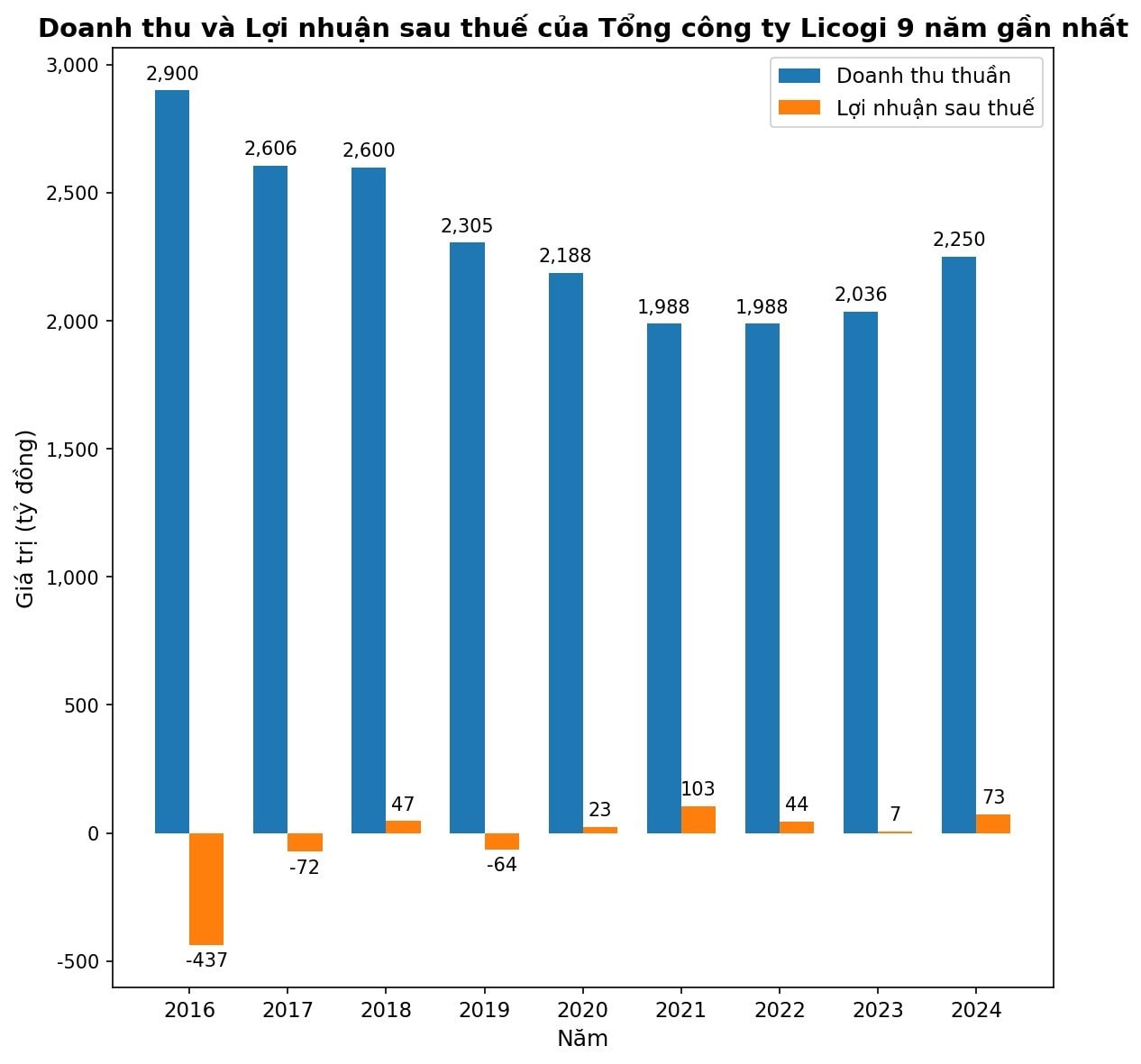

According to the documents of the 2025 Annual General Meeting of Licogi Corporation (stock code: LIC), the consolidated revenue in 2025 is expected to reach VND 2,427 billion, a decrease of 0.2% compared to the same period. The expected pre-tax profit is VND 52.1 billion, a decrease of 38.7% compared to the performance in 2024. The total investment value is expected to exceed VND 490 billion.

In 2025, the company will continue to focus on financial investment, real estate, and urban housing.

According to the plan, from January 1, 2026, the Corporation will no longer be a public company as defined by the regulations, as it does not meet the requirement of having at least 10% of the voting shares held by at least 100 non-major shareholders.

Licogi Corporation will present to the shareholders the continued implementation of the capital withdrawal from 8 invested units that were approved at the 2023 Annual General Meeting, with the implementation time frame from 2025 to 2026.

Regarding the Thinh Liet New Urban Area project, which has a scale of over 351,600 sq. m in Hoang Mai District, Hanoi, the site clearance has been completed for over 90% of the project area. The procedures for the investment approval extension have not been approved even though the company has paid the opportunity cost for the development right of the Thinh Liet New Urban Area Project (provisionally calculated) of VND 349 billion to the state budget.

As of March 31, 2025, Licogi has invested more than VND 1,363 billion in the Thinh Liet project, accounting for 30.1% of total assets, and is the largest long-term unfinished project that the Company is recognizing.

The obstacles that have caused the project to stall are mainly due to the complex land origin, petitions from local residents, and changes in compensation policies.

The report of the General Director clearly states that factors such as the relocation and consolidation of graves, petitions, and fluctuations in compensation support policies are causing significant delays in site clearance progress.

Moreover, the investment policy for the project has expired since 2024 according to the decision of the Hanoi People’s Committee. Licogi has made efforts to request an extension but still faces many obstacles, especially those related to the conclusions of the Government Inspectorate.

To meet the capital needs of the Investor of the Thinh Liet New Urban Area Project, the Corporation will submit to the AGM for approval on the issuance of shares and increase of the Corporation’s charter capital at an appropriate time.

In addition to investing in the Thinh Liet New Urban Area Project, the Corporation continues to seek opportunities to invest in new urban area projects with medium and small scales, social housing, and worker housing in some provinces and cities with large industrial zones and export processing zones that are suitable for the financial capacity of the Corporation.

For the investment project of the Corporation’s Headquarters at Lot 07-E7, Cau Giay New Urban Area, the Hanoi People’s Committee has decided to officially terminate this project. Licogi has then completed the procedures for the retrieval of investment preparation costs and received back the deposit amount of VND 8.45 billion from the Hanoi Department of Finance.

In addition, Licogi Corporation also presents to the shareholders the policy to terminate the operation of the representative office in Ho Chi Minh City.

Regarding dividends, Licogi Corporation presents to the shareholders that no dividend will be paid for the year 2024 because although the Company made a profit in 2024, it still had accumulated losses from 2016 and 2017. In addition, Licogi Corporation also presents to the shareholders not to pay dividends for the year 2025.

In the first quarter of 2025, Licogi Corporation recorded a revenue of VND 426 billion, up 28% over the same period, with a post-tax loss of VND 21.81 billion compared to a loss of VND 19.6 billion in the same period.

As of March 31, 2025, Licogi Corporation had accumulated losses of VND 574 billion, equivalent to 64% of its charter capital (charter capital of VND 900 billion), and total debt of VND 2,173 billion, 4.6 times higher than owner’s equity.

The Billion Dollar Resort: Unveiling the Mastermind Investors Behind the Vân Đồn Project

The People’s Committee of Quang Ninh Province has just approved a colossal investment project for an integrated tourism, entertainment, and premium resort complex, along with a golf course and residential area in Monbay Van Don. This ambitious venture boasts a staggering total investment of over VND 24,883 billion.

Blanca City: The Iconic Live, Play, Invest Destination in Vung Tau

Vung Tau is stepping into a new era of growth and development, transforming itself into a thriving metropolis. With a focus on inter-regional infrastructure projects and an ambitious international development strategy, the city is poised to become a prominent player on the global stage. This dynamic shift in focus to the new “super-metropolitan” area is set to change the landscape of the region, and Vung Tau is ready to take its place at the forefront.