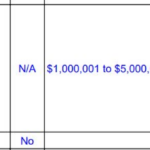

According to the Tax Department (Ministry of Finance), Decree 70/2023/ND-CP mandates the use of electronic invoices generated from cash registers only for households and individuals engaging in tax-contracted business with an annual revenue of VND 1 billion or higher in specific sectors. These sectors include retail, restaurants, hotels, supermarkets, transportation, entertainment, and others, involving direct transactions with consumers.

Out of the total number of over 3.6 million business households in Vietnam, only 37,576 fall under the mandatory implementation, accounting for approximately 1%. However, observations in Ho Chi Minh City during May 2025 revealed that while 3,763 households ceased operations, merely 440 of them were actually subject to the mandatory requirement as per the regulation.

The Tax Department emphasized that the regulation regarding electronic invoices generated from cash registers exclusively targets business households with an annual revenue of VND 1 billion or more in specific industries. Nevertheless, due to incomplete information or misinterpretation, a sense of confusion has spread among the business community.

“In reality, numerous small-scale business households, even those not subject to the regulation, have opted to temporarily halt their operations due to concerns or misunderstandings that all are required to implement cash register technology, which entails altering procedures, incurring additional investment costs, and undergoing stringent supervision,” the Tax Department stated.

For households with an annual revenue below VND 1 billion, this regulation does not impose any impact. The tax authorities clarified that the adoption of electronic invoices with data transmission to the tax authorities does not alter the existing tax policies for households and individuals engaging in business. The sole change pertains to the basis for determining actual revenue, thereby enabling tax authorities to set tax amounts more accurately for households with annual revenues of VND 1 billion or higher.

Apart from misunderstandings, the tax authorities also acknowledged that many households decided to cease operations due to apprehensions about inspections, especially with the intensified crackdown on smuggling, counterfeit goods, and trade fraud as directed by the Prime Minister.

Previously, in areas like Saigon Square, numerous shops had shut down and cleared their inventories. In response, local tax offices dispatched letters to business households, assuring them that there was no policy to increase taxes or create obstacles and emphasizing that the implementation of electronic invoices is a necessary step toward ensuring a transparent and equitable business environment.

Suzuki: A Century-Long Journey of Upholding Genuine Values for Vietnamese Consumers

Often misunderstood as “old-fashioned”, Suzuki is, in fact, a thriving automotive brand in its home country of Japan, and has garnered a loyal customer base in Vietnam. The brand’s unwavering commitment to its philosophy of manufacturing compact, durable, and fuel-efficient vehicles has been the key to its century-long success and unique appeal.

Trump Golf: A Hole-in-One for Kinh Bac with a $5 Million Brand Fee

The Trump Organization and KBC have announced a joint venture to develop a mega project in Hung Yen, Vietnam. The project, valued at approximately USD 1.5 billion, was conceived before Mr. Trump’s presidential victory and includes plans for a hotel, golf course, and residential area.

The Journey of “One Step Further, A Million Miles” with SNP Run As One 2025

Following the tremendous success of the previous two seasons, the Saigon New Port Corporation (SNP) is thrilled to announce the return of the SNP Run As One for its third edition with the theme, “One Step Connects, Thousands Advance.” The event will take place on June 8 at the Sala Urban Area in Thu Duc City, Ho Chi Minh City, bringing together nearly 2,000 athletes and participants.