Investors’ enthusiasm surged significantly in the afternoon session, as active buying drove the VN-Index to its strongest gain in eight weeks. After nearly two weeks of consolidation, the index rebounded to near its previous highs, closing at 1,338.11, up 1.72% from the reference level.

The index’s gain of 22.62 points was the strongest daily increase since April 11 and was driven by large-cap stocks. The VN30-Index, which tracks the 30 largest stocks by market capitalization, closed 1.37% higher, with the exception of VPL, which ended 6.58% higher, contributing 2.5 points to the VN-Index’s gain. The remaining constituents of the VN30 also performed well, with the exception of the Vin group.

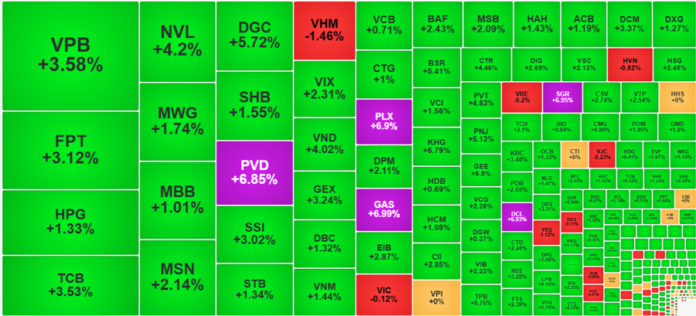

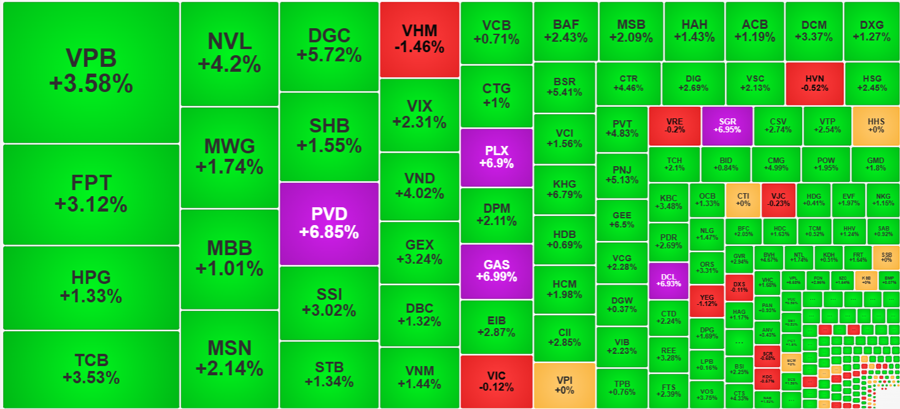

In the oil and gas sector, GAS and PLX hit the daily limit-up, with GAS gaining an additional 2.07% from its morning close, and PLX up 1%. Other oil and gas stocks also saw strong gains, with PVD, PVC, OIL, and PVO reaching the daily limit-up. BSR, PVS, and PVT also posted notable gains.

The banking sector also impressed, with all stocks in the sector trading in the green and 16 stocks gaining over 1%. Notable performers included TCB, up 3.53%; CTG, up 1%; MBB, up 1.01%; and VPB, up 3.58%. TCB, VPB, and VCB were among the top 10 contributors to the index’s gain, with VCB’s smaller gain of 0.71% offset by its larger market capitalization.

The rally was broad-based, with most sectors seeing strong performers. Even the real estate sector, which saw declines in VHM, VIC, and VRE, had several stocks posting strong gains, including KHG, NVL, KBC, CRE, CII, DIG, and PDR.

Of the 226 stocks that ended the day in positive territory, 84 rose over 2%, and 77 rose between 1% and 2%. Notably, several stocks in the strong gainers’ group saw trading value exceeding VND 100 billion. Large-cap stocks that saw significant buying interest included VPB, FPT, TCB, and MSN. Mid-cap stocks that also attracted strong buying included NVL, DGC, PVD, and VIX.

Interestingly, the afternoon session did not see a significant increase in trading volume, with the two exchanges recording an additional VND 10,753 billion in matching value, up just 8.5% from the morning session. This suggests that the significant price moves were driven by a reduction in selling pressure, as sellers withdrew or adjusted their asking prices higher.

This dynamic indicates that investors sensed the growing enthusiasm and responded by reducing selling or raising their asking prices. Within the VN30, 25 stocks saw price improvements from their morning levels, with only four stocks declining. Even the underperforming VIC, VRE, and VHM saw some recovery, with VIC up 1.07% from its morning level, VHM up 1.2%, and VRE up 1.66%. Stocks that saw notable price improvements in the afternoon included FPT, GVR, MSN, MWG, SSI, STB, and VIB, all of which rose by at least 1% from their morning levels.

The overall market breadth on the HoSE improved significantly, with 84 stocks gaining over 2% at the close, compared to 56 in the morning session. Additionally, 161 stocks gained at least 1% at the close, a notable increase from the 92 stocks in the morning.

Foreign investors also participated actively in the afternoon session, net buying an additional VND 592.4 billion, bringing their net buying for the day to VND 984.8 billion. This was the highest net buying in 23 sessions, with a focus on blue chips in the VN30, where they net bought VND 970.5 billion. Notable stocks that saw strong foreign buying included FPT (VND 314.4 billion), VPB (VND 205 billion), HPG (VND 181.4 billion), MWG (VND 110.7 billion), MSN (VND 108.6 billion), GAS (VND 63.7 billion), and VNM (VND 61.5 billion). On the selling side, STB, VCI, PVD, and VHM saw net selling of VND 65.6 billion, 56.8 billion, 54.4 billion, and 39.7 billion, respectively.

Stock Market Insights: A Glimpse of Positive Signals

The VN-Index surged, crossing above the middle Bollinger Band. With continued index strength and trading volumes above the 20-day average, the bullish trend would be reinforced. Notably, the Stochastic Oscillator has signaled a buy, exiting the oversold region. Should the MACD indicator follow suit in upcoming sessions, the short-term outlook would brighten considerably.

No Worries About Missile Issues, the Market Bounces Back Strongly, VN-Index Recaptures the 1,320-Point Level

The Middle East tensions continue to escalate, but investor sentiment has improved significantly following the weekend. Although this morning’s market saw a substantial 34% drop in capital inflows compared to the previous session, stock prices witnessed a broad-based recovery. However, the upward momentum showed signs of waning in the latter half of the session as selling pressure emerged at higher price levels.