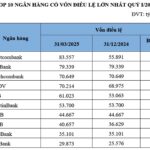

New Gold Bar Production Requirements: Seven Banks Meet the Criteria with a Minimum Chartered Capital of 50,000 Billion VND

According to the proposed amendments to Decree 24, businesses must have a minimum chartered capital of 1,000 billion VND to produce gold bars, while banks need a minimum of 50,000 billion VND.

Credit institutions considered for gold bar production permits by the State Bank of Vietnam must have a chartered capital of at least 50,000 billion VND and meet the same conditions as businesses to be eligible for licensing.

Currently, only a few large enterprises in Vietnam meet the capital requirements to engage in gold bar production, out of 38 organizations licensed to trade in gold bars.

Vietcombank, BIDV, VietinBank, MB, Agribank, VPBank, and Techcombank are among the banks with a chartered capital of 50,000 billion VND or more.

Non-cash Payment Requirements for Tax Deductions: As of 01/07/2025, purchases of goods and services under 20 million VND must be made through non-cash methods to qualify for tax deductions.

According to the 2024 Value Added Tax Law, non-cash payment receipts are mandatory for tax deductions on goods and services purchases below 20 million VND starting July 1, 2025.

Vietnam A Bank’s Subordinated Bonds Receive a Positive Rating

VAB has privately issued three subordinated bonds totaling 1,000 billion VND in 2023 and 2024, with a stable outlook. This is VIS Rating’s first assessment of VAB’s subordinated bonds, and the rating is based on the official bond terms and conditions as evaluated by VIS Rating.

VIS Rating assigned a BBB+ rating to VAB’s subordinated bonds, one notch lower than the bank’s issuer rating. This reflects VIS Rating’s assessment that the bank’s subordinated bonds have a lower legal priority for debt repayment and a higher level of loss absorption compared to the bank’s other senior obligations.

Subordinated bonds are direct, unsecured obligations and rank equally with the bank’s other subordinated debt. They are not backed by any assets and represent the bank’s secondary liabilities.

Prime Minister Orders Enhanced Management and Utilization of Electronic Invoices Generated from Cash Registers

Official Dispatch No. 88/CD-TTg, issued on June 12, 2025, instructs ministries, sectors, and localities to strengthen the management and utilization of electronic invoices generated from cash registers, improving tax administration for direct sales of goods and services to consumers.

The dispatch highlights ongoing issues, including non-compliance by businesses, shops, and business households with regulations on the use of electronic invoices generated from cash registers. Additionally, consumers have not fully embraced the habit of non-cash payments and obtaining invoices for goods and services.

To address these concerns, the Prime Minister has directed the Ministry of Finance to collaborate with enterprises and providers of electronic invoice solutions from cash registers to offer free software.

Simultaneously, the Ministry should work towards reducing the cost of generating electronic invoices for business establishments, especially households and individuals, thereby providing substantial and effective support to small and ultra-small businesses and contributing to the efficient implementation of electronic invoice regulations. This initiative aligns with the spirit of Resolution No. 68 to promote the development of the private economic sector.

Eximbank Finalizes Plans to Issue up to 10,000 Billion VND in Bonds

Eximbank intends to issue up to 10,000 billion VND in non-convertible, non-warrant-attached, unsecured, and non-subordinated debt instruments.

The bonds will have a maximum term of five years and are expected to be issued in the second quarter of 2025. They will be issued in the form of book entry, with the option of issuing bond ownership certificates or other forms as per regulations. Interest will be paid annually.

The proceeds from the bond issuance are intended to meet Eximbank’s lending and investment needs for the year 2025.

ACB Successfully Raises 7,000 Billion VND in Bonds within Two Days

ACB has successfully issued two lots of bonds, ACB12506 and ACB12507, totaling 7,000 billion VND.

Prior to this, on May 30, ACB announced Resolution No. 2812/TCQD-HQT.25 regarding the plan for the second private placement of bonds in 2025.

In this issuance, ACB intended to offer up to 200,000 bonds with a face value of 100 million VND each, raising a total of 20,000 billion VND. The maximum term was set at five years, with annual interest payments, and the bonds were expected to be issued in 20 tranches.

These bonds are non-convertible, non-warrant-attached, unsecured, and do not represent secondary liabilities of the issuer.

The New Cash Transaction Conundrum: Are Businesses Turning Their Backs on Transparency?

Introducing a common dilemma faced by many in Ho Chi Minh City: the cash-only conundrum. An array of shops, restaurants, and fashion boutiques across the city still operate on a cash-only basis, leaving customers red-faced and empty-handed when they realize their wallets are bereft of physical currency. It’s a scenario that has likely played out countless times, with a familiar chorus of “I didn’t realize” or “I thought I could pay by card.”

The Golden Opportunity: Unveiling the Authorized Banks and Enterprises for Gold Bar Production Post-Monopoly

The proposed amendments to Decree 24 set a high bar for businesses seeking to enter the gold bar production industry. To be eligible for a license, companies must now possess a minimum chartered capital of VND 1,000 billion, while banks are required to have a staggering VND 50,000 billion in chartered capital.

“Purchasing Goods Valued Under 20 Million VND: The Cashless Transaction Requirement”

As of July 1st, businesses purchasing goods who wish to claim input Value-Added Tax (VAT) deductions must possess non-cash payment transaction documents.