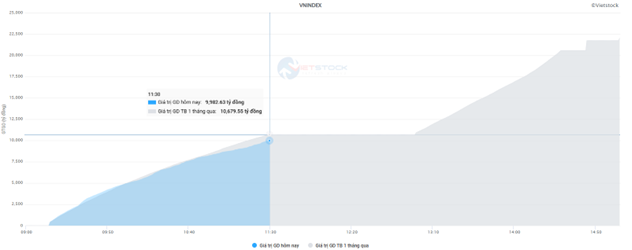

Market liquidity was significantly lower than last week’s high, but it remained close to the one-month average. This morning’s trading value reached nearly VND 10 trillion on the HOSE and VND 744 billion on the HNX.

Source: VietstockFinance

|

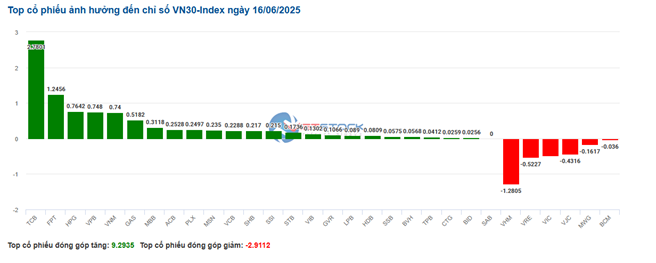

VPL, GAS, and TCB are the main pillars positively impacting the index, contributing almost 6 points to the VN-Index. Meanwhile, VHM and VIC went against the overall trend, dragging the index down by nearly 2.5 points in the morning session.

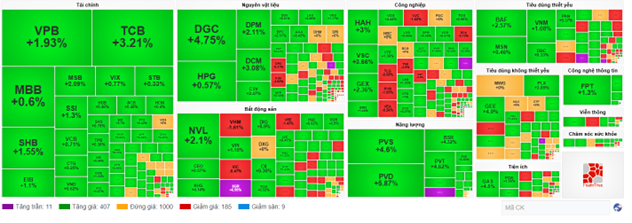

The Vingroup trio, including VHM (-2.63%), VIC (-1.17%), and VRE (-1.83%), was also the main reason for the real estate group’s red dominance, with a decrease of nearly 1%, while the remaining groups were mostly positive.

The energy group remained the most prominent highlight in the market amid escalating geopolitical tensions. PVC continued to hit the ceiling price from the beginning of the session, and other codes such as PVS (+4.6%), PVD (+5.38%), POS (+8.51%), PVB (+3.37%), BSR (+3.78%), and PSB (+4.35%) also attracted vibrant investment demand.

In addition, the non-essential consumer group made a strong impression with an increase of over 3% as large-cap stocks in the industry broke out, including VPL (+6.8%), GEX (+2.65%), GEE (+5.01%), and PNJ (+2.18%).

While the financial group wore green across the board, most of the increases were below 1%, with only a few names standing out, such as VPB (+3.03%), TCB (+2.56%), BVH (+4.06%), PVI (+2.54%), and BMI (+2.17%)…

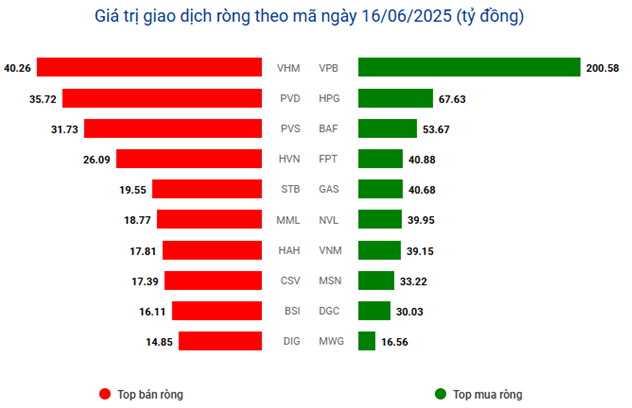

Foreign investors continued to net buy VND 342 billion on the three exchanges this morning, further boosting positive sentiment. Notably, VPB was the brightest spot, with net foreign buying of over VND 200 billion this morning, far exceeding the value of other net bought stocks. In contrast, VHM, PVS, and PVD were the most net sold stocks, but the value was not significant, at only about VND 30-40 billion.

10:30 am: Green spread across the board

This morning’s trading session continued to witness a positive market performance. As of 10:30 am, the main indices all rose, reflecting investors’ improved sentiment.

The VN-Index stood at 1,327 points, up 0.95%. The HNX-Index also recorded a gain of 0.81%, reaching 226 points. Large-cap indices such as VN30 and HNX30 also maintained their upward momentum, rising 0.54% and 1.46%, respectively, indicating the spread of cash flow.

The VN30 basket showed slight differentiation, with 24 codes increasing and six decreasing. The ratio of rising codes reflected the positive sentiment spreading across most large-cap stocks. The most influential gainers included TCB with 2.78 points, FPT with 1.36 points, VPB with 0.75 points, and VNM with 0.62 points. On the other hand, the main decliners were VHM, which took away 1.28 points, VRE with 0.46 points, VJC with 0.43 points, and MWG with 0.16 points.

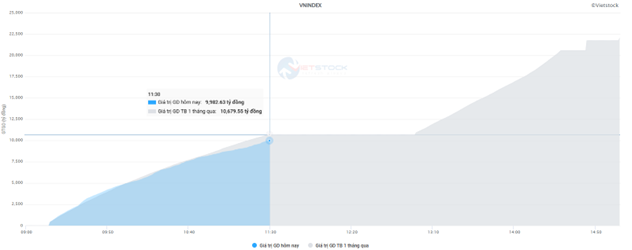

Source: VietstockFinance

|

Regarding sector performance, the picture was quite mixed, with some groups standing out. On the upside, the Hardware sector led with a strong gain of 5.26%, including POT up 8.24%, VTB up 3%, and SMT up 3.09%…

Next was the Consumer Services sector, which rose 5.11%, driven by notable codes such as VPL up 6.35%, DSD up 11.54%, and RIC up 2.22%.

In addition, the Insurance and Utilities sectors also recorded solid gains, increasing by 1.64% and 1.67%, respectively.

On the downside, selling pressure dominated the real estate sector, with large-cap codes such as VHM down 1.75%, VIC down 0.58%, VRE down 1.43%, and BCM down 0.67%…

By mid-morning, the market breadth saw 1,000 stocks unchanged. The upside dominated with 11 ceiling prices, 407 gainers. Only 185 losers and nine floor prices. The overall picture showed a significant advantage for gainers over losers.

9:30 am: Cash flow continues to favor the energy sector

VN-Index and HNX-Index opened the morning session with a positive spread of green. The energy and materials sectors were the main contributors to this positive performance.

The military campaign between Israel and Iran continues to escalate tensions. This raises concerns about a potential military escalation in the Middle East and impacts oil prices. As a result, cash flow is currently focused on the energy sector, specifically oil and gas stocks. Since the market opened, most codes in this sector have surged, including PVS (+5.75%), PVC (+10%), PVD (+6.36%), and BSR (+5.68%)…

The materials sector recorded a positive performance as large-cap codes in the industry rose sharply from the opening bell. These included DGC (+2.27%), DCM (+3.23%), DPM (+2.67%), and LAS (+4.15%)…

In addition, the industrial sector also contributed significantly to the index’s gain, particularly the marine transportation group, with notable gainers such as HAH (+4.58%), VOS (+6.14%), VSC (+4.27%), and GMD (+2.88%)…

The Stock Market is “Stirring Up a Storm”: Small-Cap Stocks Take the Lead

Over five weeks since the KRX system officially launched, the anticipated surge in stock prices within the securities industry has yet to materialize, with SSI, HCM, and BSI all witnessing declines of over 9% since the beginning of the year. However, a silent race is underway among smaller securities firms such as VFS and APG – names that have witnessed over 70% gains thanks to aggressive capital-raising plans and internal restructuring.

Revolutionizing Legal Frameworks: Forging Ahead with National Railway Systems

The proposed amendments to the Railway Law signify a pivotal moment for Vietnam’s railway industry. This draft law represents a bold initiative to establish a transformative legal framework, paving the way for the industry’s dynamic evolution and setting a precedent for transportation sector reform in the country.

The Rise of a New Property Powerhouse: Unveiling the Southern Market’s Next Boom Cycle

Bình Dương has emerged as a Southern “hotspot”, strategically poised with advantageous connectivity and a thriving real estate market that outshines its neighbors.