The Ho Chi Minh City Stock Exchange (HOSE) announces its consideration of mandatory delisting for Koji Asset Investment Joint Stock Company (code: KPF-HOSSE)

HOSE states that KPF is currently under supervision for violations, including:

– Trading suspension according to Decision No. 101/QD-SGDHCM dated February 19, 2025, by the General Director of HOSE due to the listed company’s delay in submitting its 2024 semi-annual reviewed financial statements beyond the regulated timeframe.

– Warning per Decision No. 167/QD-SGDHCM dated April 4, 2024, by the General Director of HOSE, as the auditing organization expressed an adverse opinion regarding the listed company’s 2023 audited financial statements.

– Supervision as per Decision No. 358/QD-SGDHCM dated May 8, 2025, by the General Director of HOSE, due to the listed company’s delay in submitting its 2024 audited financial statements beyond the 30-day regulated timeframe.

Following the trading suspension, KPF continued to violate information disclosure regulations by delaying the submission of its 2024 audited financial statements and annual report. As of now, HOSE has not received KPF’s 2024 semi-annual reviewed financial statements, 2024 audited financial statements, or 2024 annual report.

Referring to Clause 1, Point o, Article 120 of Decree 155/2020/ND-CP dated December 31, 2020: ‘1. Shares of public companies shall be delisted when one of the following cases occurs: … o) The listing organization seriously violates the information disclosure obligation …’ and based on the opinion of the State Securities Commission, Vietnam Stock Exchange; Ho Chi Minh Stock Exchange announces its consideration of mandatory delisting for KPF shares of Koji Asset Investment Joint Stock Company according to the above regulations.

Previously, on January 21, 2025, Koji Asset Investment reported a plan to address the warning status of KPF shares.

Specifically, Koji Asset Investment stated that in the fourth quarter of 2024, the company achieved positive financial results, including significant progress in debt recovery and expected positive profits from bond investments.

However, factors such as mandatory provisioning have affected overall business results, creating pressure on the financial statements.

Regarding the solution and implementation roadmap, in Phase 1 (first quarter of 2025 – third quarter of 2025), the enterprise plans to focus on completing debt recovery plans and conducting a review and restructuring of its existing investment portfolio to improve capital efficiency.

In Phase 2 (third quarter of 2025 – end of 2025), the company will boost investments in core business areas while implementing potential projects to create sustainable value for shareholders and investors.

In terms of business performance, in the fourth quarter of 2024, the company did not record revenue from sales and service provision. However, it still recorded financial revenue of over VND 9 billion, a decrease of 30.8% compared to the same period in 2023 (nearly VND 12 billion). After deducting taxes and fees, the company reported a profit of over VND 6.6 billion, while in the previous year, it reported a net loss of over VND 26.1 billion.

For the full year 2024, Koji Asset Investment did not record revenue from sales and service provision; the company reported a post-tax loss of over VND 276.9 billion, while in 2023, it reported a profit of over VND 1.7 billion. Consequently, the after-tax undistributed profit was nearly VND 135 billion, while in the same period last year, it was nearly VND 142 billion.

According to the company’s self-prepared first-quarter 2025 financial statements, KPF continued to record no revenue and reported a loss of over VND 50 million in the first quarter of 2025 (compared to a loss of nearly VND 104 million in the same period) and accumulated a loss of nearly VND 135 billion as of March 31, 2025.

Koji Asset Investment Joint Stock Company is headquartered at 20-22-24 Dong Du, Ben Nghe Ward, District 1, Ho Chi Minh City, with a charter capital of over VND 608.67 billion and was listed on HOSE in 2016. Its primary business is in the field of real estate, land use rights of owners, users, or lessees.

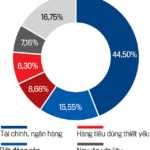

As of March 31, KPF’s total assets were nearly VND 533 billion, mostly in long-term financial investments of over VND 482 billion. Payable debt was nearly VND 17 billion, an increase of 2% compared to the end of 2024 (VND 16.5 billion).

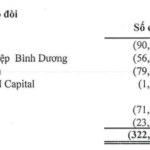

Also, as of March 31, 2025, the company had made provisions of over VND 322.96 billion in uncollectible receivables for five enterprises and two individuals.

At the close of the session on June 13, the stock price fell by 6.92% to VND 1,210, down 25% since the beginning of 2025 and 65% since the beginning of 2024. Market capitalization stands at nearly VND 74 billion.

The Stock That Once Surged by 700% is Now Under Scrutiny

The HoSE is considering a mandatory delisting of Koji Asset Investment Corporation’s KPF stock due to delays in submitting the reviewed semi-annual 2024 financial statements, 2024 audited financial statements, and 2024 annual report.

The Ho Chi Minh City Stock Exchange at 25: Expanding Products and Elevating Listed Companies’ Quality

The Ho Chi Minh Stock Exchange (HOSE) has, over its 25-year history, solidified its position as Vietnam’s pioneering centralized stock exchange and the nation’s largest securities trading platform. Listing on HOSE is a testament to a company’s operational excellence, a declaration of its commitment to transparency, and a demonstration of its adherence to governance standards—all of which contribute to building a robust corporate image and enhancing its value in the eyes of investors and the wider business community.

The Golden Touch: Unveiling the Secrets Behind the Surging Stocks of Leading Jewelry and Gold Retailers

“Facing challenges with raw material procurement and a prolonged constrained supply of 24K products since the latter half of 2024, PNJ has strategically prioritized its resources towards its retail jewelry segment, the core of their business operations.”