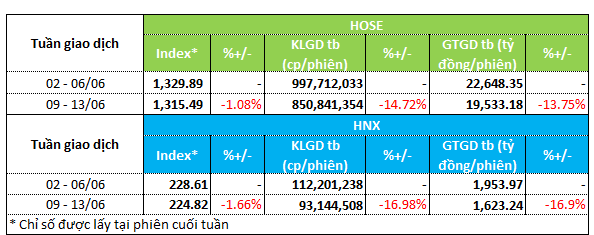

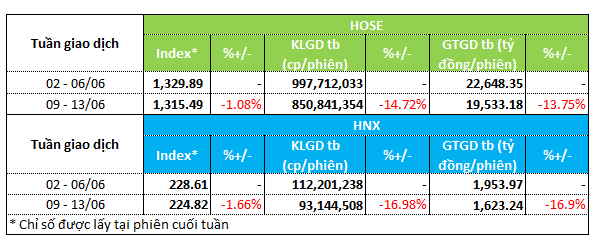

The market witnessed a downward trend during the week of April 09-13, with both indices and liquidity declining. The VN-Index and HNX-Index dropped by over 1%, settling at 1,315.49 and 224.82, respectively.

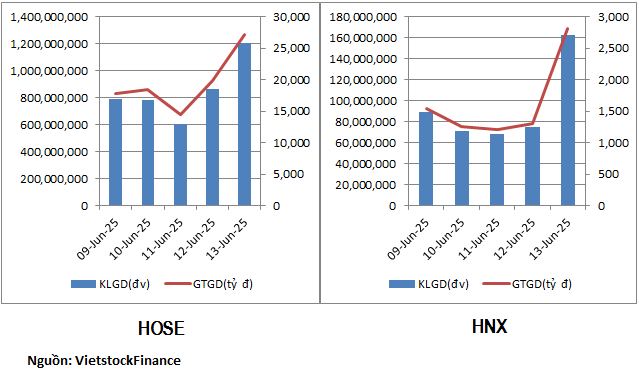

Liquidity also took a hit, with trading volume and value decreasing on both exchanges. On the HOSE exchange, trading volume fell by nearly 15% to 850.8 million units per session, while trading value dropped by 14% to VND 19.5 trillion. Similarly, the HNX exchange saw a 17% decline in trading volume to 93.1 million units per session, and trading value fell to VND 1.6 trillion per session.

|

Market Liquidity Overview for the Week of June 09-13

|

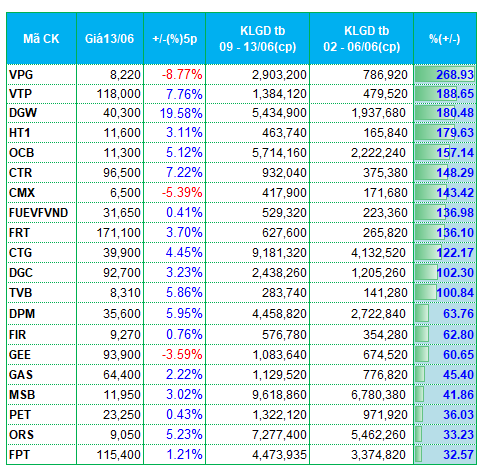

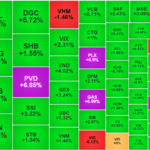

Despite the overall bearish sentiment, some stock sectors showed resilience and attracted a modest amount of capital inflows. The banking sector stood out, with several bank stocks witnessing a significant surge in liquidity on the HOSE and HNX exchanges. OCB, CTG, MSB, and NVB were among the top performers in this sector.

Additionally, distribution and retail stocks also had a strong week, with DGW, FRT, and PET witnessing a substantial increase in trading volume. Notably, DGW and FRT saw their trading volumes surge by several folds compared to the previous week.

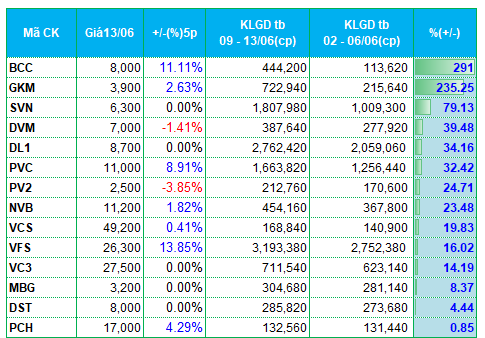

The construction materials sector also witnessed positive momentum, with HT1, BCC, GKM, and VCS experiencing a significant boost in liquidity.

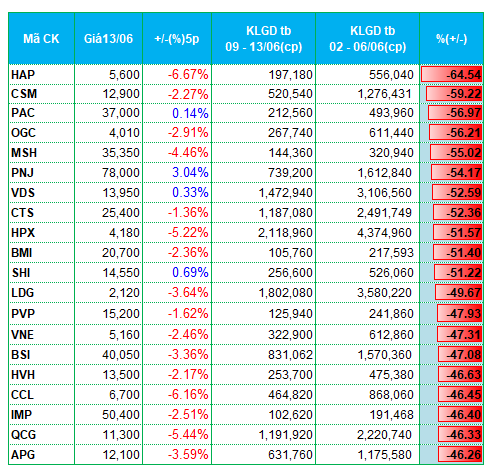

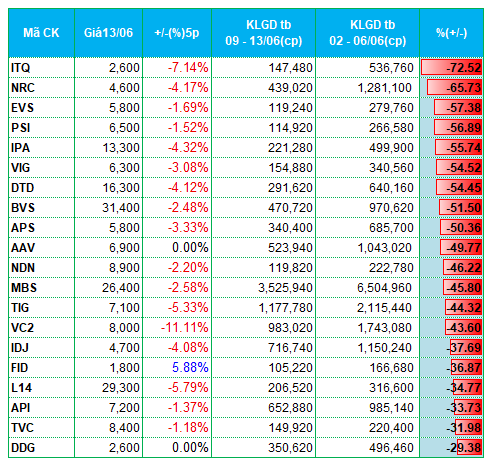

On the other hand, the real estate and securities sectors experienced the most significant capital outflows. In the real estate sector, stocks such as HPX, SHI, CCL, QCG, NRC, DTD, AAV, NDN, VC2, L14, and API witnessed capital outflows.

In the securities sector, VDS, CTS, BSI, APG, EVS, PSI, VIG, BVS, APS, MBS, and TVC were among the top losers in terms of liquidity.

|

Top 20 Stocks with the Highest Liquidity Increase/Decrease on the HOSE Exchange

|

|

Stocks with the Highest Liquidity Increase/Decrease on the HNX Exchange

|

The list of stocks with the highest liquidity increase/decrease is based on a trading volume of over 100,000 units per session.

– 7:28 PM, June 16, 2025

Market Beat June 16: VN-Index Surges Over 22 Points, Energy Sector Shines Bright

The market closed with strong gains, as the VN-Index rose by 22.62 points (+1.72%), finishing at 1,338.11. The HNX-Index also climbed, gaining 3.3 points (+1.47%) to close at 228.12. It was a sea of green across the market, with 515 tickers in the gainers’ column compared to just 211 in the losers’. The VN30 basket mirrored this sentiment, with 24 gainers, 4 losers, and 2 unchanged stocks.

Unexpected Euphoria: Energy Stocks Surge, VN-Index Flirts with 1340 Peak

Investors witnessed a surprising surge of enthusiasm during today’s afternoon session, with proactive and aggressive buying that propelled the VN-Index to its strongest gain in eight weeks. Shunning the previous two weeks of cautious adjustments, the index dramatically rebounded to near its previous peak, finishing at an impressive 1338.11 points.

Stock Market Insights: A Glimpse of Positive Signals

The VN-Index surged, crossing above the middle Bollinger Band. With continued index strength and trading volumes above the 20-day average, the bullish trend would be reinforced. Notably, the Stochastic Oscillator has signaled a buy, exiting the oversold region. Should the MACD indicator follow suit in upcoming sessions, the short-term outlook would brighten considerably.

Stock Market Blog: Keep Your Cool

Today’s market buzzed with excitement as breaking news on trade negotiations surfaced. It seems that cash-holding investors are feeling the psychological pressure, leading to a fierce buying spree. The VNI index surged in a single session, reclaiming its former peak.