Vietnam’s stock market opened the week with a positive green spread across many stock groups. Oil and gas stocks, in particular, soared, with many codes reaching the maximum daily limit. The heat in this sector shows no signs of cooling down as geopolitical tensions in the Middle East continue to escalate.

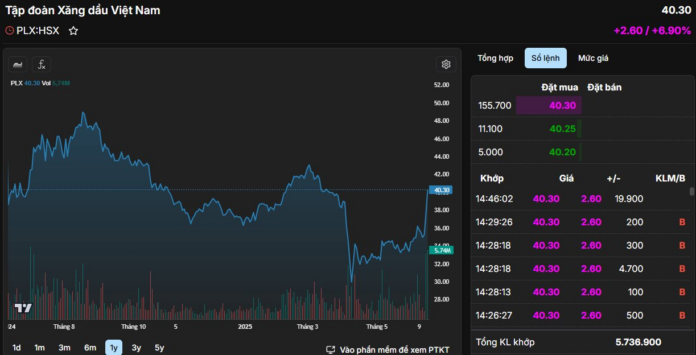

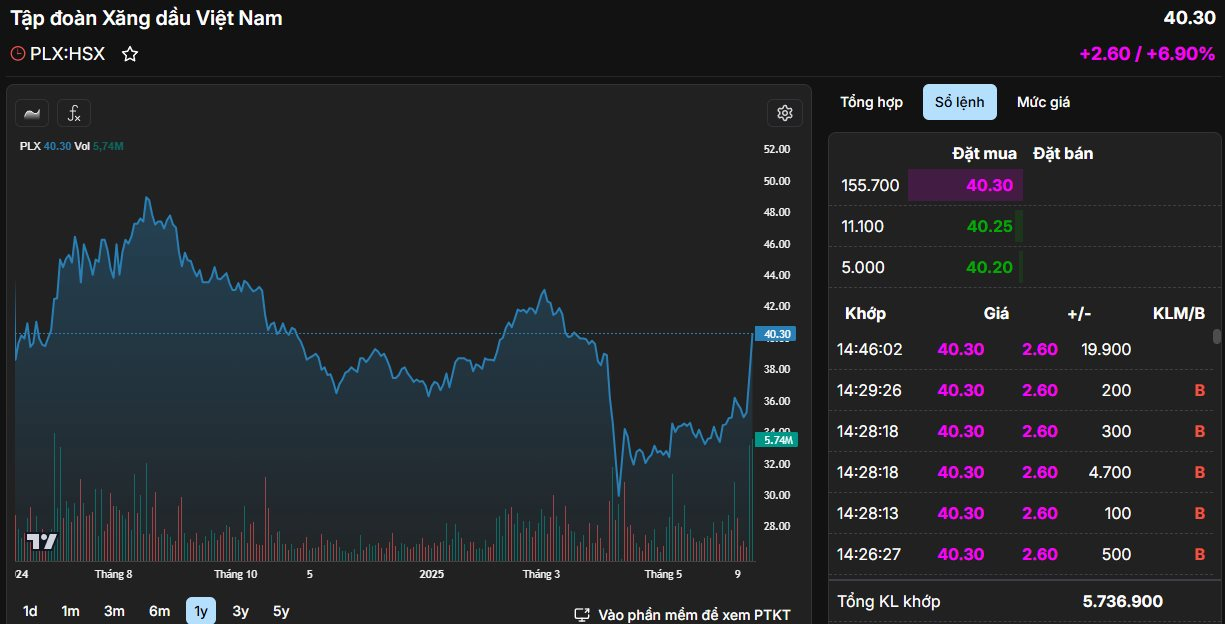

Notably, Petrolimex Group’s stock, PLX, surged for the second consecutive session, with its market price quickly climbing to 40,300 VND per share – the highest in the past three months, with a trading volume of 5.7 million units. Since the deep dip at the beginning of April due to the counterparty tax shock, PLX has recovered and surged nearly 35%, with a corresponding market capitalization of over 51.2 trillion VND.

Petrolimex shareholders have consistently received positive news about cash dividends, and the share price has soared. On June 11, this oil and gas company finalized the list of shareholders to pay a 2024 dividend in cash at a rate of 12% (VND 1,200 per share). With 1.27 billion circulating shares, Petrolimex is expected to spend about VND 1,500 billion on this dividend. The payment is scheduled for June 24.

In terms of business performance, in 2025, Petrolimex plans to achieve consolidated revenue of VND 248,000 billion, up 87% compared to the result achieved in 2024; consolidated pre-tax profit target of VND 3,200 billion, up 81%. The 2025 dividend is expected to be 10%, equivalent to nearly VND 1,300 billion.

In the first quarter of 2025, Petrolimex recorded net revenue of more than VND 67,861 billion, down 9.6% over the same period last year. Pre-tax profit reached nearly VND 358.4 billion, down 75.1% compared to the same period. With these results, Petrolimex has achieved 27.4% of the net revenue plan and 11.2% of the pre-tax profit plan.

The Stock Market Surge: Vietnam Leads Asia Despite Middle East Tensions

The Vietnamese stock market has just witnessed its strongest rally in over two months, surging ahead on June 17th and outperforming its peers since April 11th.

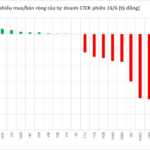

The Stealthy Sell-Off: In-House Brokers Dump $30 Million in Stocks in a Single Day

The proprietary trading group at FPT witnessed a significant sell-off, with a notable net sell value of VND 104 billion.

Unexpected Euphoria: Energy Stocks Surge, VN-Index Flirts with 1340 Peak

Investors witnessed a surprising surge of enthusiasm during today’s afternoon session, with proactive and aggressive buying that propelled the VN-Index to its strongest gain in eight weeks. Shunning the previous two weeks of cautious adjustments, the index dramatically rebounded to near its previous peak, finishing at an impressive 1338.11 points.