|

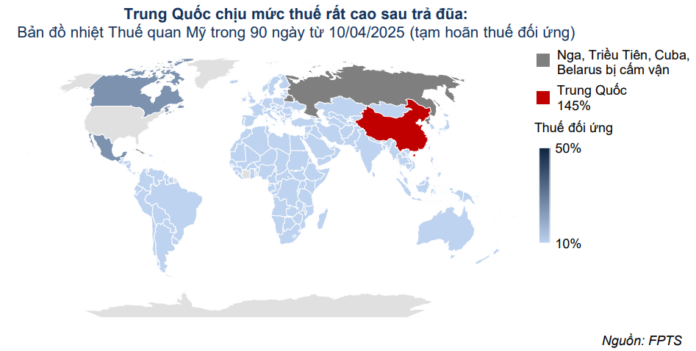

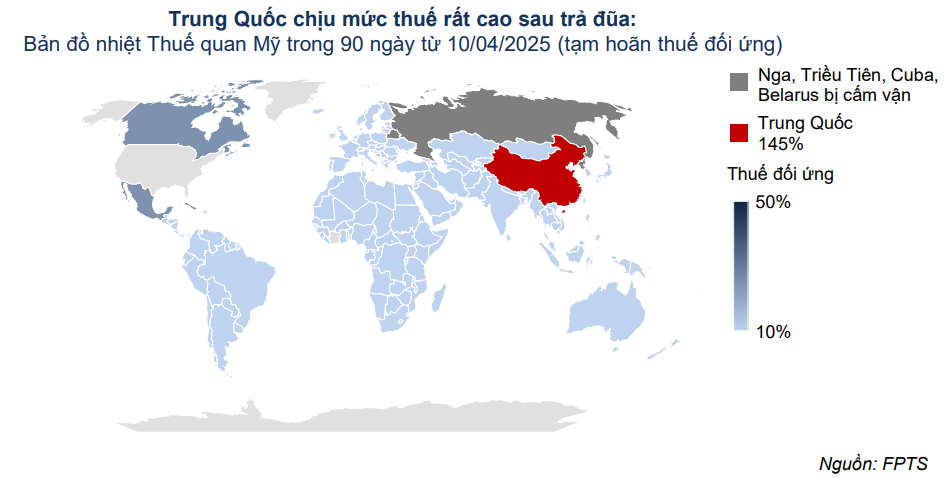

Global markets were shaken in early April by the US’s new tariff policies. While a basic 10% tax is applied universally, countries such as Vietnam, deemed to be “trade manipulators,” face retaliatory tariffs of up to 46%. Although the US has temporarily delayed the implementation of these tariffs for 90 days (excluding China) to allow for negotiations, the prospect of high tariffs remains a tangible threat.

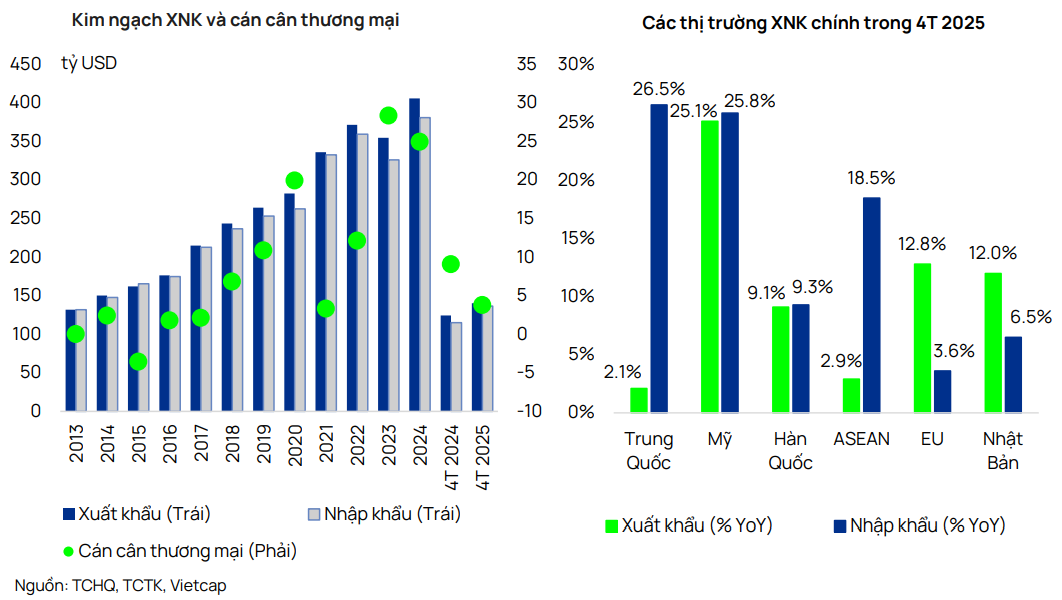

With its high trade openness and the US as its largest export market, Vietnam cannot escape the pressure. Bilateral dialogues have been initiated, with Vietnam among the 20 priority countries and some agreements reached to increase imports from the US.

Analysis reports from securities companies emphasize that the developments and outcomes of the upcoming negotiations will be decisive for the actual impact on the economy and key export sectors.

|

|

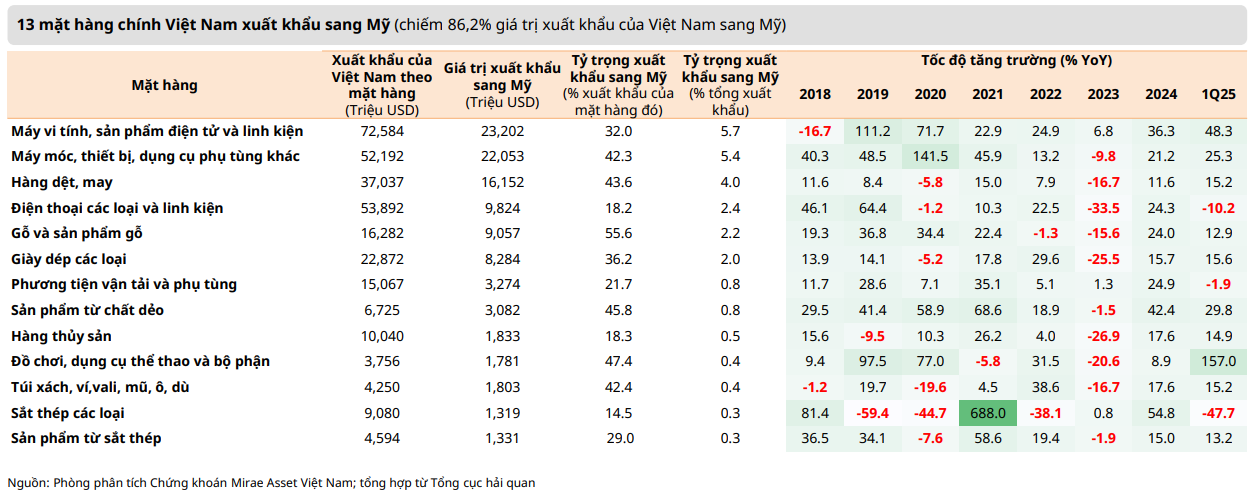

Several sectors are expected to be directly and negatively impacted, especially in the scenario of a 46% retaliatory tariff as announced by the US on April 2, 2025.

Garment and textile is the sector most directly and visibly affected. The US is currently the main market, accounting for a large portion of the revenue of listed companies such as MSH, TNG, and TCM. If subjected to a 46% tariff, Vietnamese apparel will lose its competitive advantage compared to Bangladesh, India, or even China, where tariffs have been reduced from 145% to 30% following an agreement with the US. Companies may have to consider reducing selling prices to share the tax burden with customers, further squeezing already thin profit margins.

Wood processing also faces significant challenges. The US is currently the largest market, accounting for 56% of wood exports in 2024. Before the new tariff agreement between the US and China, Vietnam benefited significantly from the shift in orders away from China, with exports to the US expected to increase by up to 10.7% year-over-year in 2025. However, with China now facing a 30% tariff, Vietnam’s pace of gaining market share has slowed, and exports to the US are now expected to increase by only 7%, equivalent to approximately $9.5 billion. Companies with a high proportion of exports to the US, such as PTB (75% in wood products), SAV (80%), and ACG (20%), face the risk of order reductions and profit declines.

Seafood is under significant pressure, especially shrimp, as Vietnamese products lose their price advantage compared to India and Ecuador, which face lower tariffs of 27% and 10%, respectively. Major exporters to the US, such as FMC and MPC, will face intense pressure if forced to share this tax burden with their customers.

On the other hand, tra fish can maintain its competitive advantage in price compared to tilapia in the US market due to the tariff differential with China. Under the 10% tariff scenario for Vietnam, tra fish exports to the US were expected to increase by 10.6% in 2025. However, the outlook has become more cautious, with a projected growth of only 4.9%, due to positive developments in US-China trade negotiations.

Industrial real estate may be indirectly affected by adjustments in FDI flows. Manufacturing enterprises, the main land tenants, will have to reconsider their investment plans, leading to reduced demand for new leases, impacting companies such as KBC, BCM, IDC, VGC, SZC, and SIP.

Logistics and port services are also within the sphere of influence. A decrease in exports to the US would lead to a reduction in container throughput, directly impacting the revenue and profits of domestic transportation, warehousing, and logistics enterprises.

The tire industry is also significantly impacted, as exports to the US account for around 20-25% of many companies’ revenue. DRC is a typical example, facing the possibility of profit margin erosion if it has to lower selling prices to retain orders.

Additionally, several other sectors, including plastic products (AAA), rubber (DPR, GVR, PHR), paper (TLG), industrial construction (CTD, HBC), and securities, are expected to be affected to varying degrees, ranging from “moderately negative” to “negative.” Risk factors include reduced orders from the US, delays in FDI disbursement, and indirect impacts on market sentiment.

Some sectors maintain a neutral outlook or even show positive potential if market conditions are favorable.

The steel industry is considered neutral, as it is not on the list of products subject to new retaliatory tariffs. Steel exports from Vietnam to the US have already been subject to a 25% tariff since 2018 under Section 232. Therefore, the direct impact of the new tariff policy is negligible. Moreover, companies like Hoa Phat (HPG) are not heavily dependent on the US market, while Hoa Sen (HSG) and Nam Kim (NKG) are currently under anti-dumping investigations.

The chemical industry is also assessed as neutral, as exports to the US account for a negligible proportion of the sector’s total exports. DGC, the leading company in the industry, is almost unaffected by the new policy.

Notably, cargo airline services emerge as a bright spot. With a competitive 10% tariff compared to 30% for China and 25% for Mexico, companies like SCS and NCT could benefit from supply chain shifts, especially in the northern region, which hosts many large technology manufacturers.

Fertilizer producers are expected to benefit from both tariff scenarios due to anticipated reductions in natural gas prices following the decline in oil prices. DCM and DPM are considered neutral as export impacts are insignificant, but they are still regarded as stable profit choices.

In the construction plastics industry, gross profit margins are positively supported by low PVC resin prices. BMP, which does not export to the US, is considered by Vietcap as an effective defensive option.

The electricity sector is generally assessed as neutral, although there are variations within segments. Hydropower and coal-fired power are considered positive in the 10% tariff scenario due to stable profit margins and low export dependence. Some codes, such as BWE, QTP, and REE, are highly regarded for their attractive and stable long-term dividends.

Sectors focusing on the domestic market or benefiting from macroeconomic policy adjustments are noteworthy. Banking is viewed as neutral, as the indirect impact of exports and FDI is not significant. However, attractive stock valuations could present new investment opportunities, especially in banks with low capital costs and the potential to benefit from public investment.

Retail and fast-moving consumer goods are expected to be positive in the low-tariff scenario, given the anticipated recovery in domestic consumption. However, in the assessments of MBS Research and VCBS, exchange rate impacts lead them to classify the sector as neutral. Vietcap believes that this group can withstand the challenges, especially companies such as MSN, MCH, VNM, FRT, FPT, and CTR, which derive most of their revenue from the domestic market.

The pharmaceutical industry is assessed as positive in the 10% tariff scenario but would become neutral if tariffs reach 46%. The water supply sector is considered a defensive option, maintaining a neutral stance, with BWE highly regarded.

For the automotive distribution sector, while not directly impacted by tariffs, exchange rate fluctuations could affect import activities, leading to a neutral outlook.

Residential real estate benefits from the 10% tariff scenario due to stable interest rates, improved legal progress, and the return of investment capital. Social housing support policies also favor companies like HQC. NLG and KDH are rated positively, while others are considered neutral due to unclear prospects.

The construction sector could benefit from public investment, a solution promoted by the government to support the economy during challenging times. However, construction companies like VCG and HHV are currently rated neutral due to significant cost and price competition pressures.

What’s the way forward for Vietnamese industries?

Overall, the prospects for Vietnamese industries under the US’s new tariff policies present a highly polarized picture. Sectors heavily dependent on the US market, particularly those with high labor intensity, low value addition, and thin profit margins, will be significantly harmed if high tariff scenarios materialize.

On the other hand, some sectors with low US dependence or well-prepared alternative market strategies can maintain their neutral stance or even improve their position in the global supply chain. In the coming period, the negotiations between Vietnam and the US will be pivotal in shaping the future of trade relations and the fate of key export industries.

Analysts agree that it is imperative for exporting enterprises to closely monitor developments from the US and the responses of China, India, and the EU. This will be a critical phase where market orientation flexibility, order structure adjustments, and cost control will play a decisive role in survival and success.

Not waiting for the outcome of negotiations, many Vietnamese enterprises have taken proactive measures. They are expediting market diversification, exploring opportunities in Europe, Japan, the Middle East, and Latin America, despite anticipated intensified competition from China, which is also redirecting its exports. Domestically, the government is boosting public investment with billions of dollars allocated for infrastructure in 2025, while also encouraging domestic consumption through tax reductions and credit incentives.

The combination of proactive business strategies and timely, decisive government support will be the key to Vietnam’s ability to weather this challenging period and potentially enhance its position on the global trade map.

STOCK MARKET IN THE MIDST OF TARIFF TURBULENCE

The Stock Market Conundrum: Experts Advise Caution as VN-Index Surges in Banking and Real Estate Sectors.

The Vietnamese market has demonstrated remarkable resilience, bouncing back from the challenges posed by the US government’s tariff policies. This recovery can be largely attributed to the strong performance of the VN30, particularly the real estate and banking sectors, which have played a pivotal role in driving the market’s resurgence.

The Trade Tensions Weave Uncertainty for Vietnam’s Textile Industry

In light of the US-China trade truce, while Vietnam is still in negotiations, Vinatex forecasts a stable order volume for Q3 due to low US inventory levels. However, the company predicts a potential 10% decline in orders for Q4 as purchasing power may weaken. Chairman Le Tien Truong emphasizes the industry’s need to seize the negotiation “lull” to proactively adapt and stay resilient.