The market was unexpectedly buoyant today with new information on trade negotiations. It seems that investors holding cash are under psychological pressure and are aggressively chasing buys. The VNI has returned to its previous peak after just one session of gains.

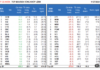

Liquidity fell 28% from the previous session to 20.7k billion in matching orders on the two exchanges. However, this is only a drop compared to the sell-off sessions, as it is still high compared to the early week sessions. The three-week average before today was about 22k billion per day, so today’s number is not low.

The positive is that buyers pushed prices up all day and widened the range significantly. Many stocks rose sharply, with a few dozen rising more than 2%. With such a range, the moderate liquidity suggests reduced selling pressure. If the selling volume had remained as high as in previous sessions, buyers would have matched more orders and pushed up transaction values.

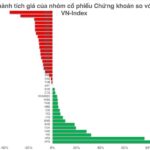

The ability to pivot is also noteworthy. VIC and VHM continued to decline but had almost no impact. In the last session of the previous week, VNI also had a “wick” candle partly because VIC and VHM were pulled back, and partly because other blue-chip stocks supported the index. If this consensus continues and VIC and VHM improve, the index is technically capable of breaking through the peak in the coming sessions.

The main strength now is that sentiment seems to be easily stimulated. Although there is no official information, some external revelations have mentioned a tax rate of 20%-25%. Sentimentally, this is a lower number than the initial 46%. However, it remains to be seen whether this rate is “good” or not, as the issue now is competitive advantage, and ultimately, consumers will bear some of the tax burden.

The reaction in the stocks of businesses affected by the countervailing duties in the previous period was quite positive. This can be interpreted as market optimism. For now, this is a short-term motivation, and the long-term outlook depends on the final numbers, which will then provide a sufficient basis for the perspective of large capital flows.

Today’s strong price range has not led to any significant changes. Oil and gas stocks and some related industries such as chemicals have shown strength, while the rest of the market has only seen a psychological boost. Apart from oil and gas, most stocks are still fluctuating within their old price ranges, so there is no need to rush. The VNI’s “dangerous” rise belies the fact that stocks have not yet exploded or broken through to change the existing accumulation trend.

From a speculative perspective, some stocks, such as oil and gas, are presenting opportunities, but chasing buys will limit profit margins as oil prices are unlikely to rise sharply continuously. From a long-term perspective, the market has not changed. We have been waiting for the Middle East tensions to ease and for tariffs to become clear, and this process is still ongoing. The main psychological pressure comes from the fact that market prices may not differ much from the profit-taking levels. However, where there is money, there are always opportunities, and it is important to assess acceptable risks.

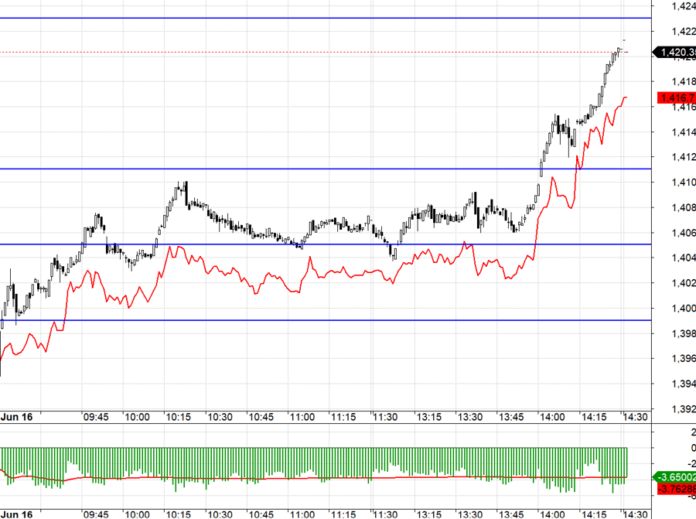

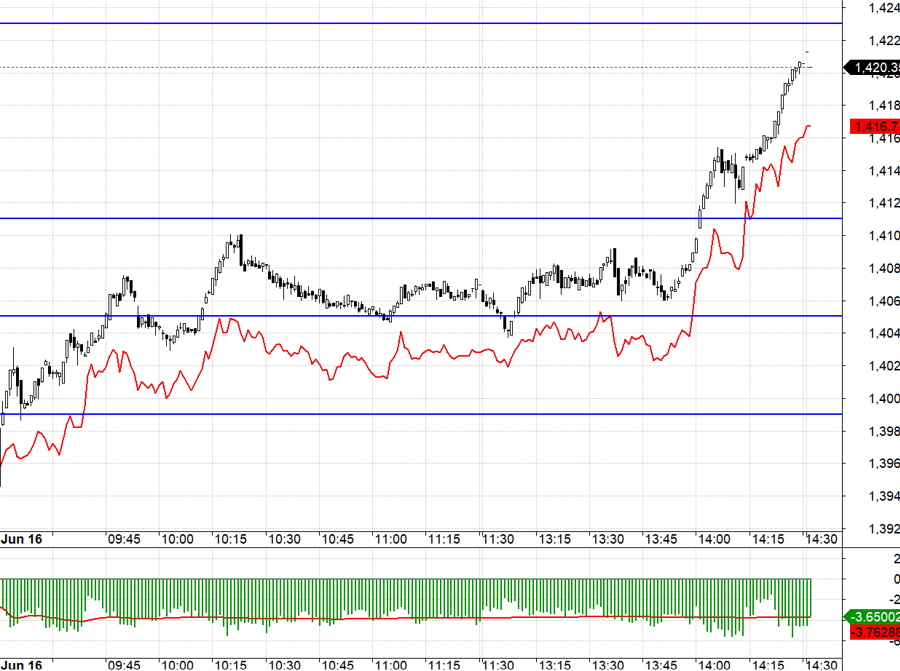

Trading transactions with derivatives are a better “relief” channel than the underlying market, as money earned is the same everywhere. F1 is about to expire but still maintained a discount today. The downside is that VN30 fluctuated sideways for most of the day within a narrow intraday range, trapped between 1405.xx and 1411.xx. The fact that the index reacted well to 1405.xx and did not break below this level helped Long positions avoid stop losses, but the “torture” time was quite long. The turning point came when VN30 broke through its morning high at 2 pm, and F1 also hit a new high. This development led to two advantages: First, all Short positions were under pressure, and second, when VN30 broke through 1415.xx, it entered a range expansion phase and was highly likely to hit 1423.xx. This was the time to “go big.” The basis narrowed very quickly, even before VN30 broke through 1411.xx.

Today’s exuberance may not last. Chasing buyers will soon face new selling volume. Moreover, the index does not represent the movement of all stocks, and many stocks have not changed much, so a 1-2 session increase is just a normal fluctuation. Bottom-fishing probes can be held, but there is no need to chase buys. “Missing the wave” on T+ in the underlying market is the same as in derivatives.

VN30 closed at 1420.35. The nearest resistance for tomorrow is 1425; 1436; 1442; 1450; 1455; 1463; 1470. Support is at 1415; 1409; 1400; 1391; 1383.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, assessments, and investment perspectives are those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for issues arising from the views and investment perspectives presented.

No Worries About Missile Issues, the Market Bounces Back Strongly, VN-Index Recaptures the 1,320-Point Level

The Middle East tensions continue to escalate, but investor sentiment has improved significantly following the weekend. Although this morning’s market saw a substantial 34% drop in capital inflows compared to the previous session, stock prices witnessed a broad-based recovery. However, the upward momentum showed signs of waning in the latter half of the session as selling pressure emerged at higher price levels.

The Stock Market is “Stirring Up a Storm”: Small-Cap Stocks Take the Lead

Over five weeks since the KRX system officially launched, the anticipated surge in stock prices within the securities industry has yet to materialize, with SSI, HCM, and BSI all witnessing declines of over 9% since the beginning of the year. However, a silent race is underway among smaller securities firms such as VFS and APG – names that have witnessed over 70% gains thanks to aggressive capital-raising plans and internal restructuring.

Revolutionizing Legal Frameworks: Forging Ahead with National Railway Systems

The proposed amendments to the Railway Law signify a pivotal moment for Vietnam’s railway industry. This draft law represents a bold initiative to establish a transformative legal framework, paving the way for the industry’s dynamic evolution and setting a precedent for transportation sector reform in the country.