The Vietnamese stock market started the new week on a positive note, allaying concerns about geopolitical tensions in the Middle East. The green hue was not limited to oil and gas stocks but spread across various sectors. Many Bluechips surged, helping the market overcome volatility.

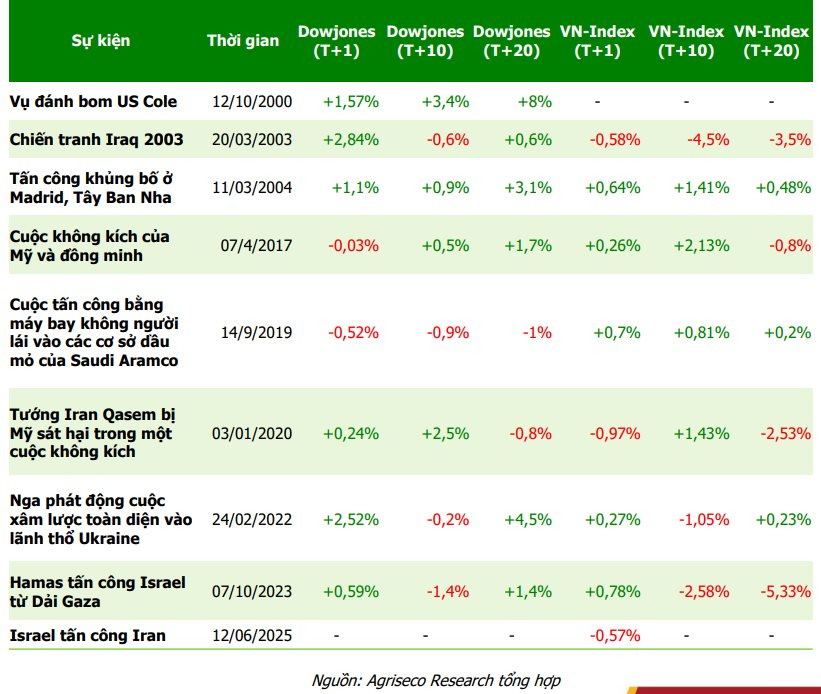

The VN-Index closed at its intraday high, gaining more than 22 points (+1.72%) to surpass the 1,338-point level. This performance placed Vietnam among the top-performing Asian markets on June 16. It was also the VN-Index’s strongest gain since April 11, during the market’s robust recovery from tariff-related lows.

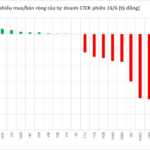

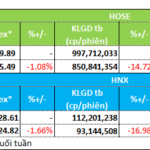

Notably, trading liquidity declined significantly compared to last Friday’s “wash out” session. However, the matching value on HoSE remained relatively high, nearing VND 20 trillion. Moreover, net foreign buying of nearly VND 1,000 billion across various Bluechips sent a positive signal, helping stabilize investor sentiment.

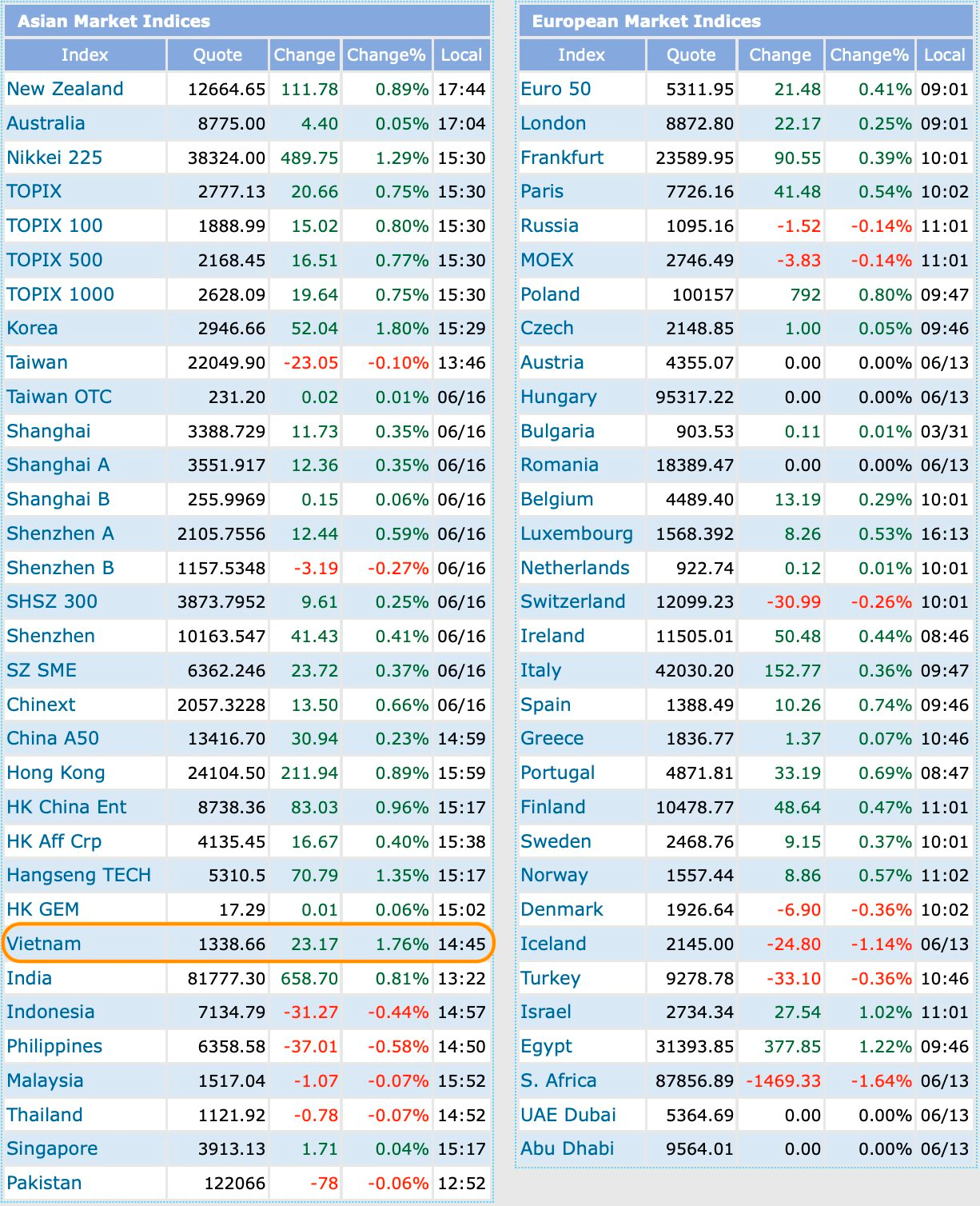

According to a recent report by Agriseco, historical data suggests that certain geopolitical tensions can cause short-term impacts, usually concentrated in the sessions immediately following the event. In most of the analyzed cases, both the Dow Jones and VN-Index were largely unaffected and quickly rebounded within 10-20 sessions.

While the stock market may witness short-term declines, it tends to recover afterward. In the near term, concerns about escalating conflicts can exert pressure on financial markets.

However, based on historical data, when conflicts do not inflict large-scale economic damage globally, financial markets typically show resilience without significant declines and resume their upward trajectory shortly after.

“This implies that the initial dip presents a buying opportunity for medium and long-term investors to acquire stocks with solid fundamentals and promising growth prospects,” the report emphasized.

Furthermore, Agriseco Research opined that Vietnam would not be significantly impacted by the event due to limited trade activities with the Middle East and negligible direct investment linkages with Israel and Iran.

Additionally, amidst rising geopolitical uncertainties, international investors seeking stability may view Vietnam as a relatively safe destination for supply chain diversification away from high-risk regions, given its stable political environment.

The Foreign Capital Stampede: A Near 1,000 Billion Buying Frenzy

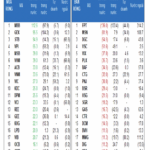

The local and foreign currencies raced to boost liquidity on three exchanges, reaching nearly 23,000 billion VND, with net foreign buyers at 964.5 billion VND. Specifically, in terms of matched orders, they net bought 942.9 billion VND.

Market Beat June 16: VN-Index Surges Over 22 Points, Energy Sector Shines Bright

The market closed with strong gains, as the VN-Index rose by 22.62 points (+1.72%), finishing at 1,338.11. The HNX-Index also climbed, gaining 3.3 points (+1.47%) to close at 228.12. It was a sea of green across the market, with 515 tickers in the gainers’ column compared to just 211 in the losers’. The VN30 basket mirrored this sentiment, with 24 gainers, 4 losers, and 2 unchanged stocks.