|

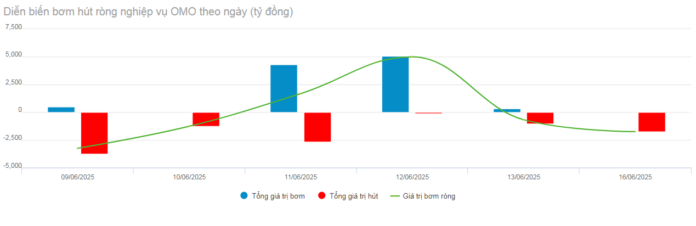

OMO Net Pumping Developments (09-16/06/2025). Unit: VND billion

Source: VietstockFinance

|

Specifically, new issuances in the term purchase channel were limited to VND 10,206 billion out of a total of VND 10,521 billion maturing, resulting in a net withdrawal of VND 315 billion by the SBV. The outstanding amount in the term purchase channel stood at VND 48,960 billion.

|

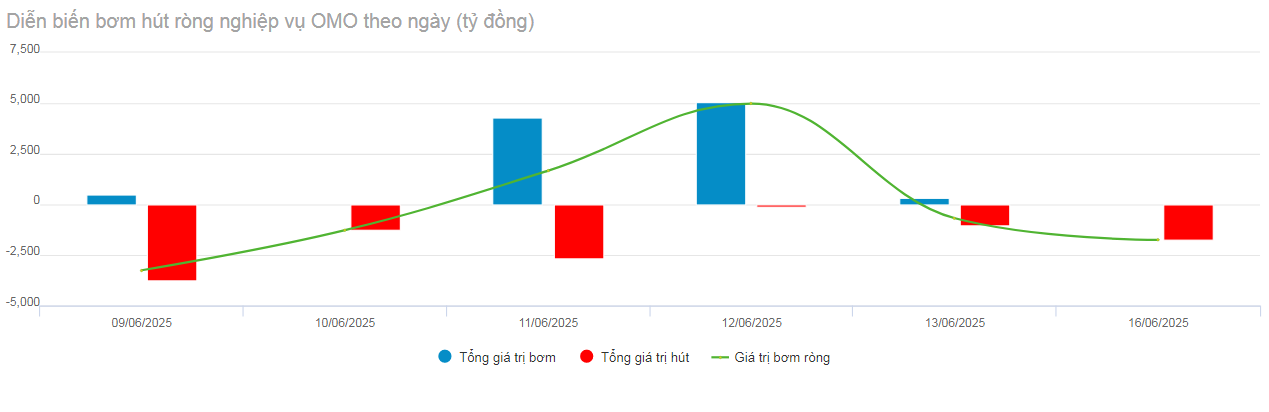

Developments in the overnight interbank interest rate since the beginning of 2025. Unit: %/year

Source: VietstockFinance

|

In the interbank market, the overnight interest rate slightly increased to 3.72%/year on 13/06, up 90 basis points from the previous week. Meanwhile, the average trading volume slightly decreased by 4% to nearly VND 437 thousand billion.

|

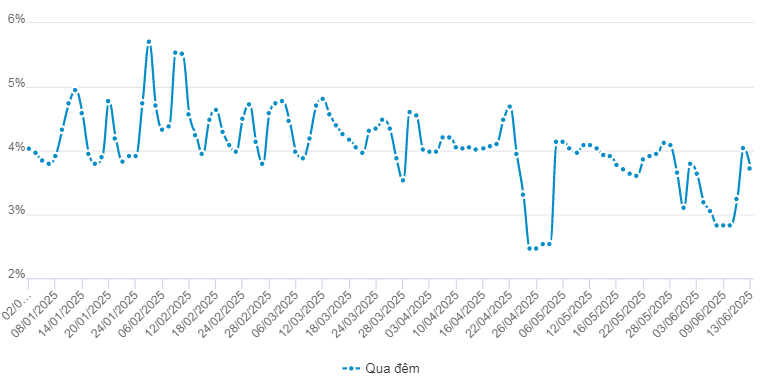

DXY Developments in the Last 3 Years

Source: marketwatch

|

In the international market, the USD Index (DXY) dropped sharply by 1.06 points to 98.14 – the lowest level in several weeks – after the US released inflation data for May, which showed a slower increase compared to April. This development raised expectations that the Federal Reserve (Fed) may soon initiate an interest rate cut cycle, putting downward pressure on the USD.

In the domestic market, Vietcombank’s exchange rate on 13/06 was listed at 25,833-26,223 VND/USD (buying – selling), a slight increase of 3 VND in both directions compared to the previous week.

– 13:48 17/06/2025

The Greenback’s Slippery Slope

The U.S. dollar remained on a downward trajectory in the week of June 9–13, 2025, despite a brief recovery following Israel’s strike on Iran.

“Trade War Truce: Markets Await Outcome of Crucial Tariff Talks”

The Vietnamese Dong has demonstrated a remarkable resilience over the past month, bucking the trend of depreciation seen among many Asian currencies. Contrary to the performance of its regional peers, the Vietnamese currency maintained its stability. Should the ongoing trade, geopolitical, and monetary negotiations yield positive results, the pressure on exchange rates will ease, providing the State Bank of Vietnam with the necessary flexibility to sustain this stability in the long term.