In the first six months, profit exceeded VND 1,200 billion, surpassing the plan

For 2025, Ca Mau Fertilizer sets a target of nearly VND 14,000 billion in total revenue, a 4% growth; however, after-tax profit is only VND 774 billion, nearly halving the 2024 performance. It is important to note that DCM has consistently set low targets and exceeded plans in previous years.

In terms of output targets, the company plans to produce 910,000 tons of urea equivalent and 340,000 tons of NPK (with 220,000 tons of self-produced and the rest from KVF factory); and targets to consume 759,000 tons of urea and 340,000 tons of NPK.

Screenshot

|

General Director Van Tien Thanh shared that the cautious plan is a realistic picture based on forecasts from the parent group (PVN). Every year, DCM creates scenarios based on oil and urea price predictions to determine revenue and profit. However, the actual context and reality differ significantly.

“We don’t want to set a low plan, but what if we don’t achieve it in a bad reality? The calculation of wage funds for workers is based on the wage fund and profit. Setting this plan is also to ensure stable wage funds. Nevertheless, at the end of the year, we often ask to change the plan upwards, not downwards” – quoted Mr. Thanh.

As of Q1/2025, the company achieved VND 3,400 billion in net revenue, up 24% over the same period; and profit after tax of VND 411 billion, up 19%. Compared to the set targets, the fertilizer giant achieved 24% of revenue target and nearly 54% of profit plan after the first quarter.

Notably, General Director Van Tien Thanh revealed that the estimated profit before tax for Q2 exceeded VND 1,247 billion, surpassing the plan by about 21%. This is a positive signal for 2025, and the company is aiming for new records.

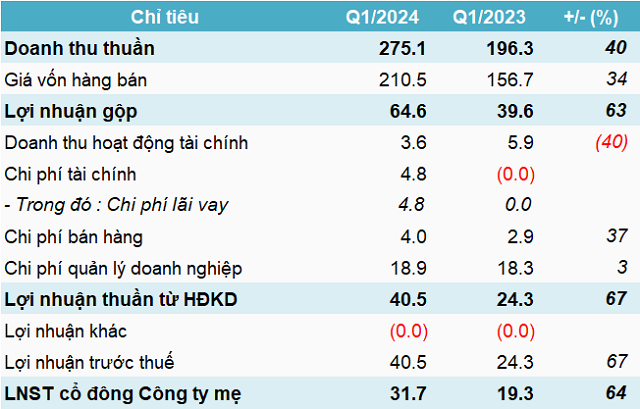

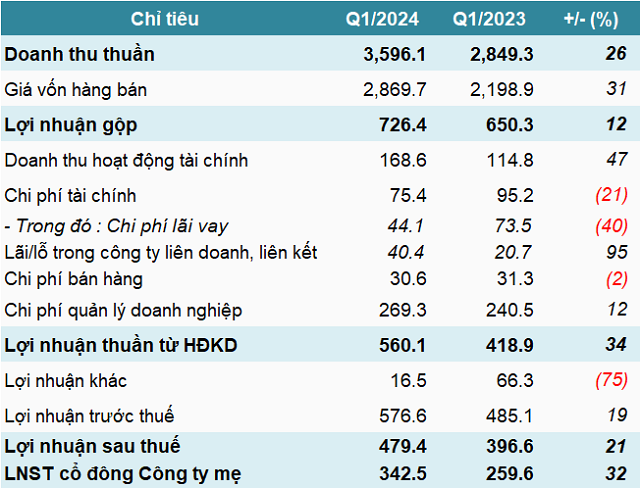

| DCM’s business results |

Regarding dividends, DCM offers 20% for 2024 and 10% for 2025. When asked why not distribute more, General Director Van Tien Thanh explained that the fertilizer industry typically grows by only 10-20% annually, with profits ranging from 8-10%. In reality, the 20% dividend payout demonstrates effective management in recent years.

“From 2022 to 2024, we have maintained this dividend rate. If we distribute all our earnings, we won’t create an advantage for the next phase. Businesses need good working capital to be flexible in different situations, such as when they need to purchase goods or foreign currency, which enhances their resilience. We can slightly increase the dividend if we perform well, but we should also consider the resilience of the business in today’s challenging context”.

Looking ahead to 2025, DCM provides a relatively positive outlook. For urea fertilizer, the company forecasts global production to reach an estimated 190 million tons, driven by increased output from China, the Middle East, Russia, and North Africa. Consumption is also expected to rise by 2-3% due to the recovery in the agricultural sector in developing countries, as positive signs in commodity prices improve, enabling farmers to afford fertilizers and other agricultural inputs.

Urea will remain the most popular fertilizer. Asia-Pacific is expected to dominate the market, particularly in countries like China and India, where agriculture plays a significant role in the economy. Government support policies and subsidies for fertilizers boost market growth.

Similarly, the global potash market is anticipated to continue its upward trajectory, with demand and prices trending upward. However, this market faces challenges related to supply chains. Potash demand is estimated at 68-71 million tons this year. The primary sources of global potash supply are major producers like Canada, Russia, and Belarus. Nonetheless, sanctions and geopolitical tensions could impact supply capabilities, leading to shortages and price increases during specific periods.

The DAP market is projected to reach 52 million tons in production with recovering supply from China, while consumption is expected to stabilize around 48-50 million tons. However, sanctions and geopolitical tensions may affect supply capabilities from countries like Russia and Belarus, leading to shortages at certain times. Additionally, China’s policy to restrict DAP exports influences market supply. DCM believes that DAP/MAP prices will continue their upward trend in 2025.

Regarding the NPK market, the company forecasts rising prices due to input costs. In reality, NPK production relies heavily on the prices of raw materials such as urea, DAP, and potash.

Turning to the domestic market, the company believes that Vietnam’s fertilizer market will continue to grow in 2025, driven by factors such as domestic and international agricultural demand, government support policies, and initiatives to promote agriculture, encourage crop diversification, and adopt sustainable farming practices. Fertilizer consumption in Vietnam is estimated to remain at 10.5-11 million tons/year.

Notably, the application of a 5% VAT on fertilizers from July 2025 is expected to support the profits of domestic fertilizer producers by enabling input VAT refunds, reducing production costs, and enhancing the competitiveness of domestic fertilizers compared to imported products.

“Before the implementation of VAT on fertilizers, all input VAT was reflected in the selling price to farmers. Meanwhile, foreign goods were exempt from VAT when exported, putting us at a disadvantage in our home market. Therefore, companies in the industry proposed to the National Assembly, and adjustments were made.”

“The VAT on fertilizers will take effect on July 1st. On average, input materials with VAT account for about 7.5%, while output VAT is 5% of the selling price. Input accounts for 85% of the cost, while the selling price includes management, sales, and standard profit, so the selling price is much higher. 5% of the selling price can be higher than 7.5% of the cost, so can we get a refund? However, the selling price also depends on world prices, so sometimes we have to balance profits to maintain market participation” – added Mr. Van Tien Thanh.

Continuing to increase plant capacity

To accomplish its goals, DCM sets out key tasks for 2025. Firstly, it aims to ensure the efficient, safe, and stable operation of the Ca Mau Fertilizer Plant, optimizing its operating capacity. Simultaneously, it will focus on cost control and energy savings, aiming to reduce energy consumption by 5% compared to the 2022 baseline. According to Mr. Van Tien Thanh, with the double-digit growth target set by the parent group PVN, DCM plans to continue increasing plant capacity, targeting over 120% of the designed capacity (compared to the current 115%).

General Director Van Tien Thanh speaking at the 2025 AGM of DCM

|

“This is a bright spot for DCM. When we first took over, the Ca Mau Fertilizer Plant operated at 100% of its designed capacity, reaching 102-103%, but then technological bottlenecks appeared. DCM engineers addressed these issues and increased capacity to 105-106%. Subsequent equipment improvements pushed it to 110-111%. In 2022-2023, we made significant improvements, achieving 115% of the designed capacity.”

“Since 2013, we haven’t just increased capacity, but we’ve also reduced energy consumption by 8%. Every year, DCM consumes about $200 million worth of gas, and the 8% savings each year is significant. From 2022 onwards, our engineers have proposed modifications that could save an additional 5% in energy. We can reach 120%, and even push towards 125%” – quoted the General Director of DCM.

Additionally, DCM will focus on implementing various management approaches: managing volatility, value chain management, ecosystem management, and governance based on digital platforms, preparing to transition to suitable business models. The company will also explore diversifying raw material and fuel sources for fertilizers, aiming for sustainable and green production.

Another goal is to develop high-tech agricultural cultivation solutions based on crop nutrition and scientific and technological advancements. DCM aims to expand exports to neighboring countries and regions, offering diverse fertilizers based on urea and organic NPK.

Regarding personnel, the General Meeting approved the resignation of Mr. Truong Hong as an independent member of the Board of Directors. Simultaneously, shareholders will elect one member to the Board of Directors and one independent member for the term 2025-2030. The candidates, nominated by the major shareholder Vietnam National Oil and Gas Group (PVN), are Mr. Nguyen Duc Hanh (candidate for the Board of Directors), currently a member of the Board of Directors; and Mr. Le Viet Dung (candidate for the independent member of the Board of Directors), currently a senior lecturer at Can Tho University.

Additionally, the General Meeting approved the election of one member to the Supervisory Board for the term 2025-2030 to replace Ms. Phan Thi Cam Huong, whose term has ended. The replacement, nominated by PVN, is Mr. Tong Viet Thong, currently Head of the Legal and Compliance Division of the Company.

The General Meeting concluded with the approval of all proposals.

“Shareholder Meeting of Ca Mau Fertilizer: 6-Month Estimate Surpasses Targets, 20% Dividend Payout”

On Monday, June 16, 2025, the Annual General Meeting of Ca Mau Fertilizer Joint Stock Company (PVCFC, also known as Ca Mau Fertilizer or DCM, listed on the Ho Chi Minh City Stock Exchange as DCM) was successfully held. As in previous years, the fertilizer giant presented a relatively conservative plan compared to the achievements of the previous year, but the estimated results for the first half of the year look promising. Furthermore, the company predicts that the conflict in the Middle East between Iran and Israel could significantly impact the fertilizer market.

VNDirect Securities to Pay Out Nearly VND 760 Billion in Cash Dividends to Shareholders

“Our CEO is proud to announce that VNDirect will be maintaining a 5% dividend policy, offering a yield of 3.5-4%. This decision empowers our shareholders with the resources to reinvest and foster further growth. We believe this move underscores our commitment to our investors and their long-term success.”

The Tasty Nest: A Stock Market Darling Dishing Out Divine Dividends

“With a hefty sum of $42 billion, the company is set to reward its shareholders with a generous dividend payout. This substantial allocation of funds showcases the company’s commitment to recognizing and valuing the investment of its shareholders.”