The majority of projects launched in Ho Chi Minh City in recent years have been in the luxury segment, with only a handful of mid-range developments remaining. This presents a significant challenge for buyers with realistic needs and moderate budgets.

In this context, completed projects hold a particular appeal. Some of the reasons for this include the ability to physically verify the existence and quality of the development, allowing buyers to directly inspect the apartments, evaluate the construction quality, design, and surrounding amenities. This reduces risks associated with buying off-plan properties, where purchasers rely on artist impressions and developer promises.

Buyers can take immediate occupation or rent out the property, saving on payments to the developer. This is considered the biggest advantage for those needing to move in immediately and wanting to quickly stabilize their lives. Additionally, completed projects allow for an assessment of the existing resident community, the surrounding living environment, and the quality of property management. These projects typically have the necessary legal paperwork, providing buyers with greater peace of mind regarding ownership rights.

However, the prices of completed condominiums are usually higher compared to off-plan projects; there may be less choice in terms of location and unit size. Moreover, the initial payment required is typically higher, and there tend to be fewer discounts or price incentives available.

Depending on their needs, priorities, and financial situation, buyers can consider these factors to make an informed decision.

In the West of Ho Chi Minh City, the Conic Boulevard project in Binh Chanh district offers units at approximately VND 37 million per square meter. Buyers only need to pay 25% of the contract value to take immediate occupation. The remaining balance can be paid over 36 months or financed through Viet A Bank.

In the East, the MT Eastmark City project is located on the frontage of Ho Chi Minh City’s Ring Road 3. Prices have increased slightly over the past three years, now sitting at around VND 45-46 million per square meter. The developer still has a primary inventory available.

In the South, the Ascent Lakeside project in District 7 offers units from VND 49 million per square meter, while surrounding projects range from VND 60 million per square meter. Buyers only need to pay 50% of the apartment value to move in immediately, with the remaining balance payable over three years. Unlike most other projects that require shorter payment terms, Ascent Lakeside offers a more extended payment schedule for the remaining balance, equivalent to 1.25% per month. Additionally, an 8% discount is offered on the standard payment method of 95% within approximately 90 days.

Ascent Lakeside: The project features approximately 184 units, providing quick connections to District 1, Phu My Hung urban area, and various commercial centers, hospitals, and schools. Amenities include a swimming pool, rooftop pickleball court, gym, children’s play area, and BBQ area…

|

Also in District 7, the Lavida Plus project at the intersection of Nguyen Van Linh and Nguyen Huu Tho streets has a remaining inventory from its final sale phase, with prices nearing VND 60 million per square meter. Buyers need to pay 50% of the apartment value to sign the purchase agreement. The remaining balance must be settled within 37 days to obtain the Certificate of Ownership.

According to Savills, in the first quarter of 2025, the total supply of apartments in Ho Chi Minh City was approximately 5,000 units, a 24% decrease from the previous quarter but a slight 2% increase from the same period last year. All new launches during the quarter belonged to the B and C segments. The segment of homes priced below VND 50 million per square meter remains scarce, accounting for only 13% of the new supply.

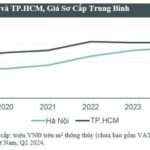

CBRE also noted that projects launched in the first quarter of this year were priced from VND 60 million per square meter, with some even reaching VND 290-500 million per square meter. As a result, the average apartment price in Ho Chi Minh City reached VND 77 million per square meter. With limited supply, prices continued to rise, and absorption slowed, reaching 60% of new supply (compared to 80% in the same period last year for projects priced between VND 55-80 million per square meter)

It is forecasted that by the end of 2025, the supply will reach nearly 7,000 units, with 90% coming from the next phases of seven existing projects and four new projects.

Ho Chi Minh City’s condominium market is undergoing a transformation. The scarcity of affordable options and the trend towards luxury developments are reshaping the supply landscape. Completed condominiums are an attractive choice for buyers, especially those seeking security and stability. The ability to physically inspect the property and move in immediately are significant advantages. However, buyers need to be prepared for higher costs and consider carefully the available designs to align with their living and working needs.

– 07:21 19/06/2025

“Final Touches: Racing to Perfect 38 Project Dossiers Ahead of District-Level Discontinuation”

“Amidst the lush landscapes of Bao Loc City, a tale of 38 unfinished projects unfolds. These ventures, now years in the making, have encountered obstacles that hinder their completion. Like dormant seeds awaiting the right conditions to sprout, these endeavors yearn for resolution and a chance to flourish.”

The New Reality: Unveiling the Current State of Hanoi’s Condo Prices Post-Peak

The primary focus of this paragraph is to highlight the significant shift in the pricing landscape of the Hanoi property market, specifically concerning off-plan apartments. The first half of the year witnessed a paradigm shift, with numerous new developments launching at notably higher price points compared to previous levels. This trend has undoubtedly set a new benchmark for the industry.

Revolutionizing the Real Estate Game: Unveiling the Latest Trends and Insights Effective August 1st

The 2023 Real Estate Business Law, which comes into effect on August 1, 2024, introduces several significant changes to the real estate industry. One of the key highlights of this law is the requirement for all real estate transactions to be made via bank transfer. This adds a layer of transparency and security to the process, ensuring that all payments are properly documented and traceable. Additionally, the law mandates that the purchase price stated in the contract must accurately reflect the actual transaction value, promoting honesty and integrity in the industry. Another notable change is the restriction on the maximum amount that can be paid for an off-plan property, which is now limited to 50% of the total value.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)