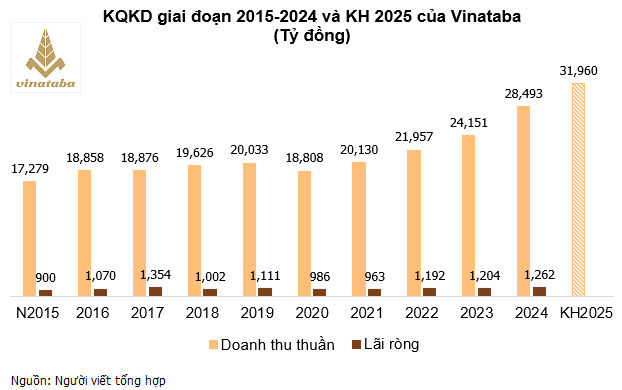

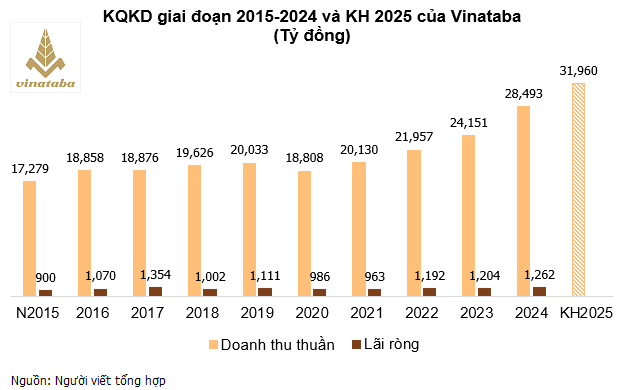

According to Vinataba’s 2024 audited consolidated financial statements, the company recorded net revenue of nearly VND 28,493 billion, an 18% increase from the previous year and the highest since 2015. On average, Vinataba achieved a revenue of VND 78 billion per day. The gross profit margin reached 18.2%, slightly lower than the 19.1% in 2023 due to a faster increase in cost of goods sold compared to revenue.

Financial income in 2024 was nearly VND 332 billion, a 4% decrease, while financial expenses slightly decreased by 2% to VND 259 billion. Selling expenses and general and administrative expenses increased by 22% and 11%, respectively, mainly due to labor costs. Profit from six joint ventures and associates amounted to VND 350 billion, a 1% decrease. Other income reached nearly VND 308 billion, mainly from financial support from partner Philip Morris International, a 14% decrease compared to the previous year.

In summary, Vinataba recorded a net profit of VND 1,262 billion in 2024, an increase of nearly 5% compared to 2023, averaging nearly VND 3.5 billion per day. This is the second-highest net profit in the company’s history, after the peak of VND 1,354 billion in 2017.

|

Facing the risk of a sharp decline in output due to new tax policies

Earlier, at the 2024 year-end conference, Mr. Ha Quang Hoa – Member of the Board of Members and General Director of Vinataba stated that the tobacco industry continued to face challenges, including the increase in illegal tobacco trading in the border areas of the Southwestern region, fierce competition, the development of new-generation tobacco products, and rising raw material prices.

Reinforcing this, Mr. Ho Le Nghia – Chairman of Vinataba’s Board of Members opined that the difficulties in the tobacco industry would continue to increase, especially with the implementation of the amended Law on Special Consumption Tax. According to Mr. Nghia’s forecast, if the mixed tax method proposed in the draft law discussed by the National Assembly is applied, the industry’s output could decrease by 30-50% after 2026.

Mr. Ho Le Nghia, Chairman of Vinataba’s Board of Members, speaking at the conference

|

The Vietnam Tobacco Association has submitted a document to the Government and the National Assembly Standing Committee, recommending a careful consideration of the level and roadmap for tax increases. The Chairman of Vinataba argued that a sudden tax increase could lead to a significant rise in tobacco smuggling, directly impacting the goal of revenue collection. In the past, tax increases were spaced three years apart with a 5% increment, allowing businesses time to adjust. In contrast, the new roadmap could make the industry passive and struggle to maintain its market share.

For 2025, Vinataba aims for a consolidated revenue of VND 31,960 billion, an 8% increase compared to 2024. However, with the new tax policy, the company plans to shift its focus from volume growth to quality, emphasizing technology advancement, digital transformation, and sustainable development towards a “green transition.”

According to the amended tax law that has been passed, from 2027, cigarettes and similar products will be subject to a special consumption tax based on an absolute rate. The absolute tax rate for cigarettes will start at VND 2,000 per pack in 2027 and increase to VND 10,000 per pack by 2031.

– 15:47 16/06/2025

The KPF Stock of Koji Asset Investments: Threatened Delisting

The Ho Chi Minh Stock Exchange (HoSE) is considering a mandatory delisting of KPF stock due to Koji Asset Investment’s continued non-compliance with disclosure obligations.

No Cash Dividends Expected for Golden Gate in 2025

Golden Gate plans to forgo cash dividends in 2025, choosing instead to “ensure optimal resource allocation and focus on capital concentration.” This strategic decision underscores the company’s commitment to fortifying its financial position and channeling resources towards value-enhancing initiatives. By forgoing immediate monetary rewards for shareholders, Golden Gate underscores a long-term vision of sustainable growth and value creation.

“Popular Vietnamese Dishes See a Price Hike: Restaurant Owners Blame Taxes”

Despite stable input costs, eateries and cafes in Ho Chi Minh City and Hanoi have recently increased their selling prices.