This week’s corporate updates: 27 companies announced shareholder registration deadlines for dividend payments, with 21 opting for cash dividends, 4 for stock dividends, and 2 for hybrid dividends.

Debt Swap:

Novaland Group (stock code: NVL) plans to hold an extraordinary general meeting on August 7, with a registration deadline of July 4. The meeting agenda includes a proposal to issue shares for debt swap and other matters.

NVL to propose share issuance for debt swap.

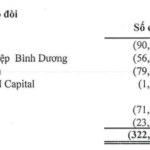

Prior to this, Novaland proposed issuing shares to swap debt with several shareholders who sold secured assets to the company as repayment for loans and bonds. Among these shareholders are two major stakeholders, NovaGroup and Diamond Properties, both affiliated with Mr. Bui Thanh Nhon, Novaland’s Chairman of the Board of Directors.

During Novaland’s most challenging period, these major shareholders committed to supporting the company by ensuring debt repayment and maintaining continuous operations. As per signed agreements, from 2022 to 2024, shares pledged by these shareholders to guarantee Novaland’s debt obligations were sold, resulting in the company recognizing debt obligations to these shareholders in its financial statements.

As of late 2021, when Novaland’s financial situation was stable, Mr. Bui Thanh Nhon-related shareholders held controlling interests in Novaland, with over 61.4% ownership.

However, in early 2022, Novaland’s share price began to decline, followed by a series of unfavorable market developments that pushed the company into a crisis, causing NVL shares to plummet.

To rescue Novaland, the shareholder group associated with Mr. Bui Thanh Nhon lent their shares for sale to settle debts and proactively sold a large portion of their NVL holdings to facilitate debt restructuring. Consequently, their ownership decreased to 60.8% by June 2022 and further down to 38.7% in December 2024.

Novaland’s management affirmed that the proposal to issue additional shares at this stage is based on the need to compensate major shareholders. The company pledges to maintain transparency and ensure fairness for all investors.

Tay Ninh Tourism and Trading Joint Stock Company (stock code: TTT) announced the appointment of Mr. Nguyen Thanh Dong as the new Chairman of the Board of Directors, replacing Ms. Nguyen Lam Nhi Thuy, who resigned.

Tay Ninh Tourism and Trading Joint Stock Company appoints a new Chairman.

Ms. Thuy served as Chairman of the Board of Directors and General Director of TTT since June 2019, succeeding Mr. Nguyen Huu Tri Nghia. To comply with Decree 71/2017/ND-CP, which mandates the separation of the Chairman and General Director roles, effective August 1, 2020, Ms. Thuy stepped down as General Director in July 2020, handing over the role to Ms. Tran Thi Hien, who was then the Deputy General Director.

In addition to her role at TTT, Ms. Thuy currently serves as Chairman of the Board of Directors of Tay Ninh Cable Car Corporation (stock code: TCT) and General Director of Tay Ninh Sun Joint Stock Company.

Increasing Foreign Ownership Limit to 100%

Binh Hoa – Thanh Thanh Cong Joint Stock Company (AgriS, stock code: SBT) seeks shareholder approval via written consent on two matters: adjusting business lines to maintain 100% foreign ownership and issuing shares under an ESOP program.

Regarding the first matter, the adjustment of business lines is necessary to comply with new legal regulations and ensure that foreign ownership can be maintained at 100%, given the evolving laws related to foreign investment limits.

For the second matter, AgriS proposes to issue over 40.7 million shares, or 4.87% of its charter capital, under the ESOP program. This initiative is expected to motivate employees and foster a long-term commitment to the company, contributing to its strategic transition during the 2025-2030 period.

AgriS aims to maintain 100% foreign ownership.

Ho Chi Minh City Stock Exchange (HoSE) announced its consideration of mandatory delisting for PSH shares of Nam Song Hau Oil, Gas, and Petroleum Trading and Investment Joint Stock Company due to serious violations of information disclosure obligations and related regulations.

According to HoSE, PSH shares of Nam Song Hau Oil, Gas, and Petroleum Trading and Investment Joint Stock Company are currently suspended from trading due to late submission of semi-annual reviewed financial statements. The company has also been placed under warning status due to exceptions noted by the auditor in its 2023 audited financial statements and under control status for submitting its 2024 audited financial statements over 30 days late. Despite the trading suspension, the company has further violated regulations by failing to submit its 2024 semi-annual audited financial statements.

PetroVietnam Transportation Corporation (stock code: PVT) announced a shareholder registration deadline for issuing bonus shares as dividend payments for 2024, with a ratio of 32%. This means that for every 100 shares owned, shareholders will receive 32 new shares. With over 356 million shares currently in circulation, PVT will issue nearly 114 million new shares, increasing its charter capital to nearly VND 4,700 billion.

Sonadezi Services Joint Stock Company (stock code: SDV) announced that June 20 is the record date for cash dividend payments for 2024, with a ratio of 30%. With 5 million shares currently in circulation, SDV expects to spend VND 15 billion on this dividend payment.

“AgriS (SBT) Assures Shareholders of 100% Foreign Ownership Limit, Focusing on International Partnerships”

“TTC AgriS (HoSE: SBT), or Thành Thành Công – Biên Hòa, is embarking on an exciting journey of strategic expansion and international collaboration. As Vietnam’s stock market edges closer towards potential reclassification, TTC AgriS is taking proactive steps to seize new opportunities. The company is seeking shareholder approval through a written resolution, marking a pivotal moment in its growth trajectory.”

The Stock That Once Surged by 700% is Now Under Scrutiny

The HoSE is considering a mandatory delisting of Koji Asset Investment Corporation’s KPF stock due to delays in submitting the reviewed semi-annual 2024 financial statements, 2024 audited financial statements, and 2024 annual report.

“AgriS Proposes 100% Foreign Ownership to Shareholders, Accelerating International Partnerships”

The Ho Chi Minh City Stock Exchange-listed company, Thanh Thanh Cong – Bien Hoa Joint Stock Company (AgriS), is seeking shareholder approval for its strategic initiatives. With the Vietnamese stock market on the cusp of a potential upgrade, AgriS (HOSE: SBT) is poised to expand its international cooperation and seize new opportunities.