Services

|

In April, MBS introduced promotional margin lending packages with T+3 and T+5 interest-free periods. This means that customers can enjoy zero interest for the first three days or 5% interest for the first five days, with a rate of 12.5% per annum applied thereafter.

Alternatively, SSI offers a T7 package, providing customers with interest-free margin lending for the first seven days, followed by a rate of over 16% per annum from the eighth day onward.

Following the interest-free period, customers often face relatively high fixed margin rates, typically ranging from 12% to 16% per annum.

Meanwhile, a foreign securities company known for its low-fee policies has joined the fray. Pinetree has introduced several competitive and flexible margin packages, including the standout P-Zero offer, which provides new margin customers with up to 30 days of interest-free margin lending. This means that new account openings (applicable to both new and existing customers who have not yet opened a margin account) and existing customers who have not incurred margin debt in the past six months will not incur any interest for 30 days from the successful disbursement date. From the 31st day onward, a fixed margin rate of 9.9% per annum will apply.

Compared to the market average of 12-16% per annum, this is a highly competitive fixed-rate offering.

When coupled with lifetime transaction fee waivers, investors effectively incur zero costs (including transaction fees) for the first 30 days of margin borrowing.

|

Additionally, other flexible margin packages have been introduced, including P-5.9% (5.9% margin interest for 90 days) and P-6.8% (6.8% margin interest for 30 days, with a limit of VND 5 billion per day).

Notably, these are long-term policies with no specified end date.

|

This is the first time the company has implemented such flexible margin interest policies, complementing its suite of low fixed-fee offerings. Backed by Hanwha Group and its comprehensive digitization strategy, Pinetree is one of the few securities companies capable of providing such attractive fee policies to investors. With Pinetree’s app or web-based trading platform, investors can easily select and register for one of these new margin packages.

– 07:00 17/06/2025

The Hottest Margin Policies on the Street: Unveiling the Top Brokers’ Strategies

In recent times, leading securities firms have been actively introducing flexible and interest-free margin lending packages with reduced rates to cater to the diverse needs of investors. Among these firms are Pinetree, SSI, and MBS, to name a few. But which of these offerings is the most advantageous for investors?

“VPBank Launches Record-Low Interest Rate Promotion at 6.6%”

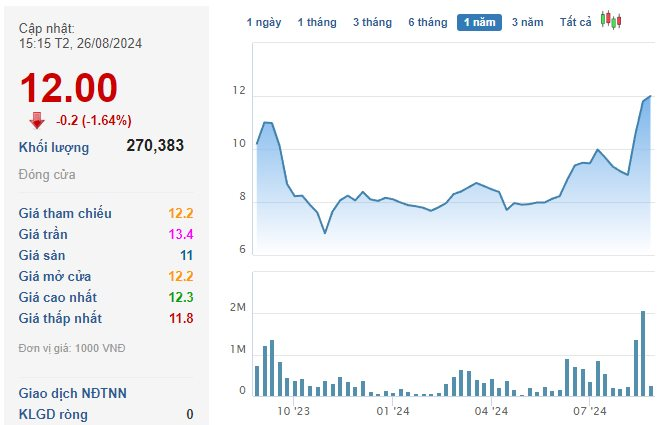

In the midst of a robust stock market recovery, VPBank Securities slashes margin interest rates to an all-time low of just 6.6%/year. This unprecedented move is accompanied by a host of other attractive offers, including lifetime waiver of trading fees, loyalty points redeemable for gifts upon account opening, and exciting gaming rewards.

“VTG Securities Aims to Disburse Up to 1,100 Billion VND in Margin in 2025”

VTG Securities JSC (VTGS) is gearing up for its 2025 Annual General Meeting, scheduled for June 26 in Ho Chi Minh City. The company has set its sights on an ambitious business plan for the upcoming year, targeting over VND 81 billion in total revenue and VND 32 billion in pre-tax profits. These figures represent a staggering 26-fold and 2.3-fold increase, respectively, compared to the previous year’s performance. VTGS aims to achieve these goals by focusing on margin lending, with plans to disburse VND 1,000 to 1,100 billion in new loans in 2025.