The Vietnamese stock market’s beauty lies in its occasional detachment from global fluctuations. As global stocks tumble, with the US market taking a significant hit due to escalating Israel-Iran tensions, Vietnam’s VN-Index defies expectations and surges at the start of the week.

The index closed in on the 1,340 mark, with a substantial increase of 22.62 points, or 1.72%. A staggering 233 stocks witnessed gains, led by the banking sector. Not a single bank stock underwent adjustments, with several performing remarkably well: TCB rose by 3.53%, VPB by 3.58%, CTG by 1%, and VIB by 2.23%. The two largest banks, VCB and BID, also contributed to the market’s growth, rising by 0.71% and 0.84%, respectively. The banking group alone accounted for nearly four points of the market’s overall gain.

However, the two stocks that made the most significant contributions to this positive movement were GAS and VPL. These two alone added five points to the VN-Index, benefiting from the surge in oil prices amid escalating tensions in the Middle East. Oil and gas stocks witnessed impressive gains, with PVD and PVC reaching their ceiling prices, while PVS rose by 5.75%, POS by 11.7%, and PVB by 4.04%.

The securities group also witnessed a heated session, with VND rising by 4.02%, SSI by 3.02%, MBS by 2.65%, VIX by 2.31%, and VFS by 6.08%. In the real estate sector, the Vin group faced selling pressure after a prolonged period of gains, while NVL broke out with a 4.2% increase, PDR rose by 2.69%, KBC by 3.48%, and DIG by 2.69%. On the other hand, the trio of VIC, VHM, and VRE witnessed declines of 0.12%, 1.46%, and 0.2%, respectively, shaving off one point from the VN-Index.

Overall, with the exception of these three stocks, most other sectors recorded positive growth, including telecommunications, information technology, steel, chemicals, construction, and port services. Domestic and foreign investors competed in a high-liquidity session, with total trading value across the three exchanges reaching nearly VND23 trillion. Foreign investors net bought VND964.5 billion, and their net buying value in matched orders alone reached VND942.9 billion.

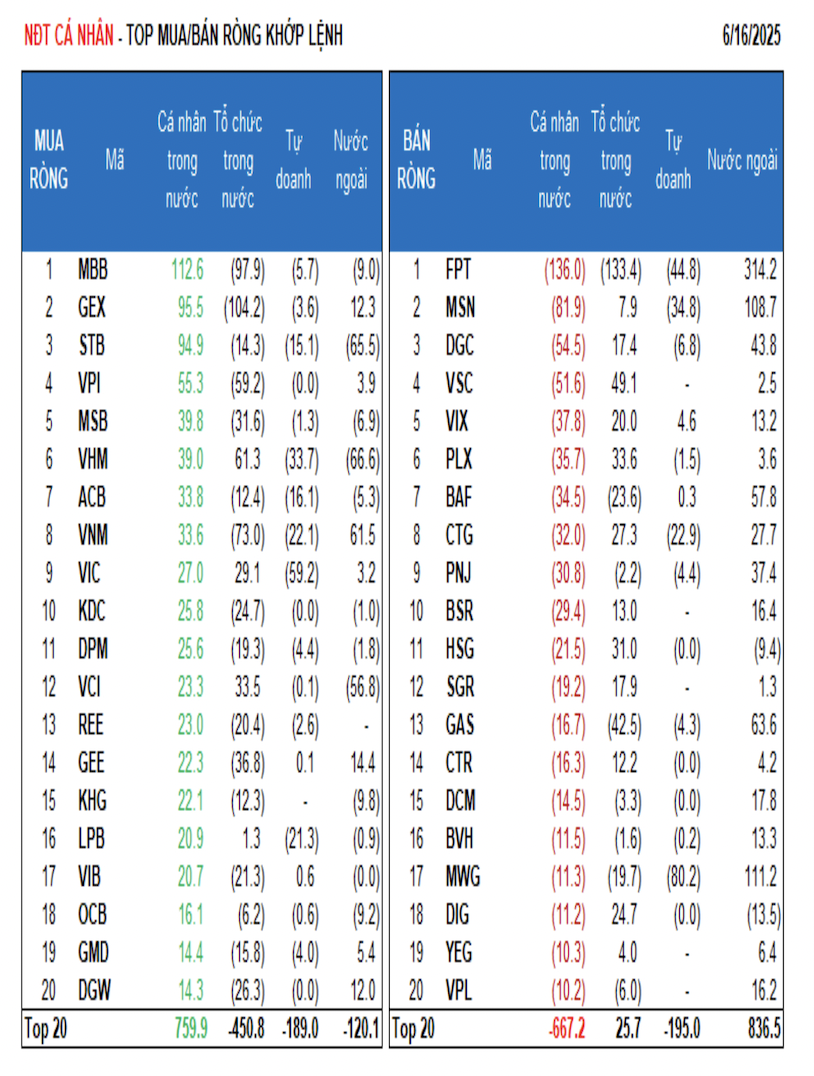

Foreign investors’ net buying in matched orders focused on the information technology and food & beverage sectors. The top net bought stocks by foreign investors in matched orders included FPT, VPB, HPG, NVL, MWG, MSN, GAS, VNM, BAF, and DGC.

On the selling side, foreign investors’ net selling in matched orders focused on the financial services sector. The top net sold stocks by foreign investors in matched orders included VHM, STB, VCI, PVD, HVN, HDG, DBC, VRE, and BSI.

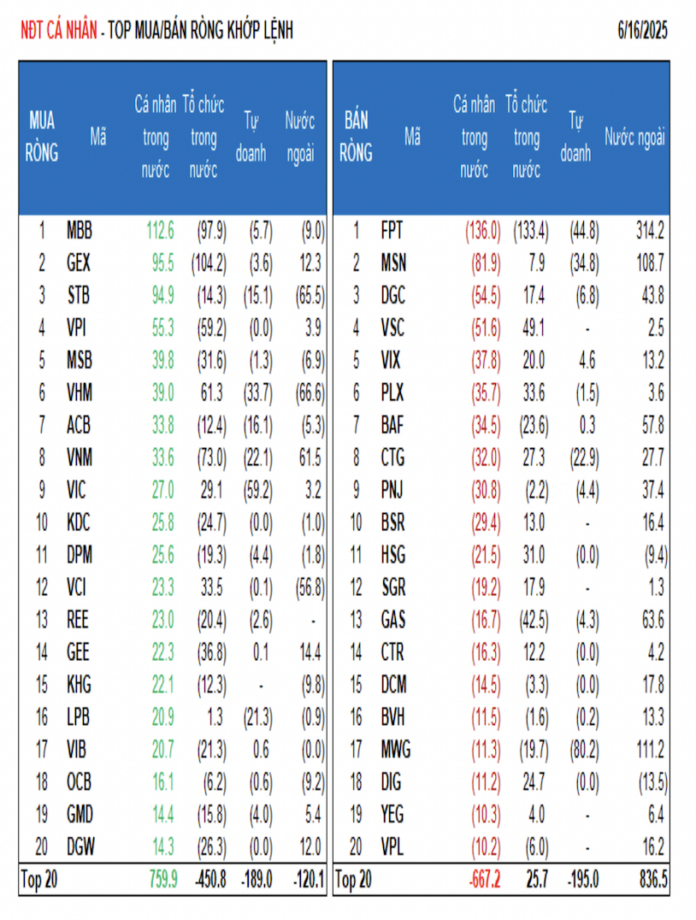

Individual investors net bought VND360.8 billion, with a net buying value of VND297.9 billion in matched orders. In terms of matched orders, they net bought 9 out of 18 sectors, mainly focusing on the banking sector. The top net bought stocks by individual investors included MBB, GEX, STB, VPI, MSB, VHM, ACB, VNM, VIC, and KDC.

On the selling side, individual investors net sold 9 out of 18 sectors in matched orders, primarily focusing on information technology and oil & gas. The top net sold stocks included FPT, MSN, DGC, VIX, PLX, CTG, PNJ, and BSR.

Proprietary trading accounts net sold VND678.1 billion, with a net selling value of VND641.1 billion in matched orders. In terms of matched orders, proprietary trading accounts net bought 3 out of 18 sectors. The most net bought sectors were financial services, construction, and materials. The top net bought stocks by proprietary trading accounts today included FUEVFVND, E1VFVN30, HHV, VIX, VND, FUEVN100, FRT, VTP, VIB, and SSB. The top net sold sector was banking. The top net sold stocks included HPG, VPB, MWG, VIC, FPT, MSN, VHM, VCB, TCB, and CTG.

Domestic institutional investors net sold VND668 billion, with a net selling value of VND599.7 billion in matched orders.

In terms of matched orders, domestic institutional investors net sold 12 out of 18 sectors, with the highest net selling value in the banking sector. The top net sold stocks included FPT, VPB, NVL, GEX, MBB, HPG, VNM, VPI, GAS, and GEE. The sector with the highest net buying value was oil & gas. The top net bought stocks included VHM, PVD, VSC, HVN, HAH, DBC, PLX, VCI, HSG, and TCB.

Today’s matched orders reached VND2,011.3 billion, up 46.7% from the previous session and contributing 8.6% to the total trading value. Notably, there was a significant matched order transaction in EIB, with over 19.1 million shares worth VND433 billion changing hands between domestic institutional investors. Additionally, there were several transactions between individual investors in the banking sector (TCB, HDB, SSB, MSB) and SUS.

The money flow allocation ratio increased in banking, steel, chemicals, food & beverage, retail, electrical equipment, oil & gas, software, and warehousing, while it decreased in real estate, securities, construction, and plastics & rubber.

In terms of matched orders, the money flow allocation ratio increased in the large-cap VN30 and small-cap VNSML groups, while it decreased in the mid-cap VNMID group.

The Great Real Estate and Stock Market Cashout

Liquidity took a significant hit during the trading week of June 9–13, with real estate and stocks being the two notable sectors experiencing capital outflows.

Market Beat June 16: VN-Index Surges Over 22 Points, Energy Sector Shines Bright

The market closed with strong gains, as the VN-Index rose by 22.62 points (+1.72%), finishing at 1,338.11. The HNX-Index also climbed, gaining 3.3 points (+1.47%) to close at 228.12. It was a sea of green across the market, with 515 tickers in the gainers’ column compared to just 211 in the losers’. The VN30 basket mirrored this sentiment, with 24 gainers, 4 losers, and 2 unchanged stocks.

Unexpected Euphoria: Energy Stocks Surge, VN-Index Flirts with 1340 Peak

Investors witnessed a surprising surge of enthusiasm during today’s afternoon session, with proactive and aggressive buying that propelled the VN-Index to its strongest gain in eight weeks. Shunning the previous two weeks of cautious adjustments, the index dramatically rebounded to near its previous peak, finishing at an impressive 1338.11 points.

Stock Market Insights: A Glimpse of Positive Signals

The VN-Index surged, crossing above the middle Bollinger Band. With continued index strength and trading volumes above the 20-day average, the bullish trend would be reinforced. Notably, the Stochastic Oscillator has signaled a buy, exiting the oversold region. Should the MACD indicator follow suit in upcoming sessions, the short-term outlook would brighten considerably.