Norges Bank: A Leading Central Bank and Global Investor

Norges Bank, Norway’s central bank founded in 1816 and headquartered in Oslo, goes beyond traditional central bank duties. While maintaining price and financial stability through fiscal and monetary policies, Norges Bank also manages Norway’s Government Pension Fund, the world’s largest sovereign wealth fund.

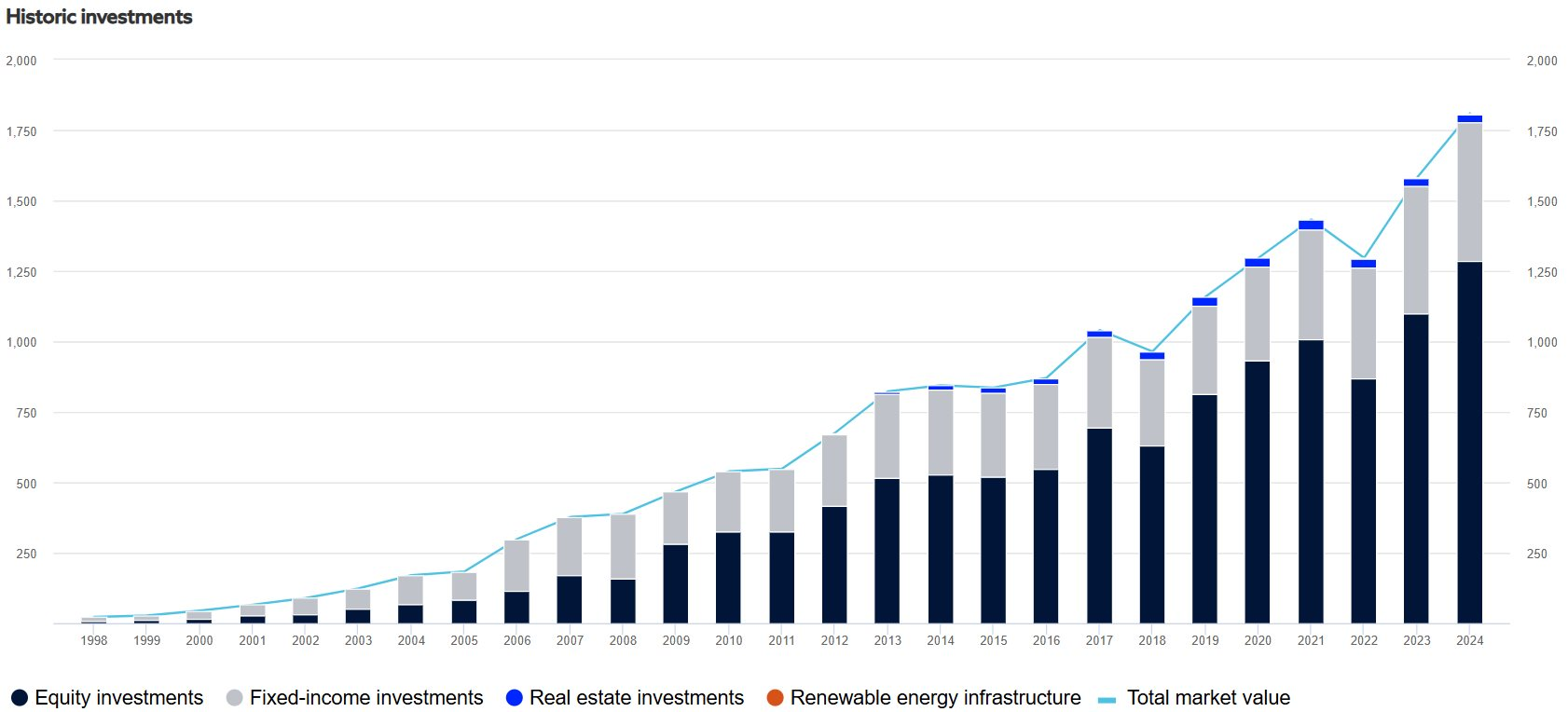

As of last year, the market value of the pension fund managed by Norges Bank reached nearly 19.8 trillion kroner (over $1.739 trillion). The fund is invested in over 11,000 assets (stocks, bonds, real estate, and renewable energy) across 70 countries, thanks to the expertise of Norges Bank Investment Management (NBIM).

As of the end of 2024, the fund’s portfolio was mainly invested in equity markets, with 71.4% in stocks worth over $1.2 trillion invested in 8,659 companies. Additionally, 26.6% was in bonds, 1.8% in real estate, and the remainder in renewable energy.

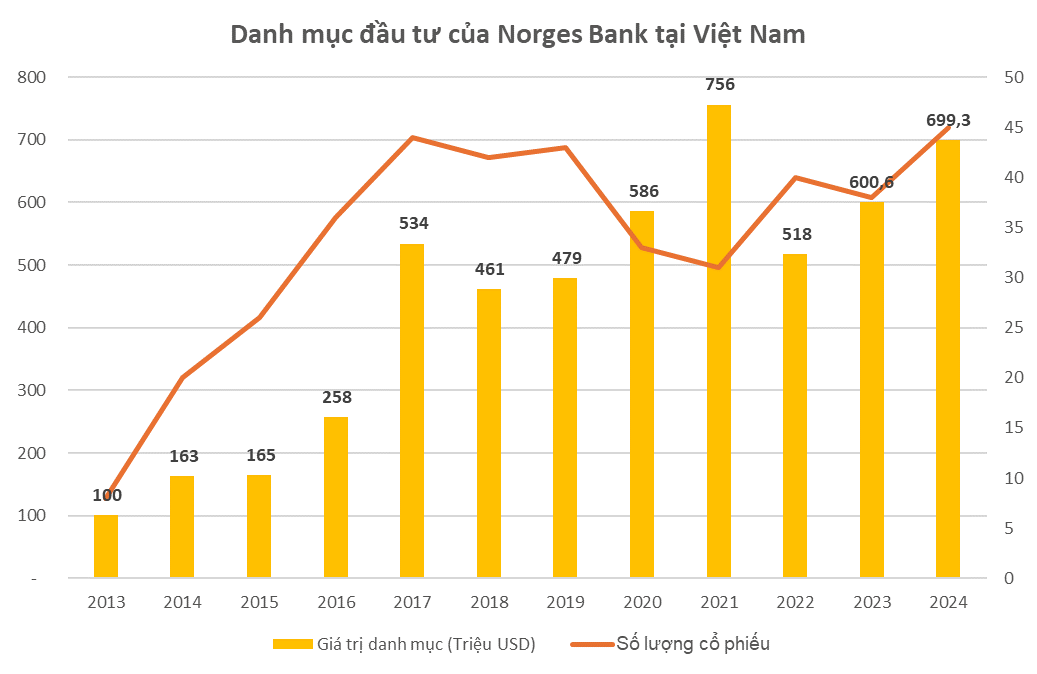

In Vietnam, Norges Bank’s portfolio is managed by Dragon Capital. As of the end of 2024, the fund had invested nearly $700 million in the country across 45 stocks, an increase of nearly $99 million from the previous year.

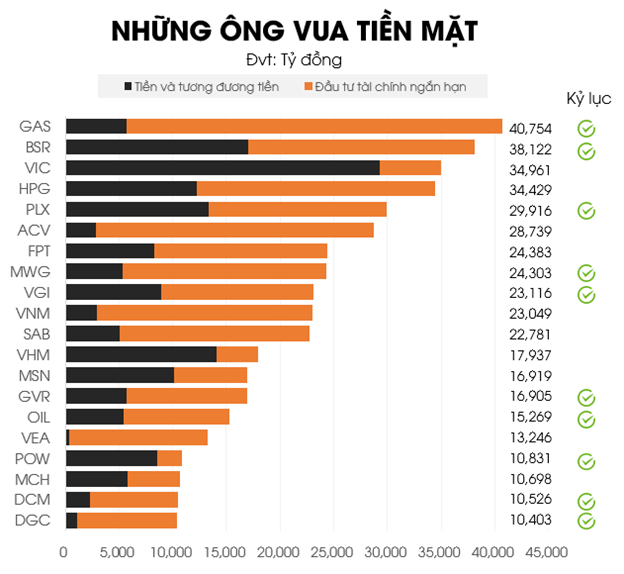

The fund’s largest stock investment in Vietnam is in MWG, a mobile network operator, with over $63 million. Other significant investments include FPT (nearly $56 million), Duc Giang Chemicals (almost $41 million), Techcombank ($38.7 million), and Nha Khang Dien ($38.5 million).

Notably, the portfolio shows a significant focus on the banking and financial services sector, with 13 investments totaling over $266 million. This includes investments in banks such as Techcombank (TCB), VPBank (VPB), Sacombank (STB), and Vietcombank (VCB), as well as four securities companies: BIDV Securities, SSI, Vietcap, and VDSC.

Norges Bank has also invested in nine real estate companies, including Nha Khang Dien, Vinhomes, Becamex IDC, and Kinh Bac, with a total investment value of nearly $98 million.

Furthermore, the bank has invested in stocks across essential and non-essential consumer goods, industrial goods, basic materials, and energy sectors. However, in the technology sector, the fund has only invested in one company, FPT, with a value of over $56 million.

Dragon Capital’s Foreign Ownership in PVS Shares Rises Above 7%

Dragon Capital has bolstered its investment in PVS by acquiring an additional 1.42 million shares, elevating its ownership stake from 6.8054% to 7.1025%.