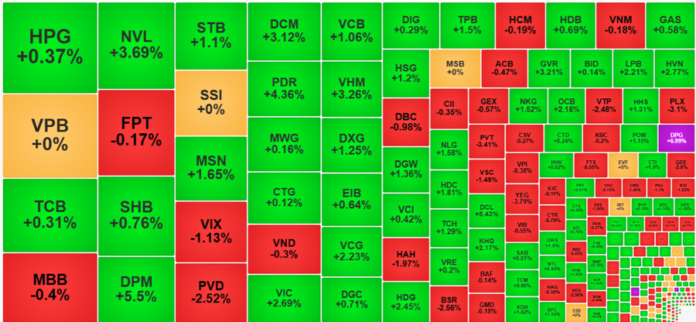

Liquidity remained subdued in the afternoon session, but the VN-Index climbed higher, propelled by some of the largest stocks in the market. Despite the large number of bottom-fishing trades, the breadth data indicated a prevailing uptrend.

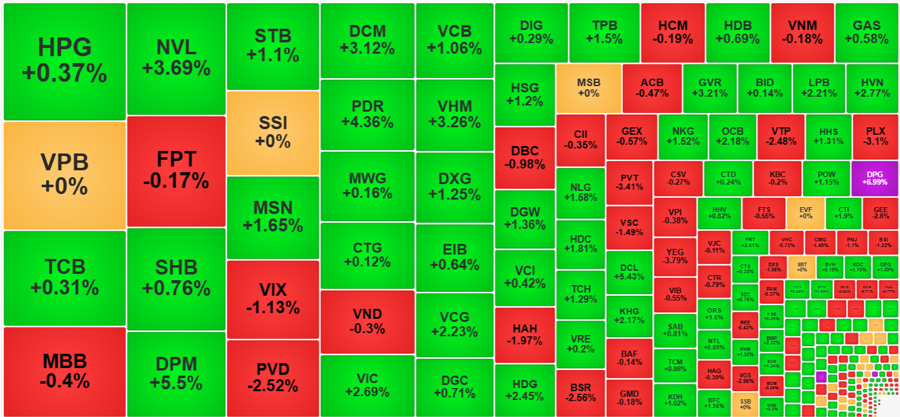

The HoSE’s benchmark index closed the day up 9.58 points (+0.72%), with 5.3 points contributed by the top three stocks: VCB, VIC, and VHM. VCB rose by 1.06%, VIC by 2.69%, and VHM by 3.26%. This positive performance, however, fell short of the intraday peak earlier in the morning session.

The VN30 basket, which represents the largest stocks in the market, showed improved stability in the afternoon session, with 16 stocks advancing compared to the morning session’s close, while 11 declined. The basket recorded 19 gainers and 8 losers, and the corresponding index rose by 0.78%, not far off from the 0.71% gain in the morning session.

The ability of blue-chip stocks to maintain their prices was crucial in keeping the VN-Index within the previous peak range. At the start of the afternoon session, some large-cap stocks like CTG and TCB witnessed rapid declines, dragging the index close to the reference level. However, the heavyweights VIC and VHM pulled the index back up. The missing ingredient for a true index breakout was the lack of resonance from other large-cap stocks. While VCB gained over 1%, other blue-chip banks showed weakness: BID, TCB, and CTG posted meager gains, while MBB slipped slightly. It was the smaller banks that shone, with VBB, BVB, KLB, ABB, OCB, and LPB all climbing over 2%.

In previous attempts to breach the 1340-point level, the index had managed to surpass it momentarily, but ultimately, those moves were deemed technical fluctuations. The reason for this was the lack of synchronization among the stocks capable of influencing the index. Today, VCB joined forces with VIC and VHM, but there’s no guarantee that other stocks will follow suit.

A positive aspect of this session was that the index’s hesitation didn’t significantly impact the trading of other stocks. Money flowed into many stocks, resulting in substantial localized liquidity. Specifically, out of the 173 green ticks on the VN-Index at the end of the day, 87 stocks rose over 1%, a slight increase from the morning session’s 63. However, the number of stocks with significant trading volumes stood out. In the morning session, only 8 stocks in this group crossed the 100 billion VND mark, but in the afternoon, this number jumped to 26.

Of course, not all stocks in this group were able to maintain their high prices. For instance, VIC fell 3.41% from its peak, VHM slipped 2.11%, and DXG declined 1.82%. Nonetheless, some stocks managed to hold their ground near their peaks, including NVL, DPM, MSN, DCM, PDR, and VCG. Considering the substantial bottom-fishing volume from the previous Friday’s session, the ability of these stocks to rise and maintain their high prices amid substantial liquidity is a positive sign, reflecting the market’s strong absorptive capacity.

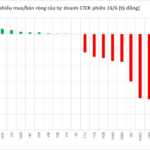

Overall market liquidity in the afternoon session was only marginally higher than in the morning, with a less than 1% increase across the two exchanges. The HoSE, however, saw a more notable increase of 1.8%. Combined, the HoSE and HNX exchanges witnessed a 4.1% decline in trading value to 19,816 billion VND, excluding matched trades. Compared to the previous Tuesday’s trading value of nearly 28,800 billion, a significant portion of stocks was retained.

While there were 133 declining stocks today, only about a dozen experienced substantial selling pressure. This group of stocks fell by more than 1% with trading volumes exceeding 100 billion VND. The energy sector contributed to this group, with BSR falling 2.56% on a volume of 119.4 billion, PLX declining 3.1% on a volume of 106.6 billion, and PVD slipping 2.52% on a volume of 359.2 billion. This development wasn’t surprising given the rapid rise and substantial accumulation in energy stocks recently. Additionally, HAH fell 1.97%, VTP declined 2.48%, PVT dropped 3.41%, and VSC slipped 1.49%, all on substantial volumes.

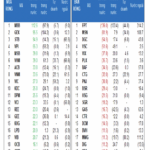

Foreign investors’ behavior in the afternoon session was noteworthy, as they significantly increased their buying activity, with a nearly 1,412 billion VND net buy value, a 37% increase from the morning session. FPT witnessed a massive influx of capital, with a net buy value of 218.1 billion VND. Other notable stocks included HPG (+129.9 billion), NVL (+115.4 billion), VCB (+88.3 billion), VCI (+59.5 billion), CTG (+56.5 billion), VPB (+56.1 billion), and MWG (+40.3 billion). The VN30 basket alone attracted nearly 492 billion VND in net buying for the entire session.

The Fastest-Growing FPT Stock: A Month of Stellar Performance

“It is noteworthy that FPT witnessed the strongest net foreign buying across the market on that day.”

The Foreign Capital Stampede: A Near 1,000 Billion Buying Frenzy

The local and foreign currencies raced to boost liquidity on three exchanges, reaching nearly 23,000 billion VND, with net foreign buyers at 964.5 billion VND. Specifically, in terms of matched orders, they net bought 942.9 billion VND.