|

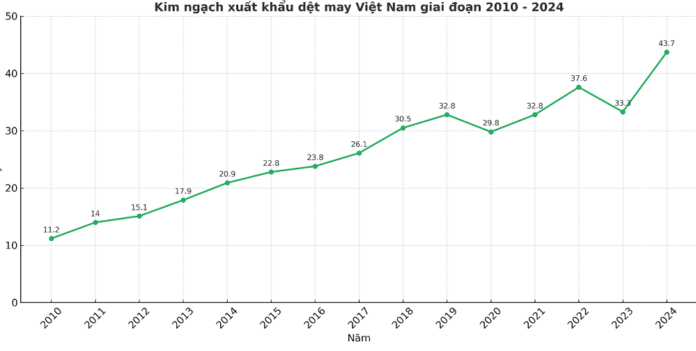

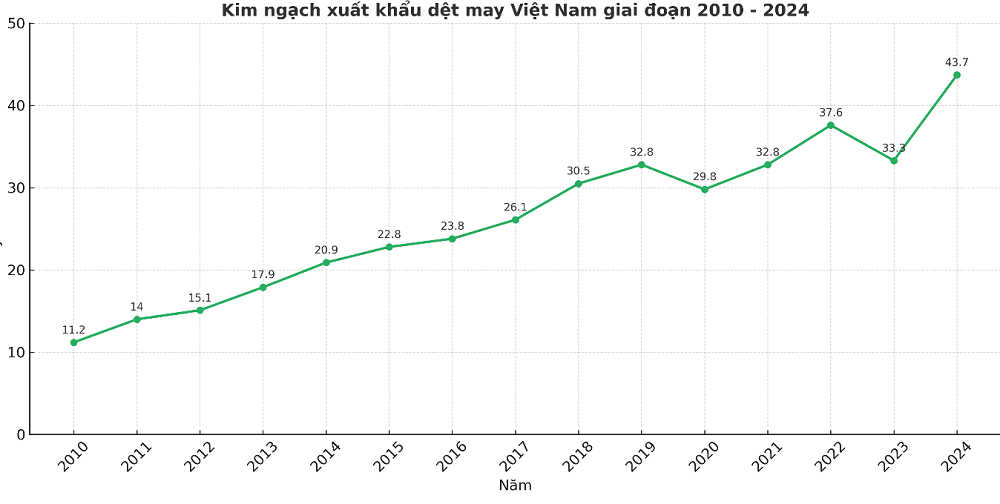

Billions of VND

Source: General Department of Vietnam Customs

|

However, alongside economic successes come enormous environmental costs. Vietnam has committed to achieving carbon neutrality by 2050 and reducing greenhouse gas emissions by at least 8% by 2030[1]. The transition of the textile industry to a circular economic model is no longer a choice but a mandatory requirement to maintain competitiveness and sustainable development.

The Big Picture of Vietnam’s Textile Industry

Vietnam’s textile industry currently plays a crucial role in the national economy, with approximately 7,000 enterprises employing 10 or more people and a total of about 3.4 million workers.

This robust development comes with alarming environmental impacts. According to the Vietnam Textile and Apparel Association (VITAS), the country’s textile industry emits around 5 million tons of CO2 annually. This places Vietnam among the top emitters from the textile sector, especially considering its production scale. Wet processing procedures for textiles (yarn, fabric, and garments) consume substantial water resources for washing, rinsing, pre-treatment, dyeing, and post-treatment[2].

Research by Assoc. Prof. Dr. Nguyen Dinh Tho (Director of the Institute of Strategy, Policy on Natural Resources and Environment) and Le Thi Lan (Ministry of Natural Resources and Environment) reveals that the global textile industry consumes approximately 93 billion cubic meters of water yearly, sufficient to provide domestic water for 5 million people. The water consumption of the textile industry accounts for nearly 4% of total global freshwater extraction, indicating the sector’s massive water resource usage[3]. With clean water becoming increasingly scarce, reducing water usage in textile manufacturing is both a significant challenge and an urgent necessity for sustainable development and global environmental protection.

According to a report on pre-consumer textile waste recycling in Vietnam conducted by the German International Cooperation Organization (GIZ), the country’s textile industry generates about 250,000 tons of waste annually before reaching consumers, excluding waste from footwear and domestic production. Currently, around 60% of this waste is sorted, pre-treated, and then recycled through basic mechanical and thermo-mechanical processes. Most of it is recycled into lower-quality products (known as downcycling). The remaining 40% of the waste is sent to waste-to-energy plants or undergoes other treatment methods[4].

Recognizing the importance of this issue, Vietnam’s textile industry has set targets to reduce energy consumption by 15% and water consumption by 20%. This aligns with the Law on Environmental Protection, which came into force at the beginning of 2022, imposing stringent inspections on energy-intensive factories. Simultaneously, brands have started requiring their manufacturing partners to adhere to environmental, social, and corporate governance (ESG) standards[5].

The Vietnamese government has issued Decision 1643/QD-TTg dated December 29, 2023, approving the Strategy for the Development of the Textile, Garment, and Footwear Industry of Vietnam until 2030, with a vision towards 2035[6]. According to this strategy, the industry will achieve efficient and sustainable development by adopting a circular economic model, completing the domestic production value chain, effectively participating in the global value chain, and developing several regional and global brands by 2035.

Circular Economy in the Textile Industry

The circular economic model represents a shift from the traditional “extract-produce-consume-dispose” economy to one that emphasizes reusing, recycling, and recovering materials within the production and consumption cycle. This approach extends the lifespan of products and resources.

According to the Ellen MacArthur Foundation, a circular economy for textiles offers a sustainable and regenerative approach to minimizing waste and environmental impacts. It emphasizes designing, producing, and using textiles to promote durability, reusability, recyclability, and responsible disposal[7].

Transitioning towards circular textile business models could generate 700 billion USD in economic value by 2030 globally, while a 1% increase in the market share of circular business models can reduce 13 million tons of CO2 equivalents[8]. This presents an opportunity for Vietnam to mitigate environmental impacts and enhance competitiveness by creating added value for the industry.

The circular economy model in the textile industry is being strongly promoted worldwide, especially in Vietnam’s major import markets. The European Union (EU) adopted the Strategy for Sustainable and Circular Textiles in March 2022, transforming the way textiles are produced and consumed[9]. The EU strategy focuses on three main pillars: transforming consumption patterns, improving production practices, and investing in infrastructure[10].

The EU has introduced Extended Producer Responsibility (EPR) regulations for textiles, which will be applied from 2025[11]. This means that producers will be responsible for collecting and treating products once consumers are finished using them.

Experiences from Bangladesh’s “Partnership for Cleaner Textiles” program, led by the IFC, have helped over 450 textile factories reduce freshwater consumption by 35 billion liters and cut down on 29 billion liters of wastewater discharged into the environment annually. The program also saves 3.8 million megawatt-hours of energy each year and reduces 723,617 tons of carbon emissions annually, equivalent to removing nearly 160,000 cars from the roads yearly[12].

In Vietnam, the Vietnam Improvement Program (VIP) of the IFC has supported 82 textile, garment, and footwear factories in investing 37 million USD in resource efficiency measures. These factories have collectively saved 30 million USD in annual operating costs for water, chemicals, and energy. Additionally, they have saved 4 million cubic meters of water and reduced 303,000 tons of greenhouse gas emissions annually[13].

Pressure to Enhance Recycling and Reduce Emissions to Meet International Standards

Vietnam faces a significant gap compared to international standards for the circular economy in the textile industry. Currently, only about 60% of textile waste is recycled, mainly through basic mechanical recycling, resulting in lower-quality products.

Vietnam’s textile recycling system comprises over 200 waste facilities, including collectors, aggregators, pre-processors, and recyclers. However, this network is highly fragmented and lacks transparency, complicating waste traceability and auditing processes. Many waste treatment facilities frequently face compliance issues, with notable concerns regarding occupational health and safety[14].

For the EU, most Vietnamese manufacturers in the textile supply chain are receiving green requirements from major brands, including social and environmental responsibility and carbon emissions reduction. In early April 2022, the European Commission (EC) mandated that clothing in the EU must be durable, reusable, and repairable. To meet this standard, manufacturers must use recycled fibers, avoid toxic chemicals, and adopt environmentally friendly practices. Additionally, when textiles can no longer be used, producers are responsible for collecting and recycling them, minimizing incineration and landfilling. All information related to the sustainability of the products must be transparently provided to consumers through a digital product passport (DPP)[15].

Opportunities and Challenges in Mitigating Environmental Impacts

Close collaboration between domestic enterprises and international organizations, such as the Sustainable Trade Initiative (IDH), has created essential prerequisites for applying and scaling up sustainable production models, promoting eco-labeling and certification for textile and footwear products. This enhances brand reputation and meets the increasingly stringent requirements of the global market[16].

Additionally, there is a growing trend towards using environmentally friendly raw materials. For instance, the consumption of shuttle-woven silk fabric increased by nine times in the fourth quarter of 2023 compared to the same period in 2022, reflecting a strong interest and investment in sustainable materials[17]. Projects like “Greening the Textile Sector” by WWF Vietnam, in collaboration with VITAS and financial support from HSBC, the Swiss Agency for Development and Cooperation, and Tommy Hilfiger, contribute to improving water and energy resource management and enhancing Mekong River basin management—one of Vietnam’s critical resources[18].

Despite these opportunities, Vietnam’s textile industry still faces challenges in transitioning to a circular economic model and reducing environmental impacts. Firstly, the textile production process is complex, involving multiple stages and diverse chemicals to create colors and product features, leading to the potential generation of various hazardous wastes.

Chemicals used in dyeing and fabric treatment, such as azo dyes, softeners, deodorizers, and compounds containing heavy metals, can pollute water and soil if not properly treated. Additionally, volatile organic compounds (VOCs) emitted during production negatively impact workers’ health and the environment.

Particularly, industrial wastewater containing pollutants can cause eutrophication and degrade aquatic ecosystems if not adequately treated, affecting ecological balance and fisheries resources. Furthermore, the lack of synchronization and fragmentation in Vietnam’s textile waste recycling system, along with compliance and occupational safety issues, pose challenges in effectively and sustainably implementing sustainable solutions.

[1] https://betterwork.org/greening-viet-nams-textile-and-garment-sector-a-high-stakes-challenge/

[2] https://vov2.vov.vn/en/society/5-million-tons-of-co2-emitted-annually-and-environmental-challenges-in-the-textile-and-garment-industry-51155

[3] https://vneconomy.vn/english-news/xanh-hoa-nganh-det-may-co-hoi-doanh-nghiep-nang-cao-canh-tranh-xuat-khau-11463-354396.html

[4] https://www.giz.de/en/downloads/giz2025-en-ecosystem-mapping.pdf

[5] https://betterwork.org/greening-viet-nams-textile-and-garment-sector-a-high-stakes-challenge/

[6] https://datafiles.chinhphu.vn/cpp/files/vbpq/2022/12/1643ttg.signed.pdf

[7] https://www.ellenmacarthurfoundation.org/articles/what-is-a-circular-economy-for-fashion

[8] https://circulareconomy.europa.eu/sites/default/files/2023-12/fullreport_unep_sustainability_and_circularity_textile_value_chain_global_roadmap_en.pdf

[9] https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52022DC0182

[10] https://www.unep.org/resources/publication/sustainability-and-circularity-textile-value-chain-global-roadmap

[11] https://cebid.vn/en/news/nganh-det-may-no-luc-giam-phat-thai/

[12] https://www.apparelviews.com/ifc-led-pact-programme-drives-sustainable-transformation-in-bangladesh-textile-industry/

[13] https://www.ifc.org/en/news/ifc-helps-apparel-and-textile-suppliers-vietnam-save-30-million-year-through-resource-efficiency-measures

[14] https://www.giz.de/en/downloads/giz2025-en-ecosystem-mapping.pdf

[15] https://www.hkbav.org/en/news/greening-textile-and-garment-for-sustainable-development_news21850

[16] https://vov2.vov.vn/en/society/5-million-tons-of-co2-emitted-annually-and-environmental-challenges-in-the-textile-and-garment-industry-51155

[17] https://viracresearch.com/en/news/vietnam-textile-industry-statistics-2023

[18] https://vietnam.panda.org/en/what_we_do/projects_thingstodo/guidelines_for_greening_the_textile_sector_in_viet_nam

– 13:12 17/06/2025

Unlocking Legal Hurdles: Ho Chi Minh City Fast-Tracks Sunshine Group’s Twin High-Rise Projects

The Ho Chi Minh City real estate market is showing clear signs of recovery, with key projects being unblocked, notably the two luxury apartment complexes by Sunshine Group in South Saigon. This marks a significant shift in governance thinking, supporting businesses in their development and contributing to state revenues.

Mitsubishi Xforce Base Model Makes a Comeback with a Bang: A $45 Million Incentive to Rival the Yaris Cross

This June, Mitsubishi continues to thrive with steady sales, as evidenced by the Xpander securing a spot in the top 10 best-selling vehicles. The brand maintains its attractive promotions across its range of familiar models, including the Xforce. This particular model has historically faced challenges in competing with rivals due to the limited availability of its most accessible and affordable variant.