Based on the latest closing price on June 13th, at VND 13,800/share, it is estimated that Ms. Hanh and Mr. Khanh could respectively pocket nearly VND 70 billion and over VND 410 million from selling CTX shares.

According to CTX’s 2024 Annual Report, Ms. Hanh is also related to two real estate companies, including S-Land Real Estate and Mat Troi Real Estate. Mr. Khanh is even related to 11 other companies, including Phu Quoc Star Real Estate, Sun Hospitality Group, Sun Symphony Orchestra, Thoi Dai Trade and Communications, Ba Na Cable Car Services, Dia Cau, Thanh Nien Detesco Building, Mat Troi Phu Quoc, Mat Troi – Vietnam Railways, Tay Hanoi Investment, and Viet Minh Hoang Real Estate Investment and Construction.

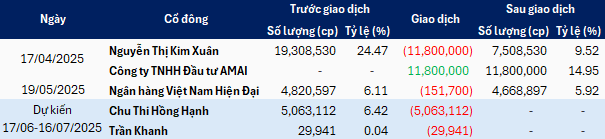

Recently, CTX’s ownership structure has witnessed significant changes. The most recent one was the case of Modern Commercial Joint Stock Bank (MBV) selling nearly 152,000 shares on May 19th, reducing its ownership to nearly 4.7 million shares (5.92%).

Prior to that, there was a transaction of handing over 11.8 million shares between Ms. Nguyen Thi Kim Xuan and AMAI Investment Co., Ltd. on April 17th, valued at nearly VND 91 billion (VND 7,700/share). As a result, Ms. Xuan’s ownership decreased to over 7.5 million shares (9.52%), while AMAI Investment became a major shareholder, holding 14.95% of CTX’s capital, up from zero.

The transaction drew attention as AMAI Investment was established on March 7th, just over a month before spending nearly VND 91 billion to own 14.95% of CTX. The company is owned by Mr. Pham Thanh Mai, with a charter capital of VND 81 billion, mainly operating in the real estate business. The company’s headquarter is located at HH2 Duong Dinh Nghe, Yen Hoa ward, Cau Giay district, Hanoi.

|

CTX’s shareholder structure is expected to continue evolving

Source: VietstockFinance

|

These moves come as CTX share transactions become active again after being suspended from trading on UPCoM from April 15th due to serious violations of information disclosure obligations.

Since leaving the suspension, CTX has immediately accelerated, and up to now, it has increased by more than 80%, with an average liquidity of nearly 78,000 shares/day.

| CTX share price surges after leaving the suspension period |

The recent and upcoming changes in the ownership structure indicate significant shifts ahead of CTX’s 2025 Annual General Meeting of Shareholders, expected to take place on June 27th.

In another development, on May 16th, CTX’s Board of Directors agreed on a plan to transfer the entire project of investing in the construction of a complex of commercial centers, apartments, and offices at lot A1-2, Cau Giay New Urban Area, Hanoi (Constrexim Complex). The Board agreed on the draft deposit for the transfer but did not disclose the transferee.

The Constrexim Complex project is strategically located, adjacent to three roads: Xuan Thuy, Pham Hung, and Tran Quoc Vuong. The land area is approximately 2.5 hectares, which used to be the temporary agricultural products market of Dich Vong Hau. According to the plan, the project will consist of five towers ranging from 38 to 45 stories. In the first-quarter consolidated financial statements of 2025, the Company recorded an investment of about VND 465 billion in this project.

In addition to Constrexim Complex, CTX is also the investor of many other prominent projects, such as the 5-star hotel Pao’s Sapa Leisure Hotel (Lao Cai), Champa Legend Hotel (Nha Trang), the marine ecological area in Quang Nam, and the PentStudio project (Tay Ho, Hanoi).

In terms of business results, in the first quarter of 2025, CTX recorded a revenue of over VND 41 billion, up 25% over the same period last year, while net profit reached nearly VND 2 billion, down 22%.

– 10:03 16/06/2025

“SIP to Issue Nearly 32 Million Shares in Dividend Payout”

The Ho Chi Minh City Investment and VRG Joint Stock Company (HOSE: SIP) has announced that the record date for shareholders to receive the 2024 dividend in shares is expected to fall in July 2025.

The Rare Survivor: Thriving SBIC (Vinashin) Enterprise Sees Success with Profits, No Debt, and Cash Reserves, Yet is Delisted from UPCoM

The SCY stock price plummeted over 30% in just one week, right before HNX delisted it from trading due to failing to meet the requirements for a public company. In stark contrast to its parent company, SBIC (formerly Vinashin), which was mired in losses and bankruptcy, SCY exhibited robust financial health. The company consistently delivered profit growth, paid cash dividends, maintained a debt-free status, and boasted a substantial cash reserve of hundreds of billions of dong.

“The Chairman of An Gia (AGG): Land Bank Acquisition Not a Priority at This Time”

Amid the uncertain macroeconomic and legal landscape, An Gia adopts a cautious and prudent approach in its market strategy for the foreseeable future. As such, the company has no immediate plans to seek new land opportunities.