POS) system. This disrupts transaction management and increases manual workload. Delayed data transmission to the tax authority is also a notable risk, which can be mitigated by using software that automates this process.

Additionally, errors in issuing invoices at the wrong time or storing them incorrectly may occur with the adoption of electronic invoicing.

Ms. Lan, the owner of a small café in Hanoi, shared her concerns: “When I heard about the electronic invoicing regulation, I was worried because I didn’t know where to start. There’s a lot of information online, and many software applications for managing sales. The costs vary widely, with some providers charging VND 5 million for installation, while others charge VND 10 million. I’m also worried about how to handle any issues that may arise during use.”

Struggles like Ms. Lan’s are not unique, reflecting the challenges many businesses face in transitioning to electronic invoicing.

Comprehensive Solution: Digistore by BVBank

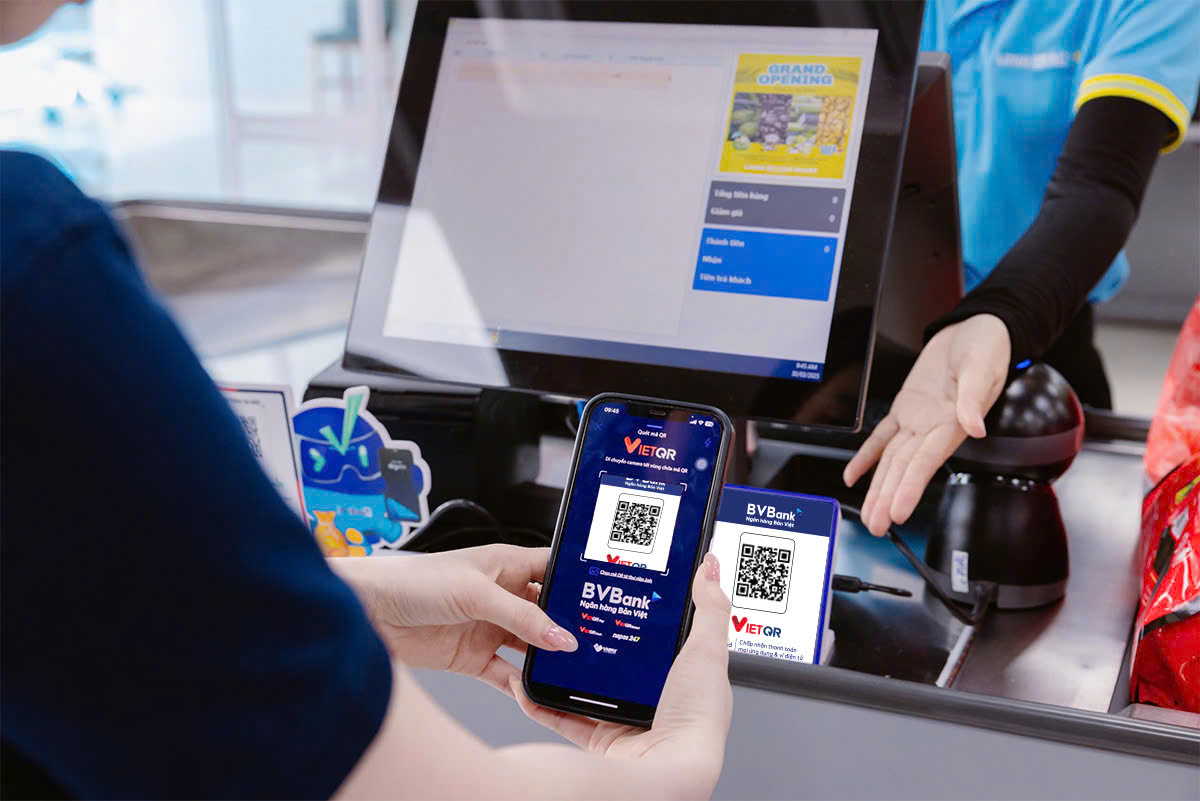

To support businesses in overcoming these challenges, BVBank recently introduced Digistore, a comprehensive digital payment solution designed specifically for retailers, restaurants, and shops.

Digistore enables the issuance of valid electronic invoices immediately after a transaction is completed, along with convenient storage and retrieval of invoices on mobile phones or computers. The system manages revenue in real-time, supporting transaction tracking at any time, even on holidays and weekends.

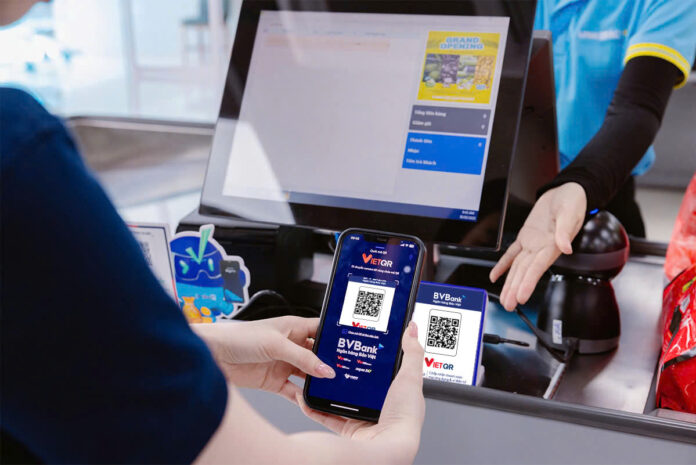

Notably, this solution integrates diverse payment methods such as QR codes, cards, or cash, providing centralized and efficient management. Digistore stands out with its built-in electronic invoicing capability, eliminating the need for separate software, along with the PaySound machine that quickly reads transaction amounts within a second. Businesses can also check the status of funds transferred to their account directly on the system, ensuring transparency and accuracy.

This solution has attracted the interest of thousands of businesses as the bank offers free consultations, on-site installation guidance, and attractive promotional packages. Customers with concerns or queries about implementing electronic invoicing will receive dedicated support. Notably, the bank’s customers can use Digistore for free until the end of September 2025, along with a reasonable cost for the comprehensive solution package.

While the initial implementation of electronic invoicing may present challenges, with solutions like Digistore, the new regulations need not be an obstacle. Businesses can focus on their core operations, confident that tax and management requirements are being handled professionally.

“Securing Deposits: Strategies to Mitigate CASA Ratio Decline Risks”

“The CASA ratio, a key metric in the banking industry, reflects a bank’s ability to source low-cost funds. However, a recent trend among businesses, especially small enterprises, to refuse transfers and accept only cash payments, poses a significant threat to banks’ CASA deposits. This development underscores the challenge banks face in maintaining a stable source of low-cost funds and highlights the potential impact on their overall financial health and stability.”

What are the Scenarios that Disqualify Individuals from Withdrawing Social Insurance Benefits in One Go, Effective July 1st?

The new Social Insurance Law of 2024 will come into force on July 1st, 2025, with significant revisions and additions to its provisions. One of the key highlights of this updated legislation is the introduction of a new one-time social insurance regime, marking a pivotal change in social security benefits for citizens.

Unannounced Inspection at Kim Bien Market

The authorities conducted surprise and regular inspections of Kim Bien Market to prevent hazardous chemicals from posing a threat to public safety.

The Port City Halts Land-Use Conversion for Households and Individuals

In recent times, there have been instances of unauthorized land-use conversions in certain districts of Hai Phong City, particularly during the provincial consolidation, social reorganization, and dissolution of the district-level government. As a response, the city of Hai Phong has issued a temporary halt on accepting and processing land-use conversion applications to address these issues.