According to Mr. Duc, the notable event currently is the Israel-Iran conflict, which is, however, considered to be confined to the Middle East region, impacting oil prices, and the US is unlikely to engage in warfare. Thus, the impact of this war on the global market is mainly focused on the energy sector.

Oil prices are currently above $70 per barrel, lower than the 2024 average. In a worse-case scenario, if sanctions are imposed, the impact could be more significant. Overall, despite the apparent tensions, the global stock market tends to recover from such adjustments.

Mr. Nguyen Viet Duc shared at the Vietnam and the Indices event on June 16th

|

A prominent macro issue recently is the US-Vietnam trade agreement, which is nearing a conclusion. So far, investors have been awaiting official information. Prior to the adjustment caused by the Israel-Iran conflict, the market had already experienced a decline due to several uncertainties. However, on June 15th, some positive news emerged.

For instance, Bloomberg reported that Vietnam proposed tariffs of around 20-25%. The US also expressed a positive outlook. President Donald Trump stated that Americans cannot produce shoes, clothing, or seafood, and Vietnam has a competitive advantage in these industries.

Given the current situation, with the US and China agreeing to freeze tariff rates (55% for the US and 10% for China, as announced by Trump), Vietnam negotiating tariffs down to 20-25% would be on par with Malaysia and significantly lower than Thailand and Indonesia, who are not in trade talks with the US. This means they will face the initially announced tariffs. As a result, Vietnam will have a competitive edge over other Southeast Asian countries and China. Mr. Duc predicts that the two sides will finalize the trade agreement by mid-July.

There is a 60-65% likelihood that the market has bottomed out

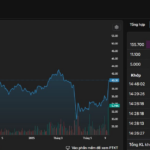

In the short term, the VN-Index has just experienced an adjustment from 1,350 to 1,300. According to Mr. Duc, it can be affirmed that the corrective wave ended at 1,310. If the market recovers and surpasses 1,340, it could enter a new uptrend. Otherwise, the market will correct again and find support at the 1,280 level.

The market has two turning points at 1,310 and 1,280, so investors need to allocate funds to buy during these dips and avoid getting caught up in strong rallies.

There is a 60-65% probability that the market has bottomed out. In the remaining 35% chance, if the market declines further, investors still have the opportunity to sell. If they are holding stocks and are worried about a market decline, investors can rest assured that there will be recovery rallies where they can exit their positions.

Currently, if concerned, investors can sell 30% of their holdings in the 1,330-1,340 range and maintain a 70% portfolio. Only when the market truly weakens and falls below the MA50 and MA200 should investors consider reducing their equity allocation to below 70%.

Mr. Duc suggested three sectors that could be of interest: banks, which benefit from economic growth and reduced risks; oil and gas companies, as oil prices are expected to remain in the $70-80 range for the year, boosting their performance; and the retail sector, as the government has been actively combating counterfeit and pirated goods.

– 09:38 17/06/2025

The Foreign Capital Stampede: A Near 1,000 Billion Buying Frenzy

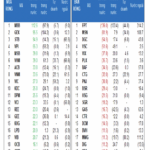

The local and foreign currencies raced to boost liquidity on three exchanges, reaching nearly 23,000 billion VND, with net foreign buyers at 964.5 billion VND. Specifically, in terms of matched orders, they net bought 942.9 billion VND.

What Stocks Surge Amid the Israel–Iran Armed Conflict?

The Israeli preemptive strike in the early hours of June 13 and Iran’s retaliation risk escalating tensions between the two Middle Eastern nations, potentially leading to a direct conflict with devastating humanitarian and economic consequences. Financial markets have already reacted, reflecting expectations and predictions about the war’s impact.

“Global Commodities Spike: Oil and Gold Surge, Coffee Plunges to 10-Month Low”

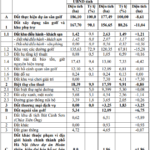

As of the market close on June 13, 2025, escalating tensions between Israel and Iran have sparked concerns about oil supplies in the Middle East, driving up the demand for gold as a safe-haven asset and pushing oil and gold prices to soar. Robusta coffee plunged to a 10-month low, while sugar prices hit their lowest level in over four years.