While Middle East tensions continue to rise, investor sentiment has significantly improved post-weekend. This morning’s inflow of funds into the market dropped by 34% compared to the previous session, but stock prices witnessed a broad-based recovery. However, the upward momentum showed signs of slowing down in the latter half of the trading day as selling pressure emerged at higher price levels.

The VN-Index peaked at 10:22 am, gaining nearly 13.3 points, but by the end of the morning session, the increase stood at 11.25 points (+0.86%). The index breached the 1320-point mark around 9:30 am, supported by robust performances from large-cap stocks. While these heavyweights started to lose steam, curbing the index’s momentum, the market breadth indicated that selling pressure at individual stock levels emerged earlier.

Specifically, the HoSE market breadth was at its best at 9:48 am, just before the VN-Index hit its first high of the day, with 200 gainers and 70 losers. At the second and highest peak at 10:22 am, the breadth recorded 204 gainers and 88 losers. By the session’s end, the HoSE had 197 gainers and 101 losers.

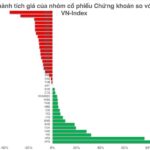

The market breadth revealed that some stocks had turned red, but it didn’t reflect the full extent of the selling pressure as most stocks remained in positive territory. Further analysis showed that nearly one-third (32.2%) of the traded stocks had declined by 1% or more from their intraday highs. Only about 24% of the stocks managed to maintain their highest prices. Thus, the vast majority of stocks experienced a slowdown in their upward momentum and pulled back to varying degrees.

This phenomenon typically occurs when buying momentum faces substantial selling volume, causing a section of participants to succumb to selling pressure and retreat from their peak prices. This isn’t surprising, as some investors may lack confidence in the conclusion of the current downward trend and view the rally as a standard technical rebound. Consequently, they opt to offload their positions during this rebound. Conversely, on the buying side, not everyone is eager to chase prices higher, despite the VN-Index’s impressive performance.

This dynamic is reflected in the weakening trading volume. The total matched orders on the two listed exchanges this morning fell by 34% compared to last Friday’s session. The HoSE saw a roughly 33% decline, reaching nearly VND 9,174 billion. Nonetheless, this volume remains relatively healthy, excluding the panic-selling session last Friday. The average trading value for the first four morning sessions of the previous week was approximately VND 7,500 billion per session on this exchange.

The VN-Index’s chances of a sustained recovery and reclaiming the 1320-point level still heavily depend on large-cap stocks. VPL, with a substantial 6.8% surge, contributed 2.53 points to the VN-Index. This stock had plummeted by nearly 16% from its highest price of VND 104,500. GAS, representing the energy sector, also performed exceptionally well, rising by 4.81% and adding 1.7 points to the index. Today, GAS returned to pre-tax shock levels. Among the HoSE’s top 10 stocks by market capitalization, TCB and FPT also contributed positively, rising by 2.56% and 1.39%, respectively, adding about 1.9 points to the index. Overall, the top 10 stocks that boosted the VN-Index today accounted for 9.8 points of the total 11.25-point gain.

Lacking the support of VPL, the VN30-Index showed limited strength, managing to stay above the reference level by only 5.76 points, or 0.41%. While the basket had a positive market breadth of 25 gainers and 5 losers, all but VPB failed to maintain their highest prices. Some stocks witnessed notable retreats from their peaks, such as VNM, which gave back 1.14%, currently up by a modest 0.54%. TCB retracted by 1.08%, trimming its gain to 2.56%. MSN slipped by 1.2%, resulting in a marginal 0.46% increase. GVR fell by 1.26%, leaving a meager 1.1% gain…

The Vin group stood out among the decliners in the blue-chip basket, with VHM dropping by 2.63%, VIC by 1.17%, and VRE by 1.83%. The remaining red-ink stocks were VJC, down by 0.57%, and BCM, down by 1.18%.

The weakening market breadth indicates that selling pressure is pushing prices down within the green territory, and only a few stocks have slipped below the reference level. Out of the 101 stocks in negative territory, only 12 recorded trading volumes of VND 1 billion or more, with declines of more than 1%. Unsurprisingly, VIC, VHM, and VRE led this group in terms of liquidity. HDG, down by 1.43%, matched VND 30.8 billion; YEG, down by 1.12%, traded VND 29.3 billion; and DXS, down by 3.11%, transacted VND 17.5 billion. In a downtrend, lower trading volumes suggest a lack of buying interest rather than intense selling pressure.

Conversely, on the advancing side, selling pressure has caused many stocks to lose momentum. Among the 197 gainers, 92 stocks rose by more than 1%. However, the liquidity in this group was impressive, with 17 stocks recording trading volumes of over VND 100 billion. Notable performers included DGC, up by 4.53%; PVD, up by 5.38%; NVL, up by 2.45%; DPM, up by 2.53%; BAF, up by 2.57%; BSR, up by 3.78%; HAH, up by 2.15%; DCM, up by 3.08%; and GEX, up by 2.65%…

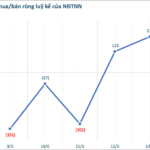

Foreign investors also abruptly curbed their selling, with net sell orders on the HoSE totaling only VND 748.8 billion, a 47% decrease from the previous session. Notable net buy orders were observed in VPB (+VND 200.9 billion), HPG (+VND 67.6 billion), BAF (+VND 53.8 billion), FPT (+VND 40.8 billion), GAS (+VND 40.6 billion), NVL (+VND 40.1 billion), VNM (+VND 39.1 billion), MSN (+VND 33.2 billion), DGC (+VND 30.2 billion). On the net sell side, VHM (-VND 40.3 billion), PVD (-VND 35.7 billion), and HVN (-VND 26.2 billion) stood out.

The Stock Market is “Stirring Up a Storm”: Small-Cap Stocks Take the Lead

Over five weeks since the KRX system officially launched, the anticipated surge in stock prices within the securities industry has yet to materialize, with SSI, HCM, and BSI all witnessing declines of over 9% since the beginning of the year. However, a silent race is underway among smaller securities firms such as VFS and APG – names that have witnessed over 70% gains thanks to aggressive capital-raising plans and internal restructuring.

The Volatile Market: What’s in Store for Stocks Next Week?

The domestic stock market experienced its second consecutive week of adjustments and consolidation following a period of robust price increases. According to analysts, June could be a volatile month for the market as trade negotiations enter their final stages and tensions between Iran and Israel escalate.

A Surprise Turn: Foreign Investors Pump Billions into Bank Stocks Amid VN-Index Adjustment

The foreign transactions witnessed a tug-of-war scenario, with net selling at the beginning of the week and a shift to net buying towards the week’s end.