The Subtle “Undercurrent” in the Stock Market Post-KRX Launch

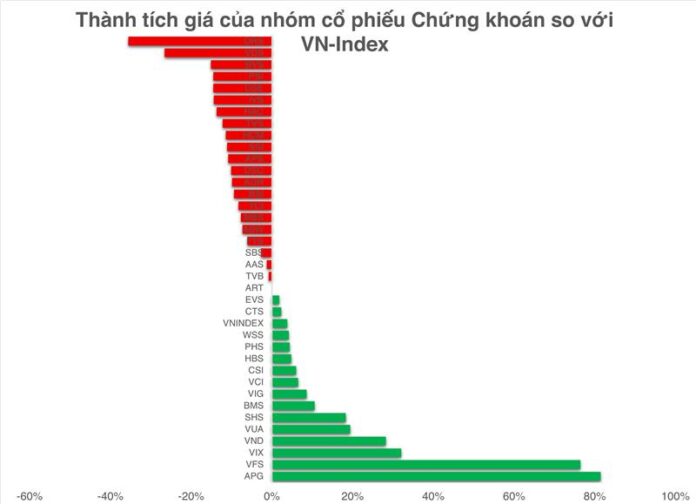

The new trading system, KRX, officially went live on May 5, 2025. Over five weeks later, expectations of a “price surge” for securities stocks have not materialized. On the contrary, industry leaders such as SSI, HCM, and BSI have continued their downward trends, losing 11%, 11.4%, and 9.4% year-to-date, respectively.

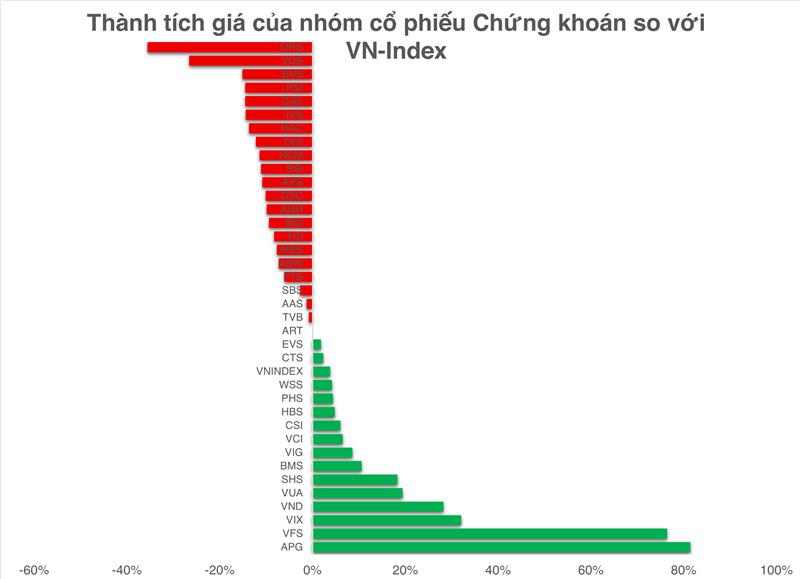

However, beneath the seemingly calm surface, there are some subtle “undercurrents” at play. Leading the price performance are two small-cap stocks, APG (with a market cap of VND 2,700 billion) and VFS (VND 3,400 billion), which have surged 81% and 76%, respectively, as of the trading session on June 13.

Price performance as of the trading session on June 13.

|

The common thread among this group of stocks is that they are undergoing a significant restructuring phase, witnessing changes in top-level personnel, and pursuing ambitious capital-raising plans.

Specifically, VFS is preparing to implement its largest-ever capital increase, offering 120 million shares to existing shareholders. Meanwhile, APG plans to privately issue a maximum of 100 million shares, with an expected issue price of no less than VND 12,000 per share.

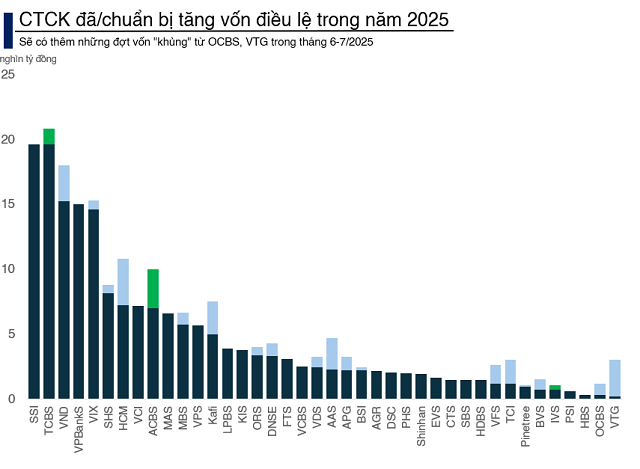

It’s not just listed companies that are transforming; many unlisted securities firms are also undergoing rapid changes. In June, OCBS (formerly VISecurities) announced plans to quadruple its charter capital from VND 300 billion to VND 1,200 billion, expected to be completed by June 20, 2025.

In July, VTGS will issue shares from July 2 to July 16, increasing its charter capital from VND 138 billion to VND 3,036 billion – a 22-fold increase. Out of the VND 2,898 billion raised, about VND 2,786 billion will be allocated for lending activities.

A quiet transformation is sweeping through the industry, even as the “big wave” has yet to make its anticipated comeback.

The Securities Industry Needs to Escape its “Hot” and “Crowded” State

With the advent of zero-fee trading, revenue generation from brokerage fees is no longer a primary concern for many securities companies. Profits from brokerage fees have dwindled to near zero, and some firms are even experiencing negative brokerage fees. Meanwhile, profit margins from margin lending are also under significant competitive pressure.

Mr. Nguyen The Minh, Director of the Analysis & Customer Development Division at Yuanta Vietnam Securities, commented: “Previously, some securities companies could achieve ROEs of up to 25%, but this has now dropped to below 15%, and it could continue to fall if there are no changes in policies or if they are not upgraded.”

At the annual general meeting of VNDIRECT, Mr. Nguyen Vu Long candidly shared his perspective: “Competing by reducing fees and interest rates will lead to a scenario of industry-wide losses. We choose to invest in AI and technology and improve efficiency instead of engaging in a price war.”

However, it must be acknowledged that the securities industry is currently both “hot” – due to the intense shifts in technology, capital, and personnel – and “crowded” because profit margins are being squeezed.

The introduction of the KRX system marks a significant infrastructure advancement, but it may not be enough if the market lacks new products to attract investors and generate sustainable revenue streams. This is especially pertinent given the expectations for a market upgrade in September, which could pave the way for foreign capital inflows.

Expanding their scope of operations has been on the agenda of many securities companies, but a comprehensive legal framework is still missing. Recently, Mr. Nguyen Chi Thanh, CEO of SHS, shared his vision for developing the carbon credit market and venturing into the digital asset space.

Currently, securities companies such as SSI, TCBS, DNSE, and VIX have also expressed their ambitions in the digital asset market and are preparing for long-term strategies.

An important development supporting these initiatives is the National Assembly’s official passage of the Law on Digital Technology Industry on June 14, 2025, with 92.26% of the delegates in favor. This is Vietnam’s first law that establishes a legal framework for digital assets and artificial intelligence (AI).

– 08:08 16/06/2025

The Volatile Market: What’s in Store for Stocks Next Week?

The domestic stock market experienced its second consecutive week of adjustments and consolidation following a period of robust price increases. According to analysts, June could be a volatile month for the market as trade negotiations enter their final stages and tensions between Iran and Israel escalate.

Optimizing Digital Asset Management: Unlocking the Power of State-Owned Digital Assets

The Digital Technology Industry Law has outlined specific provisions for state management of digital assets, including their creation, issuance, storage, transfer, and ownership establishment. It also covers the rights and obligations of parties involved in digital asset-related activities, ensuring information security and cybersecurity measures, anti-money laundering provisions, and conditions for conducting business with encrypted asset service providers.

“Aggressive Buying: Individuals and Proprietors Scoop up 4 Trillion VND in Weekly Purchases”

Individual investors bought a net amount of VND 2,605.7 billion, of which they net bought VND 543.5 billion. Proprietary trading also net bought VND 1,339.4 billion, of which they net bought VND 1,217.4 billion in matched orders.