Gold prices have surged globally due to heightened safe-haven demand.

According to market reports from Phu Quy Gold and Silver Jewelry Group, international gold prices soared last week as safe-haven demand increased. Tensions in the Middle East, protests in the US, and a weak US dollar pushed gold prices towards new highs. As a result, spot gold prices rose by 3.75%, while June Comex gold increased by 3.17%.

This week, the global gold market could be significantly influenced by the interest rate decisions of four central banks. It is predicted that the central banks of Japan, the United States, and the United Kingdom will maintain their interest rates, while the Swiss National Bank is expected to cut rates.

If these predictions hold true, precious metal prices may come under pressure as banks continue their tight monetary policies. However, if tensions in the Middle East escalate, safe-haven demand could boost gold prices further.

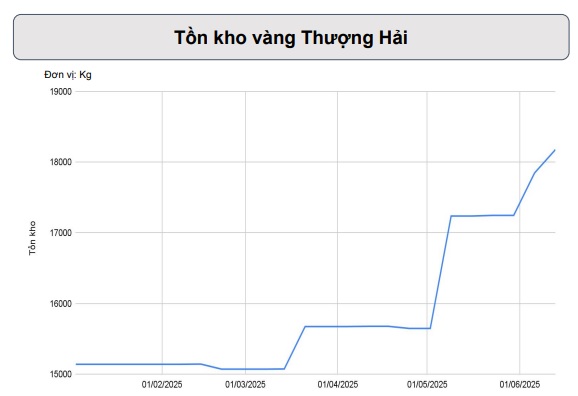

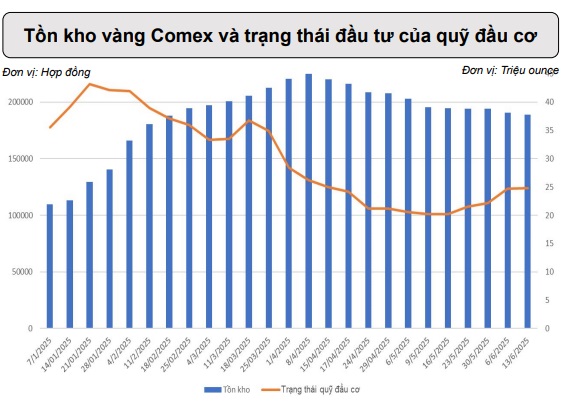

Turning to gold inventories, stocks in Shanghai continued to rise by over 18 tons, while Comex stocks declined slightly. Despite the price increase last week, net buying from speculative funds only saw a modest increase, suggesting that the upward momentum may be uncertain.

If central banks maintain high-interest rates and Middle East tensions ease, gold prices could face downward pressure.

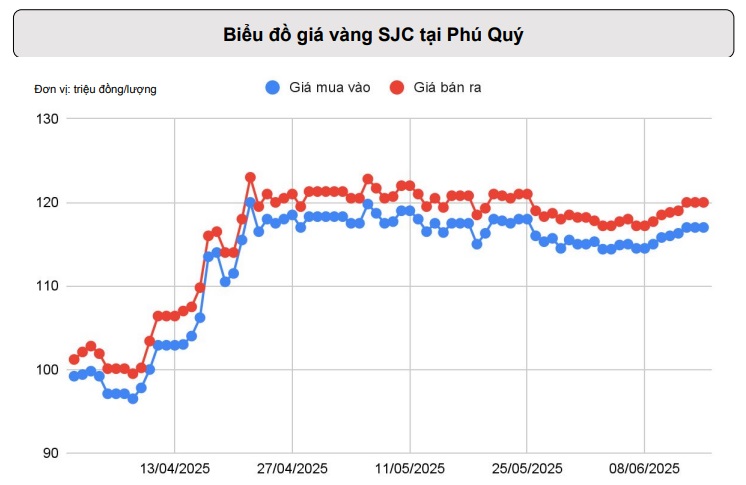

Domestically, SJC gold prices were slightly adjusted upwards, trading at around VND 116 million/tael (buying) and VND 119 million/tael (selling). The domestic gold price is narrowing the gap with international prices.

“Gold Prices Soar, But Will They Break Records This Week?”

The global investment community is keeping a keen eye on the Fed’s upcoming monetary policy meeting, amidst ongoing developments in the Middle East and trade negotiations.

“Global Commodities Spike: Oil and Gold Surge, Coffee Plunges to 10-Month Low”

As of the market close on June 13, 2025, escalating tensions between Israel and Iran have sparked concerns about oil supplies in the Middle East, driving up the demand for gold as a safe-haven asset and pushing oil and gold prices to soar. Robusta coffee plunged to a 10-month low, while sugar prices hit their lowest level in over four years.

The Price of Gold Surges Following Israel’s Attack on Iran

“Moreover, the latest statistics indicating weaker-than-expected inflation in the US have bolstered the case for a rate cut, providing a boost to gold prices.”