TL4 accumulates over 9% stake in FCS

Ho Chi Minh City Food Joint Stock Company (Foodcosa, UPCoM: FCS) has recorded Hydraulic Construction Joint Stock Company No. 4 (Hyco4, UPCoM: TL4) as a major shareholder after the latter acquired more than 2.7 million shares, equivalent to 9.22% of the charter capital, on June 5.

With no matched orders for FCS on that day, TL4 likely purchased the shares via matched orders at the closing price of VND9,900 per share, amounting to an estimated cost of nearly VND27 billion.

Bầu Đức intends to purchase 10 million HAG shares

Mr. Đoàn Nguyên Đức (Bầu Đức), Chairman of Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG), has registered to purchase 10 million HAG shares through matched orders from June 16 to June 30, 2025.

If the transaction is successful, Bầu Đức’s ownership will increase from 30.26% to 31.2%, equivalent to nearly 330 million shares. Based on the closing price on June 11, the deal is valued at approximately VND130 billion.

Conversely, Mr. Đức’s daughter, Ms. Đoàn Hoàng Anh, sold one million HAG shares from June 9 to 13 for personal financial reasons. Following the successful transaction, Ms. Hoàng Anh’s ownership in HAG will decrease from 1.32% to 1.23%, equivalent to 13 million shares.

Chairman Trương Anh Tuấn increases HQC holdings to nearly 8.7%

Mr. Trương Anh Tuấn, Chairman of Hoang Quan Trading Consulting Real Estate Joint Stock Company (HOSE: HQC), has announced the successful acquisition of 25 million HQC shares through matched and unmatched orders on June 9 and 10, 2025. This brings his total holdings to 50 million shares, or 8.671% of the company’s charter capital, making him a major shareholder of HQC.

During this period, HQC shares traded around VND3,300 per share, meaning Mr. Tuấn spent approximately VND80 billion to acquire these shares.

Major shareholder of SHP acquires over 5 million shares from foreign investors?

Dak R’tih Hydropower Joint Stock Company (DaHC), a major shareholder of Southern Hydropower Joint Stock Company (HOSE: SHP), completed the purchase of nearly 5.2 million SHP shares through matched orders on June 6.

Data shows that the number of SHP shares traded through matched orders on June 6 matches the number of shares acquired by DaHC. The deal was valued at nearly VND186 billion. Following the transaction, DaHC’s ownership in SHP will increase from 10.33% to 15.43% of the charter capital, equivalent to over 15.6 million shares.

Notably, on June 6, SHP shares were net sold by foreign investors for a value equivalent to the amount spent by DaHC on the deal.

Brother of STK Chairman completes sale of nearly 7 million shares

Mr. Đặng Hướng Cường, a member of the Board of Directors of Century Yarn Joint Stock Company (HOSE: STK), sold nearly 6.9 million STK shares (7.12%) through matched orders from June 5 to 11.

Data recorded that the number of shares traded by Mr. Cường matched the total number of STK shares traded through matched orders during the same period. The deal was valued at over VND169 billion.

In contrast, Ms. Đặng Mỹ Linh, Vice Chairman of the Board of STK, registered to purchase 7 million STK shares from June 1 to 30, aiming to increase her ownership from 14.47% to 21.72%, equivalent to nearly 21 million shares. If the transaction is successful, Ms. Linh will become the largest shareholder of STK, surpassing Investment Consulting Company Hướng Việt (20.19%), an organization related to Mr. Võ Hoàng Long, a member of the Board of Directors of STK and currently the General Director of Hướng Việt.

Thai Hung Trading Co., Ltd. intends to divest after accumulating over 11 million STH shares

Just a few days after acquiring more than 11.4 million shares of Thai Nguyen Book Publishing Joint Stock Company (UPCoM: STH), Thai Hung Trading Joint Stock Company unexpectedly registered to sell nearly 4.9 million shares, equivalent to 25% of STH‘s capital. The company, which is directly related to Ms. Nguyễn Thị Quy, General Director and Member of the Board of Directors of STH, will carry out the transaction from June 12 to July 11 through matched and unmatched orders. The purpose of the divestment is to restructure its investment portfolio. After the completion of the transaction, Thai Hung will still hold a controlling stake in STH with an ownership of over 52%.

The divestment comes shortly after Thai Hung increased its ownership from 18.46% to 77.08% within just three days (June 2 to 5) through matched orders, with a total estimated value of over VND232 billion, averaging around VND20,000 per share.

|

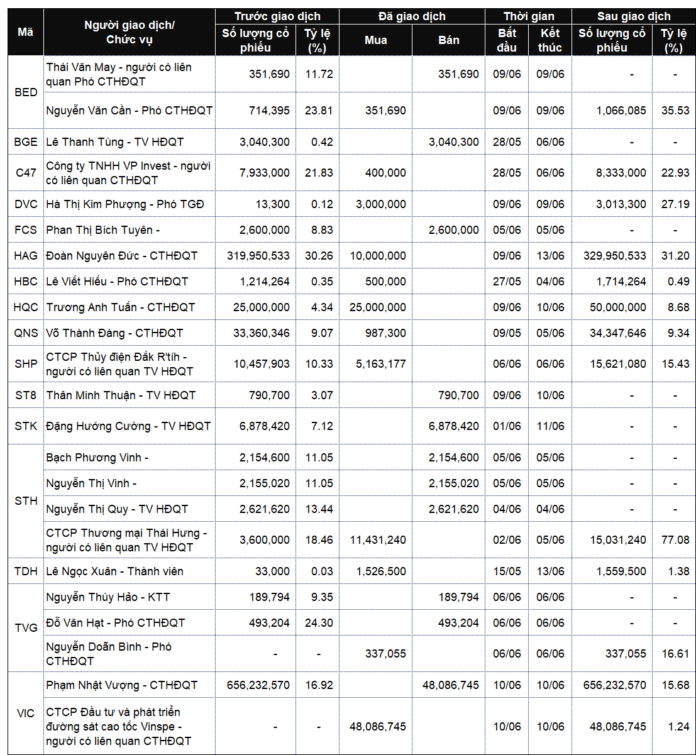

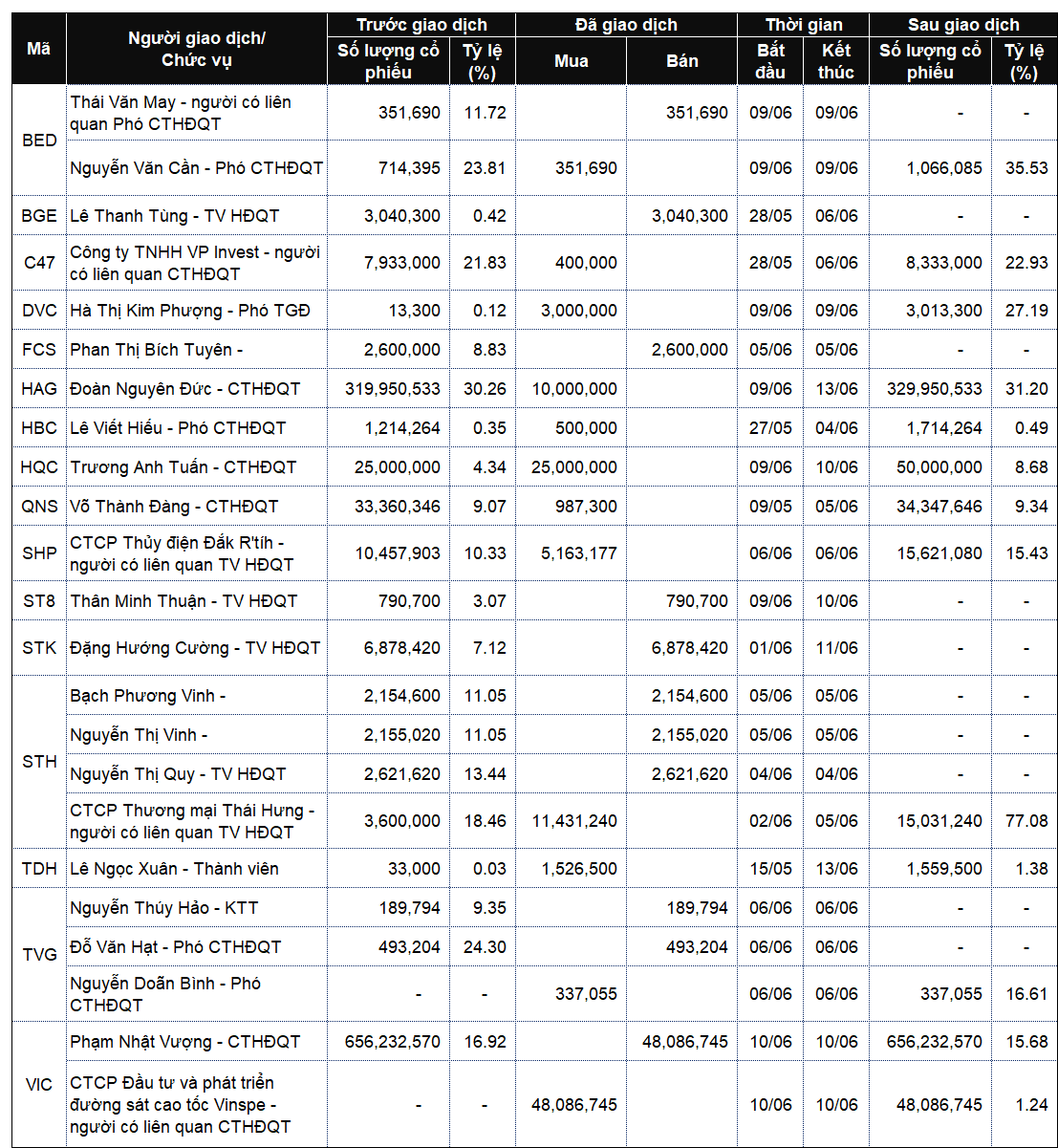

List of company leaders and relatives trading from June 9 to 13, 2025

Source: VietstockFinance

|

|

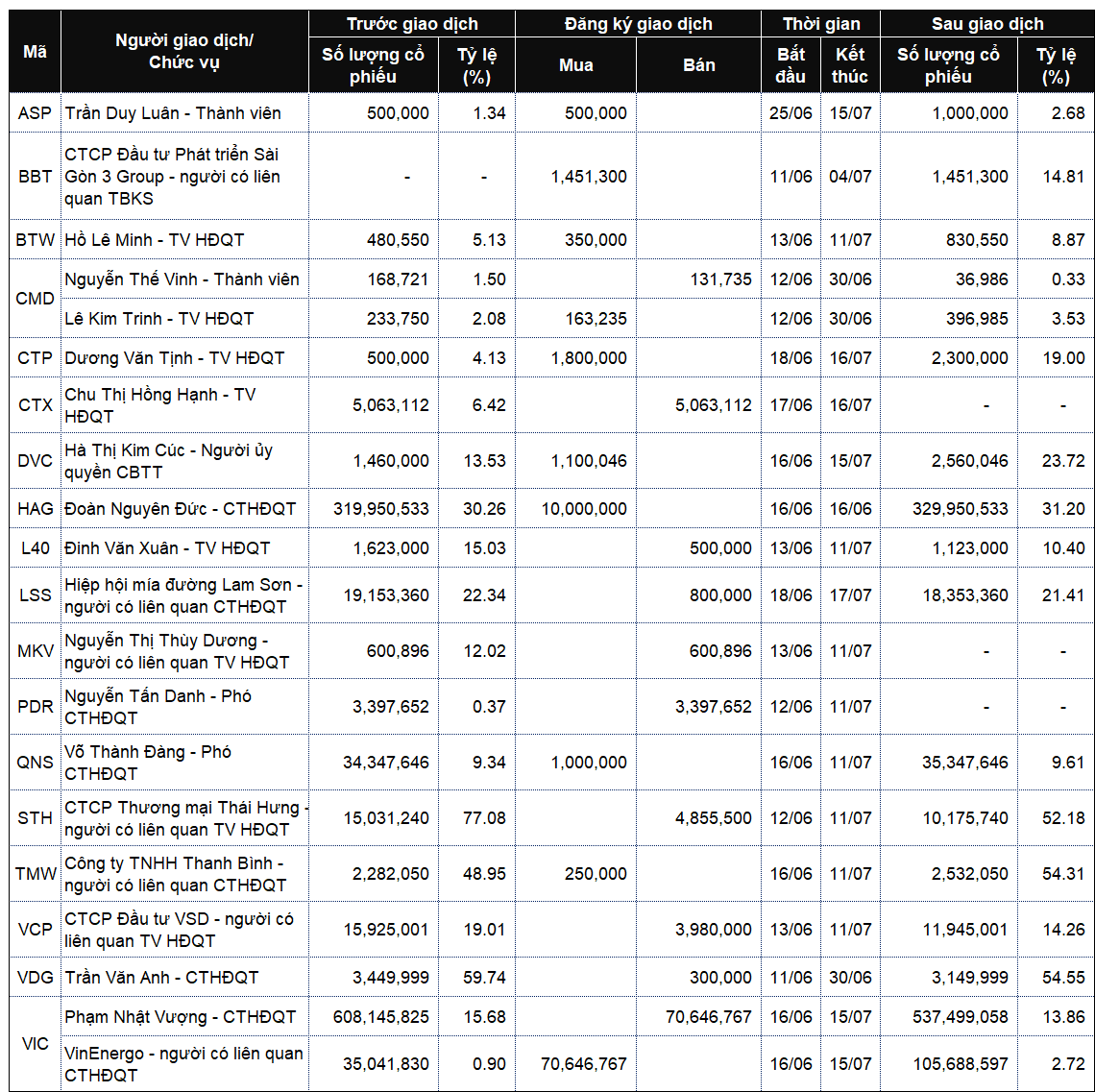

List of company leaders and relatives registering to trade from June 9 to 13, 2025

Source: VietstockFinance

|

– 2:00 PM, June 16, 2025

The Billionaire’s Bet: Bầu Đức’s $5.5 Million Investment Gamble in HAGL Shares.

As of the current market price of VND 13,000 per share, Mr. Duc’s newly purchased shares are valued at a whopping VND 130 billion.

The Billionaire’s Next Move: Bầu Đức Seeks to Acquire 10 Million HAG Shares.

“Mr. Doan Nguyen Duc, affectionately known as ‘Bầu Đức’, and Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HAGL), has signaled his intent to purchase 10 million HAG shares via a negotiated deal. This substantial purchase is slated to occur between June 16 and June 30, 2025, and has the market abuzz with anticipation.”

I hope that suits your requirements and captures the tone and style you were aiming for.

A New Era for Dia Oc Hoang Quan: Unveiling Our Dynamic Leadership Transition

Mr. Nguyen Long Trieu has been appointed as the new CEO of Dia Oc Hoang Quan, succeeding Mr. Nguyen Thanh Phong.

The Revamped Title: “Bầu Đức: The Inevitable Mention of Debt When Discussing Hoàng Anh Gia Lai”

“Despite the challenges, Chairman Doan Nguyen Duc, affectionately known as ‘Bầu Đức’, has successfully steered Hoang Anh Gia Lai (HAGL) towards a remarkable financial turnaround. Over the years, the group has diligently worked on reducing its debt and eliminating accumulated losses from the past nine years. With over 90% of this Herculean task accomplished, Bầu Đức confidently asserts that the year-end financial report will be exceptionally positive. However, despite this impressive recovery, HAGL still faces a perception challenge, as potential partners tend to overlook or remain indifferent to their achievements.”