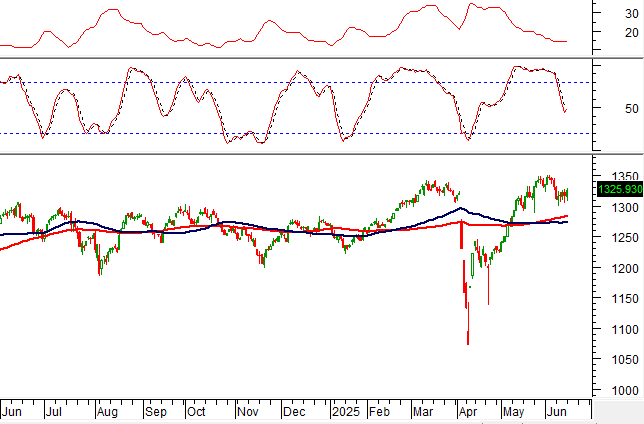

Technical Signals for VN-Index

In the trading session on the morning of June 16, 2025, the VN-Index opened higher with slightly lower trading volume, indicating investors’ hesitation.

Additionally, the ADX indicator continues to fluctuate below the gray zone (20 < adx < 25), suggesting a lack of clear trend direction.

Technical Signals for HNX-Index

During the trading session on the morning of June 16, 2025, the HNX-Index opened higher, accompanied by a slight dip in the session, reflecting investors’ uncertainty.

Furthermore, the MACD indicator continues to give a sell signal. This suggests that the short-term outlook remains pessimistic.

DGC – Duc Giang Chemical Group Joint Stock Company

On the morning of June 16, 2025, DGC’s stock price surged, forming a candle pattern similar to a White Marubozu, with significantly increased trading volume exceeding the 20-session average. This indicates active trading and strong buying pressure.

Moreover, the MACD indicator remains above the zero line after giving a buy signal, further reinforcing the stock’s potential for a short-term recovery.

VOS – Vietnam Maritime Transportation Joint Stock Company

On the morning of June 16, 2025, VOS’s stock price rose with volume exceeding the 20-session average, indicating investors’ optimistic sentiment.

Additionally, the price is retesting the medium-term downward trend line, while the MACD and Stochastic Oscillators both indicate buy signals. If these signals are sustained, the prospects for a short-term recovery will be strengthened.

The previous peak of February 2025 (corresponding to the 17,300-17,800 region) could be the target price for this recovery.

Technical Analysis Department, Vietstock Consulting

– 11:59 16/06/2025

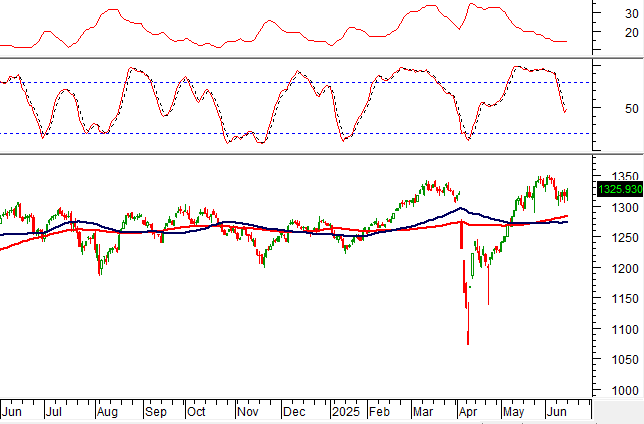

No Worries About Missile Issues, the Market Bounces Back Strongly, VN-Index Recaptures the 1,320-Point Level

The Middle East tensions continue to escalate, but investor sentiment has improved significantly following the weekend. Although this morning’s market saw a substantial 34% drop in capital inflows compared to the previous session, stock prices witnessed a broad-based recovery. However, the upward momentum showed signs of waning in the latter half of the session as selling pressure emerged at higher price levels.

The Volatile Market: What’s in Store for Stocks Next Week?

The domestic stock market experienced its second consecutive week of adjustments and consolidation following a period of robust price increases. According to analysts, June could be a volatile month for the market as trade negotiations enter their final stages and tensions between Iran and Israel escalate.

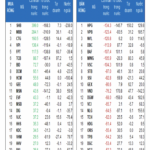

A Surprise Turn: Foreign Investors Pump Billions into Bank Stocks Amid VN-Index Adjustment

The foreign transactions witnessed a tug-of-war scenario, with net selling at the beginning of the week and a shift to net buying towards the week’s end.