According to the draft decree on customs management of imported goods through e-commerce, which is currently open for feedback, the Ministry of Finance proposes to exempt import tax for orders with a value of up to VND 1 million. At the same time, it suggests limiting the annual purchase value to VND 48 million per organization or individual.

Vietnam’s e-commerce retail market size is estimated to exceed $25 billion in 2024

However, the Ministry of Industry and Trade suggested considering removing the import tax exemption. They highlighted that many countries have tightened regulations on import taxes and specialized inspections, especially for low-value goods imported through e-commerce channels, such as Thailand, Indonesia, Singapore, and Malaysia. These measures aim to prevent the proliferation of cheap and low-quality products and protect domestic production from the competition of cheap imported goods.

The Ministry of Finance did not accept this suggestion, stating that the import tax exemption for goods imported through e-commerce transactions is similar to the exemption for goods imported through postal and express delivery services. They argued that goods traded through e-commerce are usually small in quantity and for personal use, making it impractical to obtain permits and conduct inspections for such small volumes.

Setting an annual limit of VND 48 million, in their view, strikes a balance between preventing the rampant import of cheap goods and facilitating the development of cross-border e-commerce in line with global trends.

Previously, the Vietnam Chamber of Commerce and Industry (VCCI) proposed that the drafting agency consider applying a comprehensive import tax policy without exemption for e-commerce imports. With the proposed exemption for low-value import orders (below VND 1 million), VCCI argued that this mechanism could create inequality with domestically produced goods. They pointed out that most imported goods would be exempt from import tax since e-commerce orders typically have low values, not exceeding VND 1 million.

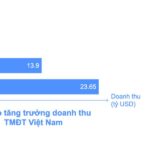

In recent years, Vietnam’s e-commerce has grown significantly, with an annual growth rate of 15-20%, according to the Ministry of Industry and Trade. In 2024, Vietnam’s e-commerce retail market size is estimated to exceed $25 billion, a 20% increase compared to 2023. This figure surpasses the previous forecast of $22 billion by Google, Temasek, and Bain & Company in their report “e-Economy SEA 2024.”

Vietnam’s e-commerce market size is now the third-largest in the region, after Indonesia ($65 billion) and Thailand ($26 billion). Vietnam is also recognized as one of the top ten countries with the fastest-growing e-commerce sectors globally.

Stop “Aiding” Cheap Imports: Protecting Domestic Manufacturing.

The influx of untaxed imported goods purchased online is creating an uneven playing field for domestic Vietnamese products. Removing the tax exemption on these imported goods is a necessary step to not only boost the state budget but also to protect and foster the local manufacturing industry.

The Ultimate Shopping Hack: Temu’s Secret to Success with Order Values

Temu has unexpectedly altered its selling policy in Vietnam, imposing a restriction on orders ranging from 887,000 VND to just over 1,000,000 VND.

Revolutionizing the National Innovation Hub: Unveiling a Treasure Trove of Opportunities

The Ministry of Planning and Investment has proposed additional incentives for the National Innovation Center (NIC), including land and tax breaks, as well as the establishment of a national innovation investment fund. These proposals aim to foster a thriving environment for innovation and entrepreneurship in the country.