From Phones to Electric Vehicles

While phone brands like Xiaomi, Honor, and Huawei dominate global market shares and are household names worldwide, few have heard of Transsion—the company that ranks fourth in global smartphone sales yet does not sell its products in its home country of China.

Headquartered in Shenzhen and established in 2006, Transsion took an unconventional path by expanding into Africa, initially selling feature phones on the continent from 2008 before transitioning to smartphones in 2014.

Transsion owns a range of brands familiar to Africans, including Infinix, Tecno, and Itel, earning the nickname the “king of Africa’s smartphone market.” In 2024, the company brought 9.3 million smartphones to the continent, capturing approximately 50% market share, outpacing renowned competitors.

Much like other Chinese companies, after conquering the phone market in Africa, Transsion now sets its sights on owning the roads.

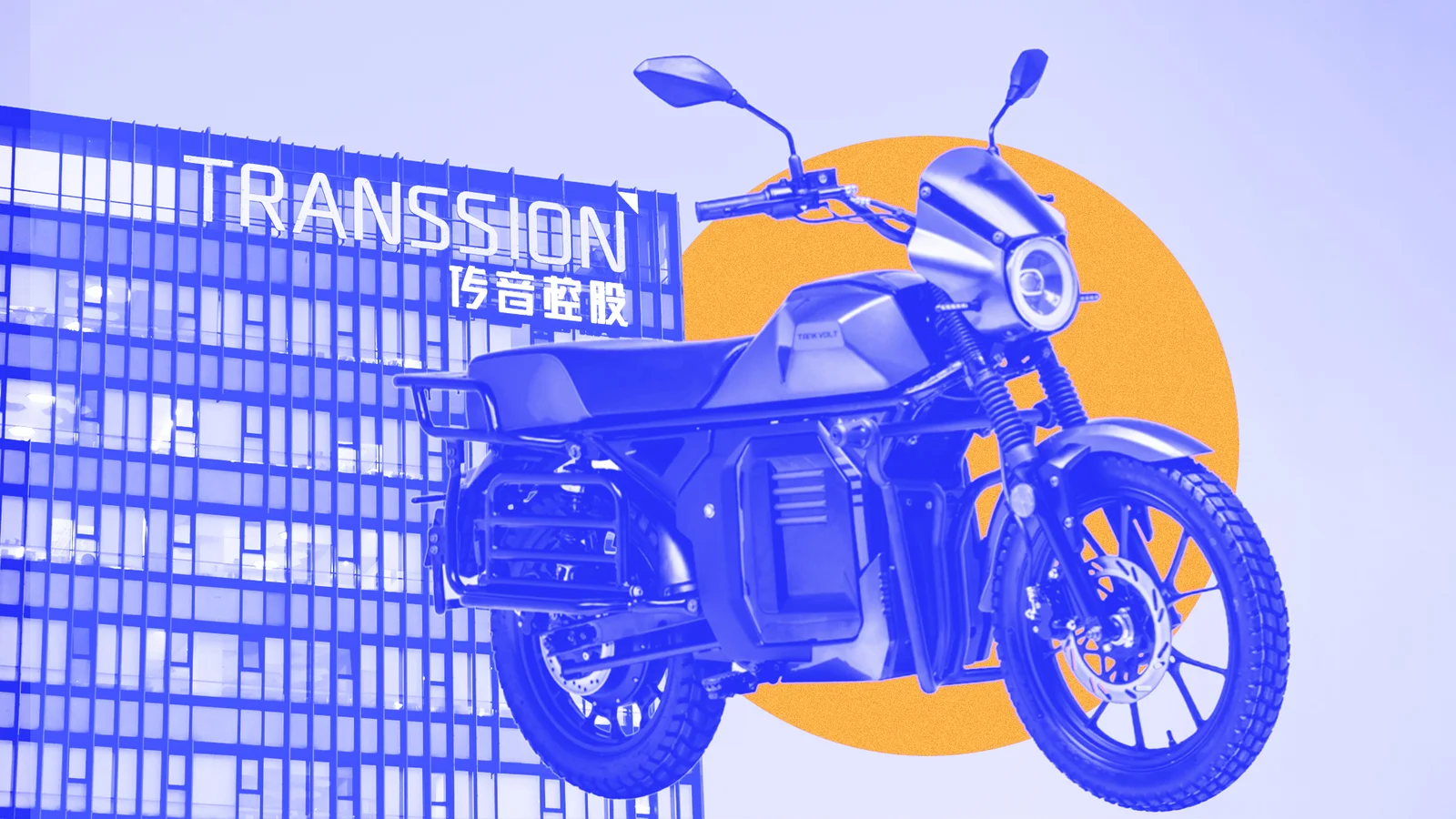

The Chinese company ventured into the continent’s electric vehicle competition with the launch of its two-wheeler TankVolt in Uganda in 2023. Two years later, the company expanded into four other markets—Nigeria, Kenya, Tanzania, and Ethiopia.

Daniel Nyakora, Transsion’s business development director in Nigeria, stated that the company is now among the top three electric vehicle brands in Africa in terms of sales volume and aims to lead the market by next year.

“Our two-wheelers and three-wheelers are market leaders in quality, offering fantastic pricing, and we are partnering with financial organizations to bring flexible payment options,” said Nyakora.

Transsion leverages its distribution strengths built over years of phone sales to dominate the continent’s EV sector, combining an understanding of African consumer preferences with production scale and a robust sales network.

“TankVolt has a clear advantage in leading Africa’s EV market in terms of capital, production capacity, and supply chain expertise. They can scale much faster than most local startups,” said Tom Courtright, research director at EV Africa E-Mobility Alliance.

Although relatively small compared to China and Europe, Africa’s EV market is estimated to reach $17.41 billion by 2025 and is projected to hit $28.30 billion by 2030.

Electric Motorcycles at $1,500

With its success in smartphones, the company now applies a similar strategy to electric vehicles. The TankVolt, produced in its Shenzhen facility, retails for approximately $1,500. In comparison, bikes from Ethiopia’s Dodai sell for around $1,800, while Spiro and Roam offer similar prices to TankVolt.

TankVolt Bikes

The TankVolt two-wheelers and three-wheelers feature integrated or swappable batteries. Transsion also leases batteries to third-party charging stations for a monthly fee. Additionally, the company provides asset management and operation software to EV companies. They have already launched battery-as-a-service in Tanzania and plan to roll it out in Uganda by the end of June.

TankVolt actively targets African governments, promoting a clean vehicle agenda. This strategy has shown initial success, with the Niger state government placing an order for 5,000 vehicles in November.

In Nigeria, electric vehicle adoption is becoming a pillar in state governments’ plans. At least four states have implemented operational electric vehicle fleets or announced transition plans, providing a ready market for EV brands like Transsion.

Despite Transsion’s advantages, larger companies are not conceding easily. Transsion faces competition from established firms like Cotonou and Spiro, local startups including Ampersand and Roam in Kenya, Dodai in Ethiopia, and the Chinese company Yidea, which recently entered Ethiopia.

Niko Kadjaia, co-founder of the EV startup Tri, acknowledges Transsion’s experience in scaling but doubts its ability to replicate that success in a different sector.

“Transsion understands how to do business in Africa and clearly knows how to scale across the continent,” Kadjaia told Rest of World. “But they have to prove they can use the same strategy across multiple product categories.”

Building a battery-swapping infrastructure will be Transsion’s most significant challenge in expanding across African markets. The company will require local partners in every market.

Unlike most African EV brands that source from Chinese manufacturers, Transsion controls its entire value chain, from production to distribution.

According to Kayode Adeyinka, CEO and co-founder of Gigmile, a Lagos-based fintech mobility platform, this vertical integration gives Transsion a cost advantage over competitors, but they still have their work cut out for them.

“We’ve seen what Transsion is capable of,” Adeyinka said. “But selling EVs and phones are two different ball games.”

The Master Wordsmith: Unveiling VinFast’s Million-Dollar Plan

“This is a well-grounded plan and we are confident in our ability to execute it effectively. Our team is committed to delivering even stronger strategies moving forward.” – Ms. Hai asserted.

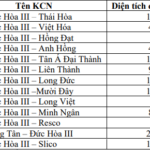

‘Automotive Giant’ with 7 Car Plants in Quang Nam Province Builds Charging Stations Across Vietnam, Offering Free Charging for Foreign Brand Vehicles

Among the operating charging stations, some have a capacity of up to 120 kW, enabling a full charge in just 45 minutes.