The stock market witnessed the second consecutive week of downward pressure. VN-Index fell more than 19 points in the first trading session of the week, then recovered to test short-term support around 1,310 points before returning to a strong correction in the last trading session. Oil and gas and banking stocks remained the two key sectors helping the main index hold the 1,300-point support. For the week, the VN-Index decreased by -1.08% to 1,315.49 points.

Many analysts believe that the VN-Index will face corrective pressure as geopolitical instability increases. However, Vietnamese stocks continue to be attractive in the medium and long term due to a stable macro foundation, attractive valuations, and superior economic growth potential compared to the region.

Stock Market Enters a “Challenging” Phase

Nguyen Tan Phong – Pinetree Securities’ Analyst

The VN-Index has gone through a very challenging second week of June due to corrective pressure from Vingroup’s stocks.

Specifically, the Vingroup trio of VIC, VHM, and VRE fell by more than 10% from last week’s peak, causing the market to correct.

Some positive news emerged last week: the US and China reached a framework agreement on trade negotiations, and retail stocks benefited as the state tightened tax issues and unregulated goods for small retailers. In addition, capital began to return to banking stocks.

On Friday, news of escalating conflicts between Iran and Israel caused global stock markets to plunge. Although the tension in the Middle East does not directly affect Vietnam, and with limited catalysts to continue pushing the market higher, as well as the approaching deadline for Trump’s tax postponement, the VN-Index could not avoid a corrective session.

Looking ahead, the Pinetree analyst forecasts that the stock market is entering a “challenging” phase as the upcoming movement will depend entirely on information about the trade situation and global macro conditions. There are two possible scenarios for the week ahead:

Positive Scenario: In the absence of new information on trade relations and no strong correction in Vingroup stocks, the VN-Index may retest the 1,350 peak next week, led by banking stocks. Capital will also be differentiated and may rotate from overheated stocks back to those accumulating at the base.

Negative Scenario: In the event of negative news on trade relations, such as unsuccessful US-China trade negotiations, and a strong correction in Vingroup stocks, a continued downward trend is likely. Currently, the VN-Index is trading around the resistance of MA9 and MA20, and if it continues to fall, the 127x level will be the market’s strong support.

Focus on Sectors with Clear Profit Growth Potential and Policy Benefits

Nguyen Anh Khoa – Head of Analysis and Investment Consulting, Agriseco Securities

According to Agriseco’s analyst, the market continued to experience strong fluctuations last week due to short-term corrective pressure on large-cap stocks. However, the fact that the VN-Index maintained the 1,300-point level indicates the presence of bottom-fishing demand, especially for stocks with a positive fundamental background.

Looking ahead, Mr. Khoa forecasts that the index will continue to face corrective pressure amid escalating geopolitical tensions in the Middle East between Israel and Iran. In a positive scenario, the VN-Index may fluctuate in the 1,280-1,320 range, awaiting further cooling of global geopolitical tensions, along with new information from Q2 business results and government support policies. Market liquidity is expected to continue to be polarized, focusing on policy-benefiting sectors and short-term speculative capital.

Last week, there was news that the US and China had reached trade agreements. However, for the EU, trade agreements are currently difficult to achieve due to internal divisions. At the same time, the EU’s key industries will compete directly with the US, so concessions from both sides are unlikely. The trend of protectionism is increasing, which could raise inflation risks and put pressure on global growth, affecting international financial markets.

For Vietnam, Mr. Khoa believes that the impact could be twofold. On the one hand, Vietnam may benefit from supply chain shifts and new FDI inflows. On the other hand, the risk of trade scrutiny and increased tariff barriers from the US cannot be overlooked, especially as the trade surplus with the US has been rising sharply in recent years. The issue of product origin will be crucial in ensuring smooth negotiations between the two countries.

Nonetheless, the Vietnamese stock market remains attractive in the medium and long term due to its stable macro foundation, attractive valuations, and superior economic growth potential compared to the region. Efforts to upgrade the market, along with progress in completing the KRX trading system, will support foreign capital inflows.

” However, in the short term, this capital may fluctuate due to international geopolitical factors, especially the escalating tensions in the Middle East between Israel and Iran, which could dampen global risk appetite. To maintain its attractiveness, Vietnam needs to continue institutional reforms, improve transparency, and promote policies to attract long-term capital “, emphasized the Agriseco analyst.

Regarding the unexpected popularity of oil and gas stocks, Mr. Khoa attributed it to the sector’s positive performance amid surging global oil prices, mainly due to supply disruption fears following new tensions between Israel and Iran, two influential countries in Middle Eastern security. Additionally, expectations for the progress of key projects like Lot B – O Mon and the recovery of leading businesses have attracted capital back to this sector. In the short term, oil and gas stocks may continue to perform well if oil prices maintain their upward trend and geopolitical risks persist.

In a cautious investment environment, investors will prioritize sectors with clear profit growth potential and policy benefits.

Specifically, the banking sector continues to play a leading role thanks to credit growth potential and the government’s determination to boost economic growth. The steel industry benefits from recovering selling prices and increasing construction demand, especially from public investment and real estate projects.

Following this, the real estate sector, after a strong correction, is showing signs of recovery as liquidity improves in some segments, and low-interest rates support investor sentiment. Many real estate projects have recently had legal obstacles removed and can soon be implemented.

The retail industry is also expected to grow positively due to the recovery of domestic consumption, especially in the upcoming peak tourism season. Additionally, the policy of reducing VAT to 8% may be extended until the end of 2026, and the master plan for e-commerce development will be crucial for retail businesses. These sectors could lead the market’s recovery if the current accumulation trend persists.

VN-Index May Fluctuate During the Crucial Negotiation Phase

SHS Securities

SHS Securities’ analysts predict that the VN-Index’s short-term recovery and growth trend is ending as the temporary tariff postponement period concludes. The VN-Index is entering an accumulation phase, awaiting updates on companies’ fundamentals.

Despite corrective pressure around the 1,300-point level and a sudden increase in selling pressure in the last trading session for many stocks, SHS observes that buying demand at lower prices has improved. Technically, the VN-Index can only improve significantly by surpassing the resistance around 1,325 points, corresponding to the current 20-day moving average, with psychological support at 1,300 points and stronger support around 1,270 points.

SHS forecasts that the market in June will be unpredictable as it is in the final phase of trade negotiations, with new tariffs possibly being imposed. In the short term, under the influence of escalating tensions in the Middle East, the market has experienced risk-averse selling, especially in speculative sectors such as financial services and real estate, and in stocks that have already surged.

In terms of strategy, investors should consider portfolio restructuring and be cautious about new investments in the current context. Meanwhile, maintaining a reasonable allocation with a focus on stocks with solid fundamentals, industry leaders, and sectors critical to economic growth is advisable.

The Volatile Market: What’s in Store for Stocks Next Week?

The domestic stock market experienced its second consecutive week of adjustments and consolidation following a period of robust price increases. According to analysts, June could be a volatile month for the market as trade negotiations enter their final stages and tensions between Iran and Israel escalate.

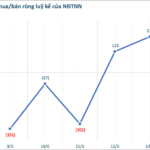

A Surprise Turn: Foreign Investors Pump Billions into Bank Stocks Amid VN-Index Adjustment

The foreign transactions witnessed a tug-of-war scenario, with net selling at the beginning of the week and a shift to net buying towards the week’s end.

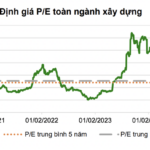

“Undervalued Construction Stocks: Outperforming Earnings Prospects”

The volatile and uneven fluctuations in the cost of raw materials can put varying degrees of pressure on the profit margins of construction companies. However, the sustained low-interest rate environment will serve as a crucial supportive factor, alleviating financial burdens, especially for the capital-intensive construction industry.

Stock Market Insights: The 1,300 Point Region – A Critical Support Level

The VN-Index declined and concluded a volatile week of trading. A decrease in weekly trading volume compared to the previous breakout period indicates a return to cautious investment strategies. The 1,300-point level remains a crucial support zone, and if breached, the VN-Index could face further downward pressure, potentially testing the next support zone around 1,270-1,280 points.