Thuduc House Joint Stock Company (Thuduc House, Stock Code: TDH, HoSE) has just announced a report on the trading results of the company’s insiders.

Specifically, Ms. Le Ngoc Xuan, the Company’s Executive and Authorized Information Disclosure and Secretary of the Board of Directors of Thuduc House, has successfully purchased over 1.5 million TDH shares out of the previously registered 2 million shares.

The transaction was made through order matching from May 16, 2025, to June 13, 2025.

Illustrative image

After this transaction, Ms. Xuan’s ownership of TDH shares increased from 33,000 shares to nearly 1.6 million shares, equivalent to an increase in holding ratio from 0.029% to 1.38% of Thuduc House’s capital.

Based on the closing price of TDH shares on May 16, 2025, which was VND 5,490 per share, it is estimated that Ms. Xuan spent nearly VND 8.4 billion to purchase the aforementioned number of shares.

In another development, Thuduc House has recently announced the addition of documents for the Annual General Meeting of Shareholders (AGM) to be held on June 27, 2025, in Ho Chi Minh City.

Specifically, the company added a proposal on the 2025 business plan with consolidated revenue expected to reach nearly VND 235.4 billion and after-tax profit estimated at nearly VND 66.5 billion.

In addition, Thuduc House also plans to present to the shareholders the list of candidates for the election of Members of the Board of Directors for the term 2025 – 2030.

This list includes 3 members: Ms. Tran Thi Lien, who is currently the General Director and Member of the Board of Directors of the company; Mr. Vu Hai Quan, Independent Member of the Board of Directors and Chairman of the Audit Committee; and Mr. Tran Thanh Vinh, Chairman of the Board of Directors.

Furthermore, based on the financial results in the audited separate financial statements for 2024, the Board of Directors of Thuduc House also plans to propose to the AGM a plan to not pay dividends for 2024.

In terms of business results, according to the consolidated financial statements for the first quarter of 2025, Thuduc House recorded net revenue of nearly VND 8 billion, a decrease of 21.2% compared to the same period last year. Thanks to other income of nearly VND 7.7 billion, the company reported a net profit of nearly VND 5.7 billion in the first quarter of 2025, while there was a net loss of nearly VND 1.7 billion in the same period last year.

As of March 31, 2025, the company’s total assets decreased by VND 5.5 billion compared to the beginning of the year, to nearly VND 680.2 billion. Of which, inventory was over VND 229.3 billion, accounting for 33.7% of total assets.

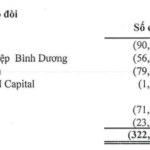

On the liability side of the balance sheet, total liabilities stood at nearly VND 604 billion, a decrease of VND 11.2 billion compared to the beginning of the year. Among which, short-term advance payments from customers accounted for VND 257.3 billion, or 42.6% of total liabilities, and short-term payables to suppliers accounted for VND 140.1 billion, or 23.2% of total liabilities.

The KPF Stock of Koji Asset Investments: Threatened Delisting

The Ho Chi Minh Stock Exchange (HoSE) is considering a mandatory delisting of KPF stock due to Koji Asset Investment’s continued non-compliance with disclosure obligations.

“SJ Group Issues Shares to Pay 5-Year Cumulative Dividends and Increase Charter Capital”

SJ Group plans to issue over 182.6 million shares to pay dividends for the years 2018, 2019, 2020, 2021, and 2024, as well as to increase its charter capital.