Loc Troi Group Joint Stock Company (code: LTG, UPCoM) plans to hold its 2025 Annual General Meeting of Shareholders in the afternoon of July 14th at the Loc Troi Agricultural Research Institute in Hoa Tan hamlet, Dinh Thanh commune, Thoai Son district, An Giang province.

According to the documents prepared for the meeting, notably, Loc Troi sets its 2025 business plan with net sales revenue and service provision reaching VND 4,200 billion, the lowest in over a decade, and an accounting loss before tax, interest, and depreciation of VND 524 billion.

Illustrative image

In its report on the situation in 2024, Loc Troi’s Board of Directors assessed that 2024 was an exceptionally challenging year. The Group faced operating cost pressures, low-profit margins, and financial difficulties, making it challenging for the grain industry to implement material regions with farmers and limiting exports.

Financially, Loc Troi is facing potential payment constraints on its obligations, including to banks, suppliers, employees, and state financial obligations.

As of now, Loc Troi has not yet published its semi-annual and 2024 audited financial statements. The LTG Board of Directors stated that the company’s auditor, Ernst & Young Vietnam Co., Ltd. (EY Vietnam), is analyzing and performing additional audit procedures to conclude on the company’s ability to continue as a going concern.

Another notable item is Loc Troi presenting to shareholders the cancellation of the 2023 dividend payment plan. Previously, the 2024 Annual General Meeting of Shareholders approved the 2023 dividend payment plan with a rate of 30% from the after-tax profit not yet distributed in the 2023 audited financial statements.

However, Loc Troi stated that due to the company’s challenging production and business situation in the first half of the year, it no longer has sufficient resources to pay dividends as planned.

On the other hand, the company also has outstanding payments to the state, including taxes and social insurance, and debts to suppliers, partners, and bank loans. Therefore, the LTG Board of Directors presents to the meeting the approval of the cancellation of the 2023 dividend payment plan.

Regarding personnel, the meeting will dismiss Mr. Johan, Sven Richard Boden from the Board of Directors for the 2024-2029 term according to his resignation letter dated August 23, 2024. Conversely, the meeting will elect one additional member to replace him.

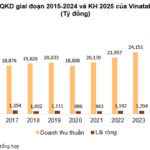

A Transformational Tobacco Company: Vinataba’s Highest Profit in Seven Years Amid Concerns of a 50% Production Loss Due to the New Special Consumption Tax Law.

The Vietnam National Tobacco Corporation, Vinataba, reported a net profit of 1,262 billion VND in 2024, averaging nearly 3.5 billion VND per day. While the industry boasts impressive profits, consumers are facing risks from products associated with numerous social illnesses. Additionally, a new tax policy could potentially turn the tables from 2027 onwards.

Insider Trading: Thuduc House Insiders Successfully Accumulate Over 1.5 Million TDH Shares

“Ms. Le Ngoc Xuan, the esteemed Company Administrator and Authorized Information Disclosure Representative, as well as the Secretary of the Board of Management of Thuduc House, has successfully purchased over 1.5 million TDH shares.”

“Iconic 68-Year-Old Vietnamese Company Faces Doubts: Can the Former ‘People’s Brand’ Survive?”

The financial report revealed a staggering after-tax loss of nearly 13 billion VND, a figure that is 2.6 times higher than the loss incurred in 2023.