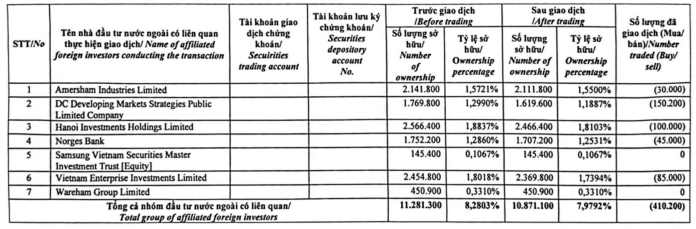

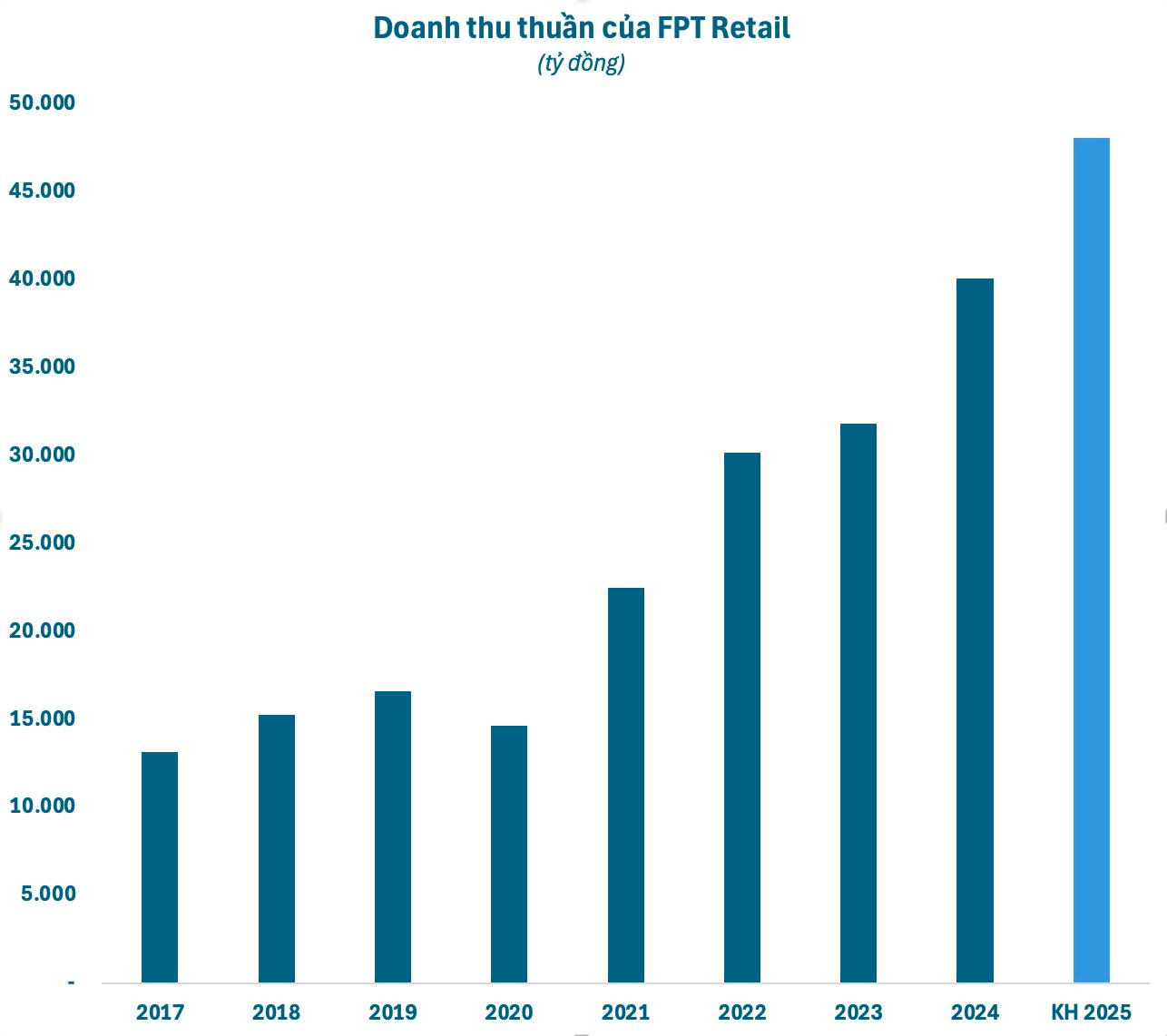

Dragon Capital-related funds have recently offloaded 410,200 shares of FPT Digital Retail Joint Stock Company (FPT Retail – ticker: FRT) on June 13, 2025. This move decreased their collective ownership from 8.3% to approximately 8%, equivalent to nearly 10.9 million shares. Based on FRT’s closing price on the transaction date, the group of funds could have pocketed an estimated VND 70 billion.

Dragon Capital group has been consistently reducing its stake in FPT Retail. Previously, at the end of 2024, the fund group held around 14% of the shares in the Long Chau pharmacy and FPT Shop chain. It is estimated that since the beginning of the year, Dragon Capital has sold approximately 8 million FRT shares.

On the stock exchange, FRT shares have climbed nearly 30% from their tariff-related lows in early April, although they remain slightly lower than at the start of the year. As of June 16, 2025, FRT’s market price stood at VND 173,900 per share, translating to a market capitalization of nearly VND 24 trillion.

FPT Retail is currently in the process of implementing a plan to issue bonus shares as dividends for the year 2024. Accordingly, FPT Retail will issue 34 million new shares to existing shareholders at a ratio of 25% (holding 04 shares will receive 01 new share). Following the issuance, the company’s charter capital will increase to VND 1,700 billion.

The source of capital for this issuance will come from the company’s undistributed post-tax profits as recorded in the audited separate financial statements for 2024. The Board of Directors has authorized the company’s legal representative to choose the appropriate timing for the issuance after obtaining approval from the competent authorities.

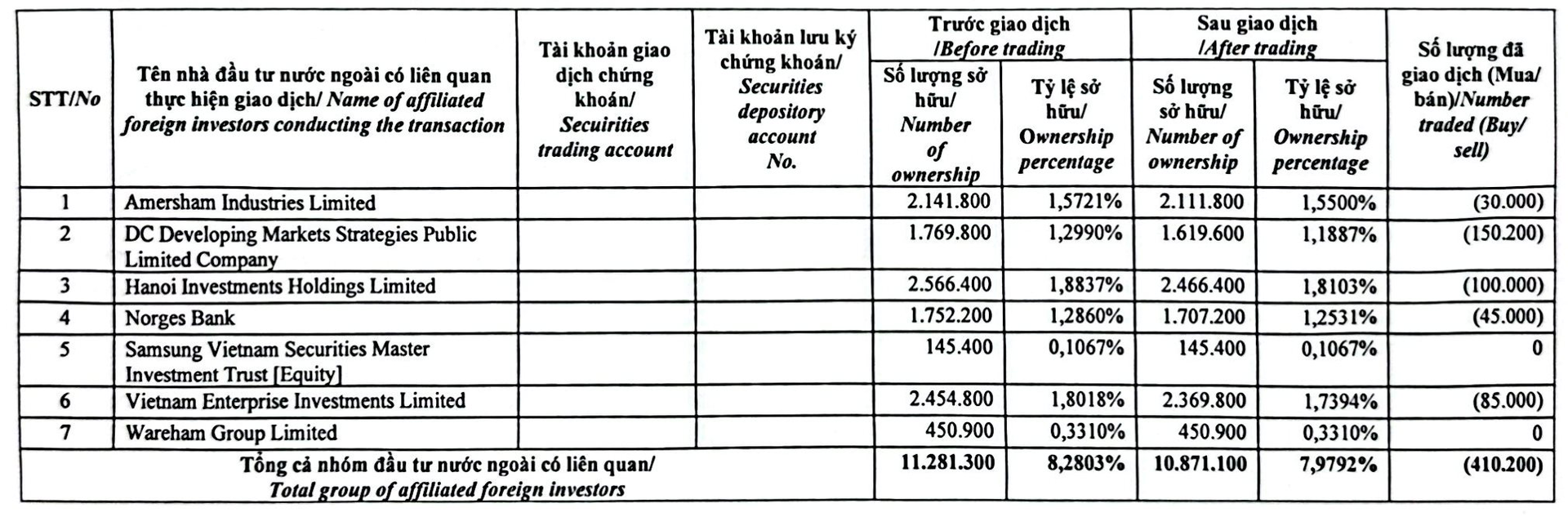

In terms of financial results for the first quarter of the year, FPT Retail reported consolidated revenue of VND 11,670 billion and post-tax profit of VND 213 billion, representing increases of 29% and 3.5 times, respectively, compared to the same period last year. With these results, FPT Retail has achieved 24% of its full-year business plan.

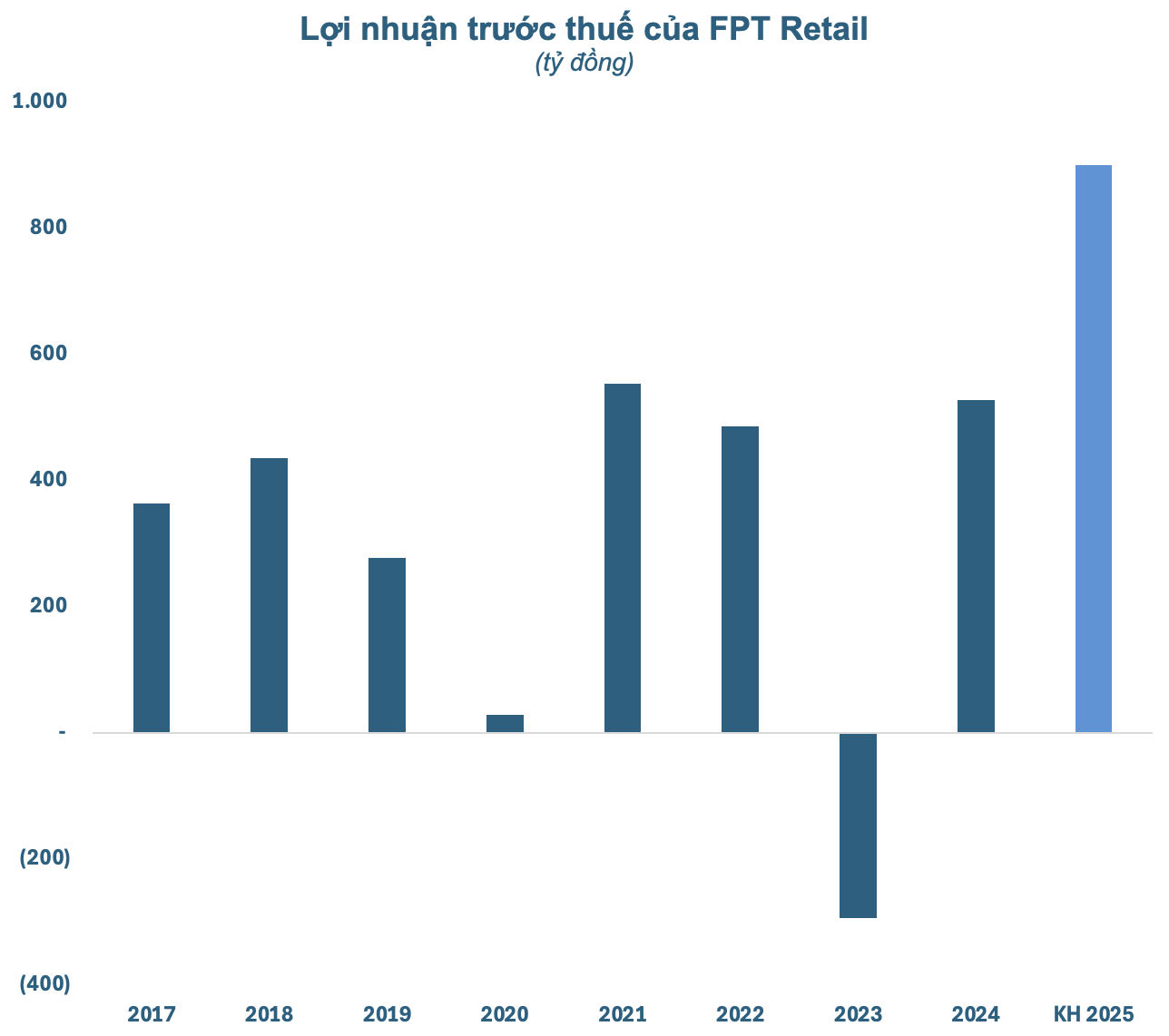

For the fiscal year 2025, FPT Retail has set ambitious targets, aiming for consolidated revenue of VND 48,100 billion and pre-tax profit of VND 900 billion, reflecting increases of 20% and 71%, respectively, compared to the previous year. Should these goals be met, FPT Retail will break its records for both revenue and profit.

As of the first quarter of 2025, FPT Retail boasted a network of 2,794 stores nationwide. FPT Long Chau expanded to 2,022 pharmacies, while Tiêm Chung Long Châu grew to 144 centers.

Dragon Capital Aggressively Purchases an Additional 5.37 Million Vinhomes Shares Amidst a 30% Stock Price Surge

In a one-month period, the two funds collectively purchased nearly 5.37 million VHM shares. This strategic move has had a positive impact on the funds’ investment performance, as VHM shares have witnessed a significant surge in value over the past months.