Liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 778 million shares, equivalent to a value of more than 19.2 trillion dong; HNX-Index reached over 67.6 million shares, equivalent to a value of more than 1.4 trillion dong.

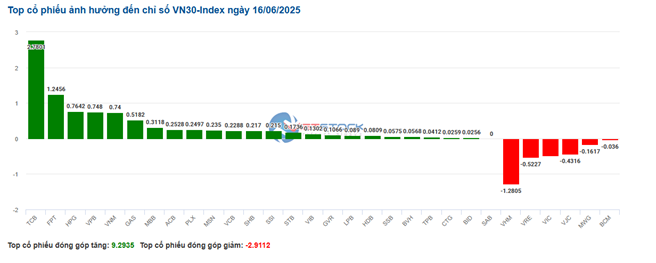

VN-Index in the afternoon session shifted from a tug-of-war situation to a positive recovery as buyers continuously increased their strength, causing the index to surge and close in the green. In terms of impact, GAS, VPL, TCB, and FPT were the codes with the most positive impact on the VN-Index, with an increase of 8.2 points. On the contrary, VHM, HVN, VIC, and STG were the codes still under selling pressure, taking away more than 1.1 points from the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on 06/16/2025 |

Similarly, the HNX-Index also had a fairly optimistic movement, with the index positively impacted by the codes PVS (+5.75%), NTP (+5.74%), MBS (+2.65%), SHS (+2.34%)…

|

Source: VietstockFinance

|

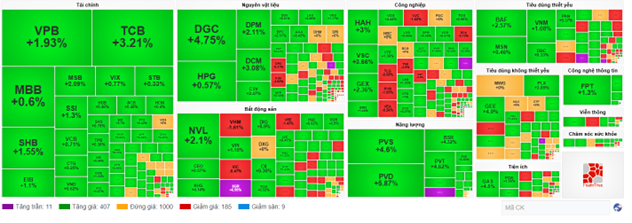

At the end of the session, the HOSE index increased by 1.56% with green covering all industry groups. Among them, the energy sector was the group with the strongest increase in the market at 5.46%, mainly contributed by the codes PVS (+5.75%), PVD (+6.85%), PVC (+10%), and PVB (+4.04%). This was followed by the non-essential consumer goods sector and the information technology sector, with increases of 3.84% and 3.19%, respectively.

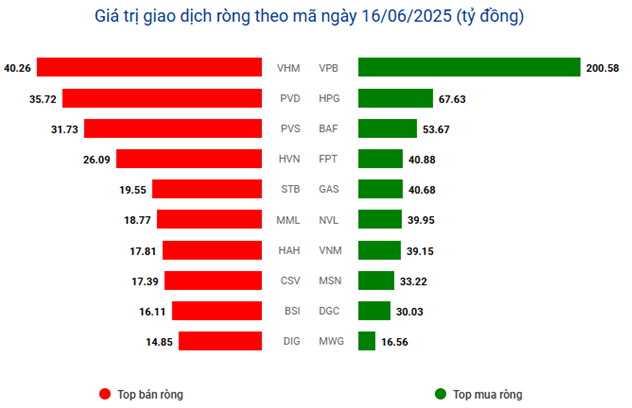

In terms of foreign transactions, foreigners continued to net buy more than 942 billion dong on the HOSE floor, focusing on the codes FPT (314.22 billion), VPB (204.04 billion), HPG (181.25 billion), and NVL (116.68 billion). On the HNX floor, foreigners net sold more than 4 billion dong, focusing on the codes PVS (21.96 billion), SHS (10.05 billion), CEO (3.3 billion), and LAS (820 million).

| Foreign buying and selling movements |

Morning session: Positive sentiment persists, foreigners accumulate VPB strongly

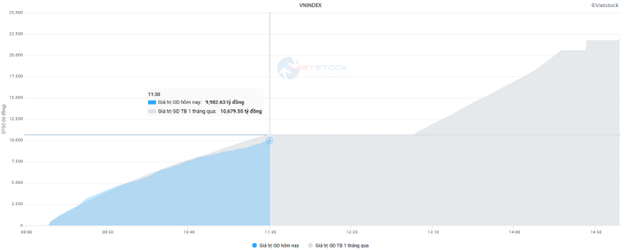

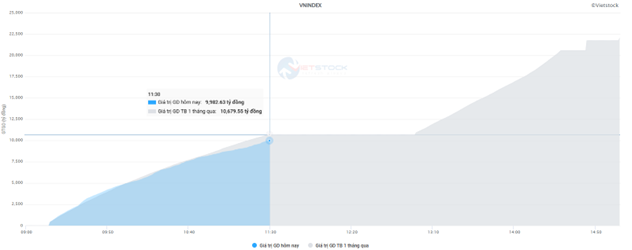

The upward trend was well maintained across all major indices towards the end of the morning session. At the midday break, the VN-Index increased by 11.25 points, or 0.86%, to 1,326.74 points; HNX-Index increased by 0.77% to 226.55 points. Buyers maintained their advantage with 405 stocks rising and 218 falling.

Market liquidity was significantly lower than the high of the previous week’s session but still close to the 1-month average. This morning’s trading value reached nearly 10 trillion dong on the HOSE and 744 billion dong on the HNX.

Source: VietstockFinance

|

VPL, GAS, and TCB are currently the pillars that are having the most positive impact on the index, contributing nearly 6 points to the VN-Index. Meanwhile, VHM and VIC went against the general trend, causing the index to lose nearly 2.5 points in the morning session.

The Vingroup trio, including VHM (-2.63%), VIC (-1.17%), and VRE (-1.83%), was also the main reason why the real estate group was dominated by red, with a decrease of nearly 1%, while the other groups were mostly in the green.

The energy group remained the most prominent highlight in the market amid escalating geopolitical tensions. PVC continued to hit the ceiling from the beginning of the session, while other codes such as PVS (+4.6%), PVD (+5.38%), POS (+8.51%), PVB (+3.37%), BSR (+3.78%), PSB (+4.35%), etc., also attracted strong demand.

In addition, the non-essential consumer goods group made a strong impression with an increase of more than 3% as large-cap stocks in the industry all broke out strongly, including VPL (+6.8%), GEX (+2.65%), GEE (+5.01%), and PNJ (+2.18%).

The financial group, although mostly in the green, was mostly below 1%. Notable increases were only seen in a few names such as VPB (+3.03%), TCB (+2.56%), BVH (+4.06%), PVI (+2.54%), BMI (+2.17%), etc.

Foreigners continued to net buy 342 billion dong on all three floors this morning, helping to reinforce positive sentiment. Among them, VPB was the most notable highlight as it was net bought by foreign investors by more than 200 billion dong this morning, far exceeding the value of other net bought stocks. In contrast, VHM, PVS, and PVD were the codes with the highest net selling value, but the value was not significant, at only about 30-40 billion dong.

10:30 am: Green spread across the board

The morning session continued to witness positive market movements. As of 10:30 am, all major indices rose, reflecting the improved sentiment of investors.

The VN-Index is currently at 1,327 points, up 0.95%. HNX-Index also recorded an increase of 0.81%, reaching 226 points. Large-cap indices such as VN30 and HNX30 also maintained their green status, increasing by 0.54% and 1.46%, respectively, indicating the spread of cash flow.

The VN30 basket showed slight differentiation as 24 codes increased, while only 6 codes recorded red. The ratio of rising codes reflected the positive sentiment spreading across most of the large-cap stocks. The codes with the most positive impact on the index included TCB with 2.78 points, FPT with 1.36 points, VPB with 0.75 points, and VNM with 0.62 points. On the contrary, the decrease was mainly due to VHM, which took away 1.28 points, VRE took away 0.46 points, VJC took away 0.43 points, and MWG took away 0.16 points.

Source: VietstockFinance

|

In terms of industry groups, the picture was quite differentiated with the outstanding performance of some groups. Among them, on the rising side were the Hardware group with an increase of 5.26%, including POT up 8.24%, VTB up 3%, SMT up 3.09%…

Next was the Consumer Services group, with an increase of 5.11%, including notable codes such as VPL up 6.35%, DSD up 11.54%, and RIC up 2.22%.

In addition, the Insurance and Utilities sectors also recorded good increases of 1.64% and 1.67%, respectively.

On the opposite side, selling pressure dominated the real estate group, with red appearing in large-cap codes such as VHM down 1.75%, VIC down 0.58%, VRE down 1.43%, BCM down 0.67%…

By the middle of the morning session, the market breadth had 1,000 stocks standing. The rising side dominated with 11 ceiling codes, 407 increasing codes. Only 185 codes decreased and 9 floor codes. The overall picture showed that the number of increasing codes far exceeded the number of decreasing codes.

9:30 am: Cash flow continues to favor the energy group

VN-Index and HNX-Index opened the morning session with a fairly positive spread of green. The positive contribution came from the energy and materials sectors.

The military campaign between Israel and Iran continues to escalate tensions. This has raised concerns about the escalation of military conflict in the Middle East region in the near future and its impact on oil prices. Therefore, cash flow is currently focused on the energy group with codes in the oil and gas industry. Since the opening, most of the group’s stocks have surged, such as PVS (+5.75%), PVC (+10%), PVD (+6.36%), BSR (+5.68%)…

The Materials sector recorded a positive green status as the large-cap codes in the industry all increased significantly from the beginning of the session. These included DGC (+2.27%), DCM (+3.23%), DPM (+2.67%), LAS (+4.15%)…

In addition, the codes in the industrial group also contributed significantly to the index’s increase, with the group of maritime transportation codes such as HAH (+4.58%), VOS (+6.14%), VSC (+4.27%), GMD (+2.88%)…

– 15:35 06/16/2025

Unexpected Euphoria: Energy Stocks Surge, VN-Index Flirts with 1340 Peak

Investors witnessed a surprising surge of enthusiasm during today’s afternoon session, with proactive and aggressive buying that propelled the VN-Index to its strongest gain in eight weeks. Shunning the previous two weeks of cautious adjustments, the index dramatically rebounded to near its previous peak, finishing at an impressive 1338.11 points.

Stock Market Insights: A Glimpse of Positive Signals

The VN-Index surged, crossing above the middle Bollinger Band. With continued index strength and trading volumes above the 20-day average, the bullish trend would be reinforced. Notably, the Stochastic Oscillator has signaled a buy, exiting the oversold region. Should the MACD indicator follow suit in upcoming sessions, the short-term outlook would brighten considerably.

Technical Analysis for June 16: A Market Torn Between Sentiments

The VN-Index and HNX-Index both climbed in the morning session, with a slight dip in liquidity indicating a cautious sentiment among investors.

No Worries About Missile Issues, the Market Bounces Back Strongly, VN-Index Recaptures the 1,320-Point Level

The Middle East tensions continue to escalate, but investor sentiment has improved significantly following the weekend. Although this morning’s market saw a substantial 34% drop in capital inflows compared to the previous session, stock prices witnessed a broad-based recovery. However, the upward momentum showed signs of waning in the latter half of the session as selling pressure emerged at higher price levels.