In its latest report, VNDirect Securities assesses that real estate will continue to be the driving force behind Techcombank’s (TCB) credit growth in 2025. Credit growth is expected to reach 18.5% year-over-year, surpassing the assigned credit limit of 16.4%.

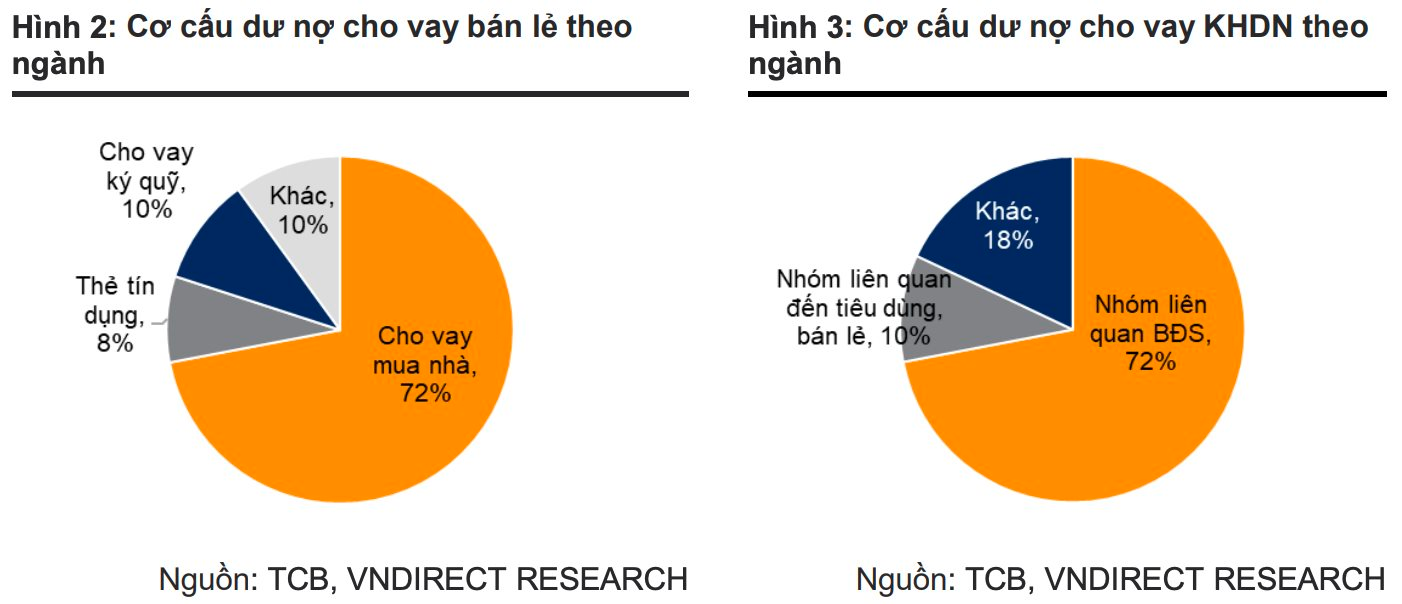

VNDirect points out that as of Q1/2025, home loans accounted for 29.9% of total outstanding loans, while loans to real estate-related businesses made up 42.1%, reflecting the significant impact of this market on TCB. The improved outlook for the real estate market is anticipated to boost stronger loan demand from both individual and corporate clients.

Figure 1: Real estate market’s impact on TCB’s loan structure

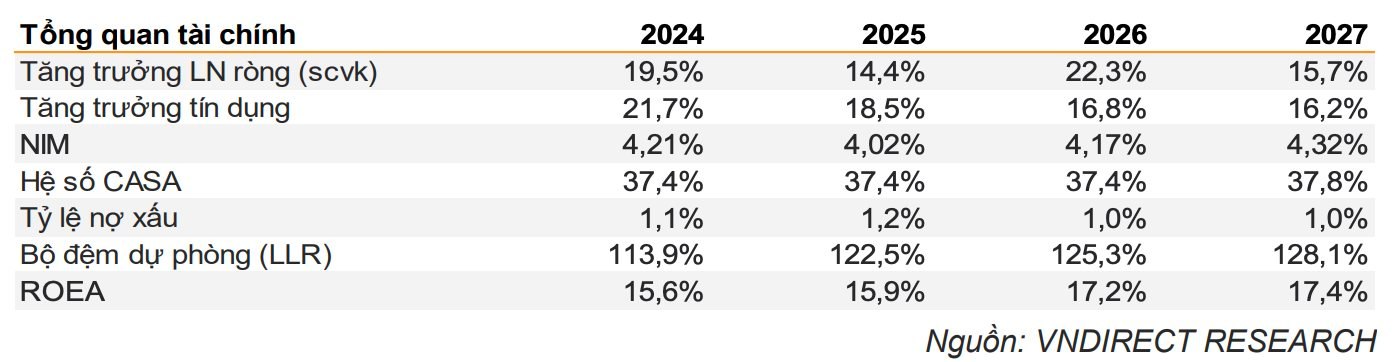

However, the low-interest-rate environment continues to put pressure on NIM. VNDirect projects NIM for 2025 at 4.0% as TCB maintains low lending rates to stimulate credit growth and retain long-term customers. Meanwhile, funding costs are expected to remain high due to tight market liquidity. Therefore, NIM pressure is likely to persist, especially in the first half of 2025.

Nonetheless, VNDirect appreciates TCB’s prudent provisioning, with the bad debt coverage ratio increasing to 122.5%. This buffer will help TCB mitigate potential credit risks in the context of ongoing macroeconomic fluctuations.

TCBS IPO creates upside for Techcombank’s valuation

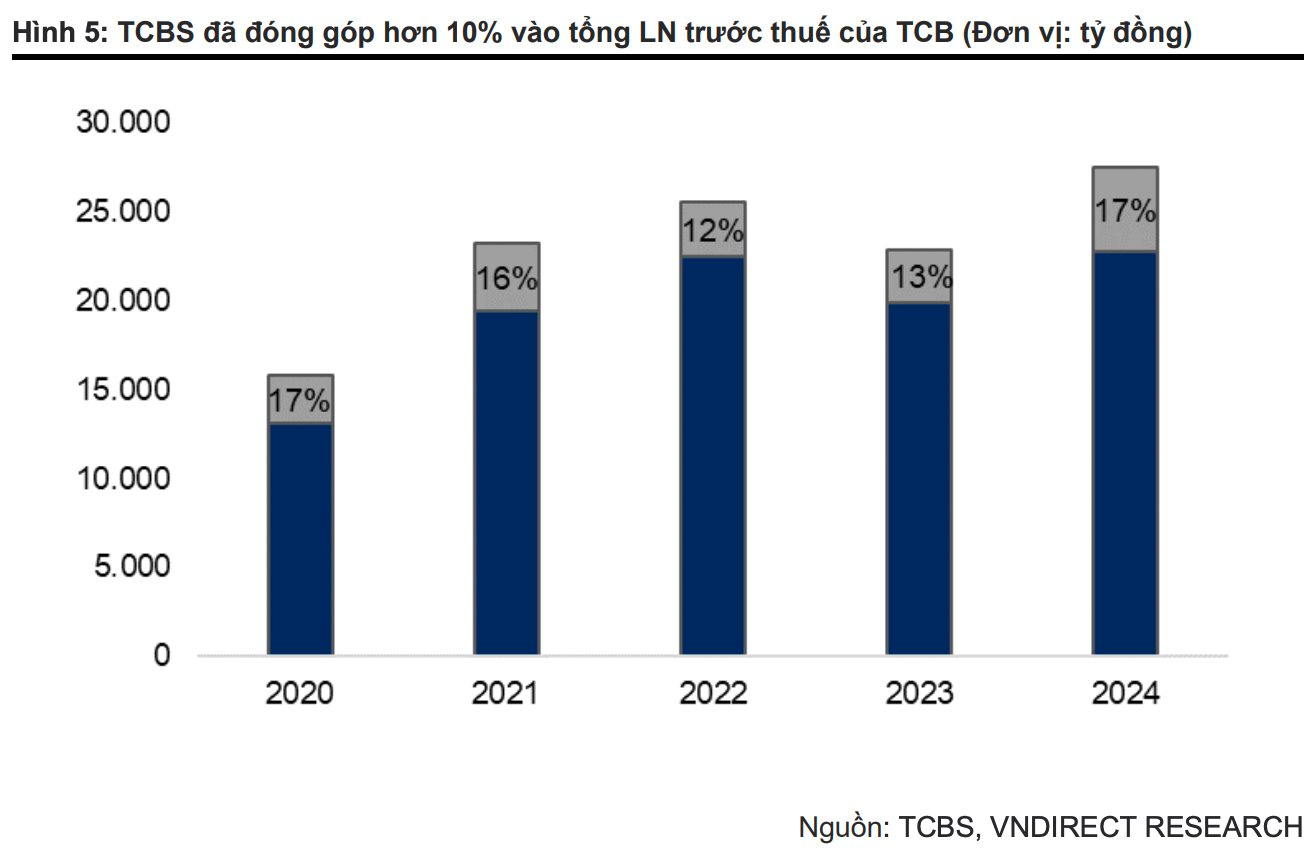

A highlight of TCB’s business performance in 2025 also comes from the securities sector with Techcom Securities (TCBS). As one of the leading securities companies in Vietnam, TCB currently owns 94.07% of TCBS. In 2024, TCBS contributed more than 17% to TCB’s consolidated PBT. As of Q1/25, TCBS maintained its position in the top 3 in market share for brokerage on HoSE and expanded its market share in corporate bond underwriting services to 57%.

Figure 2: TCBS’s market share in brokerage and bond underwriting

At the TCB General Meeting of Shareholders, the management updated the IPO plan for TCBS, aiming for the end of 2025, depending on market conditions. TCB also mentioned working with one or two large investors for this IPO’s stake sale.

VNDirect expects the IPO transaction to bring a one-off financial profit to TCB’s parent bank’s financial statements and/or re-evaluate the investment value in TCBS, thereby increasing TCB’s book value in 2025. In the long term, the IPO will help TCBS strengthen its capital foundation and support independent growth.

In summary, VNDirect projects TCB’s PBT to increase by 14.4% yoy in 2025, lower than the 20% growth in 2024, due to more cautious views on credit growth and NIM projections. This caution stems from a more conservative approach to credit expansion and low lending rate environment to support economic recovery.

Figure 3: TCB’s consolidated PBT growth projection

The Billion Dollar Resort: Unveiling the Mastermind Investors Behind the Vân Đồn Project

The People’s Committee of Quang Ninh Province has just approved a colossal investment project for an integrated tourism, entertainment, and premium resort complex, along with a golf course and residential area in Monbay Van Don. This ambitious venture boasts a staggering total investment of over VND 24,883 billion.

The Pearl of Northern Vietnam: Vân Đồn’s 600 Islands Prepare for Economic Free Zone Status

“With years of meticulous infrastructure development and planning, Van Don is emerging as a vibrant and promising special economic zone. This region is now a magnet for both domestic and foreign tourists and investors, offering a wealth of opportunities and a bright future.”

The Golden City Kick-Off Event: Mayhomes Makes a Splash!

On the evening of June 11th, over a hundred Mayhomes warriors gathered at the European Square of Vinhomes Royal Island to attend the kick-off event for the launch of Vinhomes Golden City. The event attracted more than 2,500 business professionals and garnered 15,000 online views, marking an impressive start to the 2025 sales campaign in Hai Phong.

“Infrastructure Leverage Enhances Sei Harmony Residential Area’s Value”

Sei Harmony is an exclusive, meticulously planned residential community in Binh Tan District, boasting a prime location in the heart of Saigon West. With a strong Japanese influence in its modern design and architecture, Sei Harmony sets a new standard for contemporary living in the area. The development benefits from a booming infrastructure and a diverse range of local amenities, offering residents a vibrant and convenient lifestyle with strong potential for sustainable capital growth.