While still highly regarded in the medium and long term, Vietnam’s stock market is expected to face significant short-term pressure as global geopolitical tensions rise.

Speaking at the Cafe Cung Chung event organized by SSI Securities, Mr. Le Dang Phong, SSI Securities’ Stock Consulting Expert, shared his insights on the impact of escalating geopolitical tensions on global stock markets. He noted that the Dow Jones index, Asian stock markets, and the Vietnamese stock market did not experience significant fluctuations in the past week, indicating a limited effect from the tensions.

The Vietnamese stock market exhibited stable trends last week. Stocks and sectors that had previously reached peak levels may encounter resistance and undergo adjustments. Simultaneously, many sectors are witnessing bottom-up trends, with some even surpassing historical peaks.

“These are normal fluctuations in an emerging stock market. After a period of intense volatility with alternating declines and increases, the market has recovered by about 300 points and is currently hovering around the 1,300-point mark. It is understandable that investors would exercise caution during this phase,” emphasized Mr. Phong.

It is natural for investors to cash in their profits upon achieving their targets or reduce their portfolio ratios to mitigate risks.

Turning to foreign transactions, after consecutive years of record-breaking net selling, there has been a positive shift in foreign investment trends, indicating a potential “reversal.” This development bodes well for a broad spectrum of stocks in the Vietnamese stock market in the upcoming period. SSI’s expert predicts that as an emerging market, Vietnam’s stock market will witness a return to net buying by foreign investors, given time.

Looking ahead, the expert forecasts a predominantly upward trajectory for the market until the year’s end, albeit with potential short-term corrections in certain sessions or weeks. Such corrections present opportune moments for investors seeking short-term gains.

Notable events in June, particularly towards the month’s end, include MSCI’s announcement of market classification results for 2025. Against the backdrop of Vietnam’s robust economic growth, the market is expected to reflect the economy’s positive momentum. An upgrade is inevitable, be it sooner or later.

However, the stock market’s upward trend is not solely reliant on the prospect of an upgrade. According to Mr. Phong, this factor serves as a “catalyst,” fostering the market’s ascent in the forthcoming period.

If the economy’s fundamental strengths are lacking, even positive news of an upgrade may fail to sustain a bullish market trend. Conversely, with the current supportive factors in play, the upgrade narrative will amplify the market’s positive response in the short term, acting as a catalyst to overcome impending resistance levels.

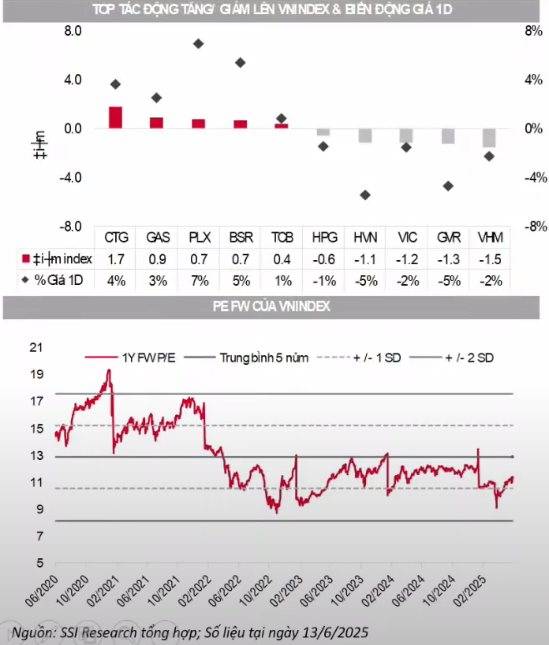

In terms of valuation, P/E ratios over the past 3-5 years indicate that the market’s valuation remains relatively low, hovering around historical lows.

Presently, several sectors have outperformed the broader market, including banks, fertilizer companies, the Vingroup conglomerate, and the Gelex Group. This performance indicates that many stocks remain attractively valued, presenting rational long-term investment opportunities. Investors may consider allocating capital at these lower-risk levels. However, if P/E ratios rise by 20-30-50% in the upcoming quarters, subsequent investment decisions would necessitate different calculations due to heightened risk levels.

In summary, the stock market boasts reasonable valuations, and numerous sectors are poised for growth in the next phase. Given the current context, the preferred strategy is to allocate capital, notwithstanding political fluctuations or tariff-related changes. “The P/E ratio’s fluctuation around this attractive zone signals that it is still an opportune moment to deploy capital and initiate new positions across most sectors and stocks,” concluded the expert.

Market Beat June 16: VN-Index Surges Over 22 Points, Energy Sector Shines Bright

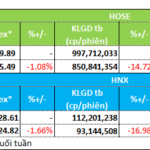

The market closed with strong gains, as the VN-Index rose by 22.62 points (+1.72%), finishing at 1,338.11. The HNX-Index also climbed, gaining 3.3 points (+1.47%) to close at 228.12. It was a sea of green across the market, with 515 tickers in the gainers’ column compared to just 211 in the losers’. The VN30 basket mirrored this sentiment, with 24 gainers, 4 losers, and 2 unchanged stocks.

Stock Market Insights: A Glimpse of Positive Signals

The VN-Index surged, crossing above the middle Bollinger Band. With continued index strength and trading volumes above the 20-day average, the bullish trend would be reinforced. Notably, the Stochastic Oscillator has signaled a buy, exiting the oversold region. Should the MACD indicator follow suit in upcoming sessions, the short-term outlook would brighten considerably.

No Worries About Missile Issues, the Market Bounces Back Strongly, VN-Index Recaptures the 1,320-Point Level

The Middle East tensions continue to escalate, but investor sentiment has improved significantly following the weekend. Although this morning’s market saw a substantial 34% drop in capital inflows compared to the previous session, stock prices witnessed a broad-based recovery. However, the upward momentum showed signs of waning in the latter half of the session as selling pressure emerged at higher price levels.