Gold Price Fluctuations: Geopolitical Tensions and Fed’s Decision

Gold prices are experiencing fluctuations, currently trading at $3,393.05 per ounce, up 0.3% in today’s session (June 17th). Earlier in the day, spot gold fell 1.2% to $3,392.86 per ounce after hitting its highest since April 22nd.

Gold futures in the US also fell 1% to $3,417.30. David Meger, director of metal trading at High Ridge Futures, commented: “Keep in mind that gold has rallied higher in the past few sessions, largely due to the Israel-Iran conflict. Today, we’re seeing some profit-taking off those highs.”

Tensions in the Middle East remain a key focus for the market. Iran called on US President Donald Trump to push Israel to cease fire as the only way to end the four-day-long air war, while Israeli Prime Minister Benjamin Netanyahu declared his country was on a “path to victory”. Meanwhile, leaders of the Group of Seven (G7) nations began their annual talks in Canada.

Aside from geopolitical concerns, investors are focused on the two-day policy meeting of the US Federal Reserve, which is expected to conclude on Wednesday. The central bank is widely expected to keep interest rates on hold.

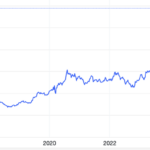

Gold prices are on an upward trend.

Meger stated: “At this point, it looks like the Fed is leaning towards keeping rates on hold, given the significant uncertainty in the economy, from tariffs to geopolitical tensions. So, it wouldn’t be surprising to see the Fed delay any rate cuts.”

Bullion has long been considered a safe-haven asset during times of geopolitical turmoil and rising inflation. Gold also benefits from a low-interest-rate environment as it bears no yield.

Spot silver was steady at $36.33 per ounce. Platinum rose 2% to $1,252.57, and palladium gained 0.8% to $1,036.10.

Commodities and Stock Market Volatility

In the commodities sector, prolonged uncertainty in the Middle East and oil supply disruptions pushed prices higher. Brent crude futures rose 0.34% to $73.47 a barrel. West Texas Intermediate crude increased by 0.43% to $72.09.

On Tuesday, US stock futures fell while oil prices surged as investors worried about the potential escalation of conflict in the Middle East. President Trump called for people to evacuate Tehran as the Israel-Iran clash entered its fifth day, raising fears of a wider regional conflict.

Markets were on edge after separate reports suggested that Trump had asked for a plan for a potential military response and had cut short his stay at the G7 summit in Canada. These developments triggered a risk-averse sentiment in Asian markets, with S&P 500 futures falling 0.46% and European futures dropping 0.69%, while oil prices surged over 2% in a short span.

Stock market volatility continues.

Tony Sycamore, market analyst at IG, commented: “We suspect the US is about to start some sort of military action in Iran, and that risk-averse sentiment is bringing another element of uncertainty to the market.”

The US dollar strengthened against the euro, yen, and pound sterling, reinforcing its safe-haven status even as the dollar remained within a narrower range. The broadest MSCI index of Asia-Pacific shares outside Japan was higher, while Hong Kong’s Hang Seng index futures rose slightly.

Aside from geopolitical issues, central bank interest rate decisions are a key focus for investors this week.

The Bank of Japan’s (BOJ) ruling is expected to be announced later in the day. The BOJ is expected to keep short-term interest rates at -0.1% but markets will be watching for clues on quantitative tightening. Japan’s Nikkei rose slightly by 0.5%, while the yen weakened slightly to 144.96 yen per dollar.

Investors anticipate that the BOJ will consider slowing its bond purchases next year as the central bank focuses on avoiding major market disruptions and tries to lessen the impact of its decade-long massive stimulus program.

This week features meetings of multiple global central banks. Investors are paying close attention to officials’ comments as they navigate Trump’s unpredictable tariff policies and their impact on the global economy.

The Fed is expected to keep rates unchanged on Wednesday, but the focus once again is on the path that Chairman Jerome Powell lays out for future rate cuts. Traders have priced in two cuts by year-end.

“Global Markets: Oil and Gold Prices Dip Over 1%”

The commodities market witnessed a mixed bag of results on June 16th. Oil and gold prices dipped by over 1%, while copper and iron ore prices rose, buoyed by positive data from China.

A Proposal for Regional Minimum Wage Increase from July

The representative cited that since 2023, electricity prices have surged four times, amounting to a 17% increase, while the minimum wage for workers has only been adjusted once, with a mere 6% increment. The proposal urges an immediate review and adjustment of the regional minimum wage, effective from July onwards. This is deemed a pressing necessity to address the practical needs of the working population.

What Factors Will Influence Gold Prices This Week?

“With escalating tensions in the Middle East and the impending interest rate decisions of four major central banks, this week could see a significant impact on gold prices. “