The Mechanical, Electrical, and Plumbing (MEP) segment witnessed robust growth in 2024.

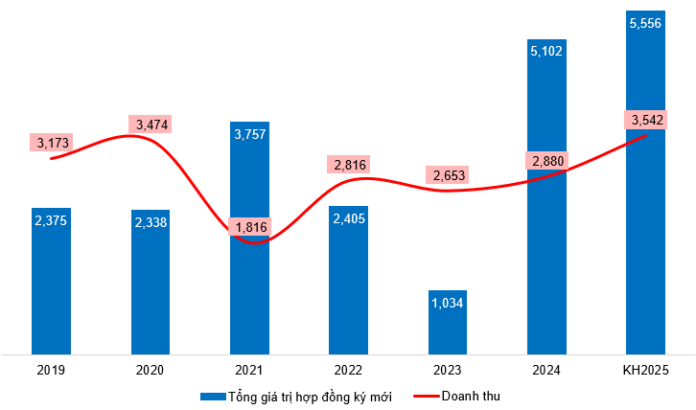

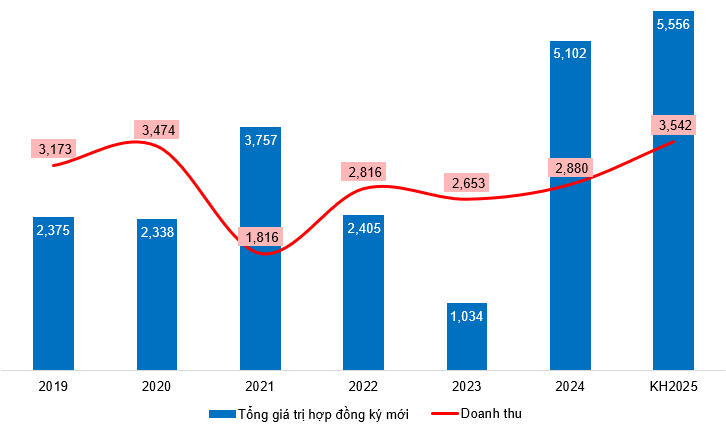

REE’s MEP segment achieved impressive results, with new contract values totaling VND 5,102 billion, surpassing the annual plan by 28% and reflecting a nearly fivefold increase compared to the previous year. This success is largely attributed to winning bids for several large-scale projects, most notably the Long Thanh International Airport project, with a contract value of up to VND 2,534 billion, expected to be operational by late 2026.

As of the end of 2024, the total value of contracts carried over to 2025 stood at VND 5,556 billion, providing a solid foundation for the company to accomplish its revenue and profit plans for the upcoming year.

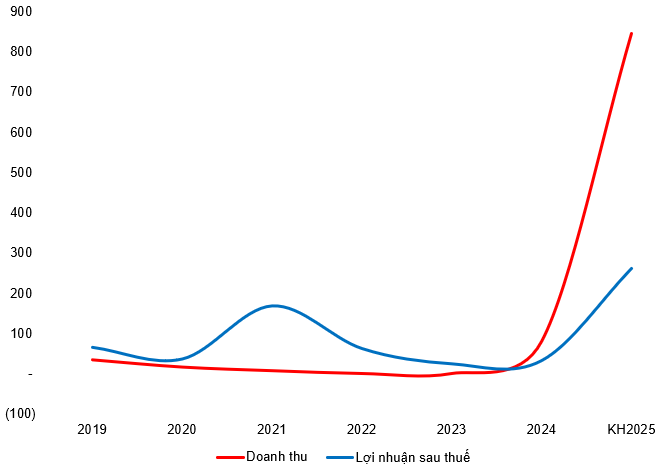

New contract values and revenue of the MEP segment for 2019-2025

(Unit: Billion VND)

Source: REE Annual Report

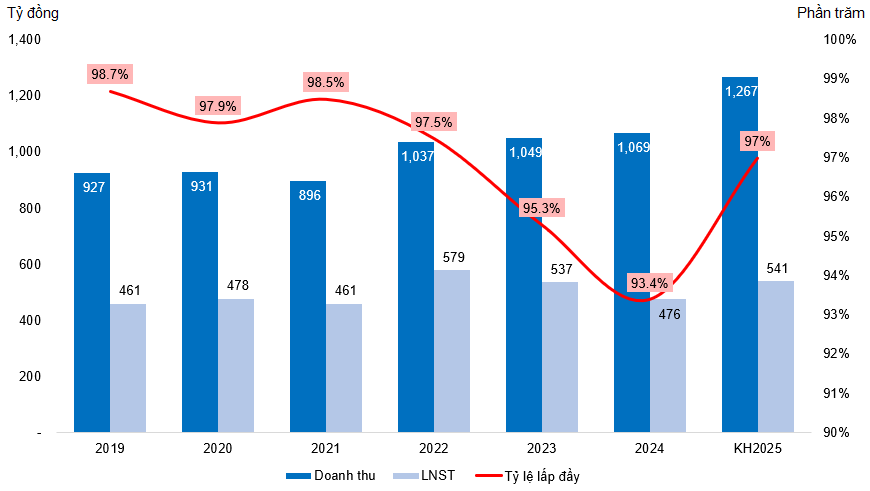

The office real estate segment witnessed stable development.

REE’s first LEED Platinum-certified Class A office building, E.town 6, commenced operations in July 2024, offering 37,000 sq. m. of leasable area out of a total floor area of 182,000 sq. m. From this point on, the company recognized full depreciation expenses. However, due to low occupancy rates, the revenue could not offset interest expenses and depreciation, resulting in an 11.3% decline in net profit for the office leasing segment compared to 2023.

Amid competition and the trend of remote work, REE aims to achieve a 97% occupancy rate in 2025 by adopting flexible leasing policies and slightly increasing rental rates to enhance financial performance.

Financial performance of the Office Leasing segment for 2019-2025

Source: REE Annual Report

The real estate development segment is expected to witness a breakthrough.

Vietnam’s real estate market witnessed a strong recovery in Q1 2025, with a 33% increase in supply compared to the previous year (approximately 27,000 units, including 14,500 new units), thanks to relaxed legal policies, improved infrastructure, and low-interest rates. Absorption rates reached 45-60%, despite high selling prices in Hanoi and Ho Chi Minh City, averaging VND 70-72 million/sq. m. This presents a significant potential boost to GDP if legal barriers are further eased.

The real estate development segment is poised for a breakthrough as The Light Square project commences deliveries, with REE expected to recognize a significant jump in revenue and profit in 2025, amounting to VND 846 billion in revenue and VND 262 billion in profit, signifying a clear shift from the recovery phase to an acceleration phase for REE’s real estate business.

Financial performance of the Real Estate Development segment for 2019-2025

Source: REE Annual Report

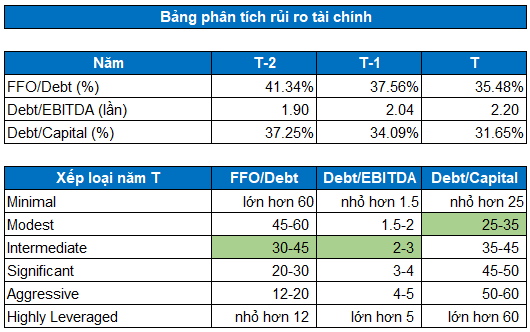

Financial Risks

Based on REE’s financial risk analysis using Standard & Poor’s methodology, the FFO/Debt and Debt/EBITDA ratios fall within the ‘Intermediate’ range, indicating acceptable debt repayment ability and capital structure. The Debt/Capital ratio is close to the ‘Modest’ threshold, reflecting a reasonable debt proportion. Therefore, long-term investors may consider purchasing REE shares.

Source: VietstockFinance

REE Stock Valuation

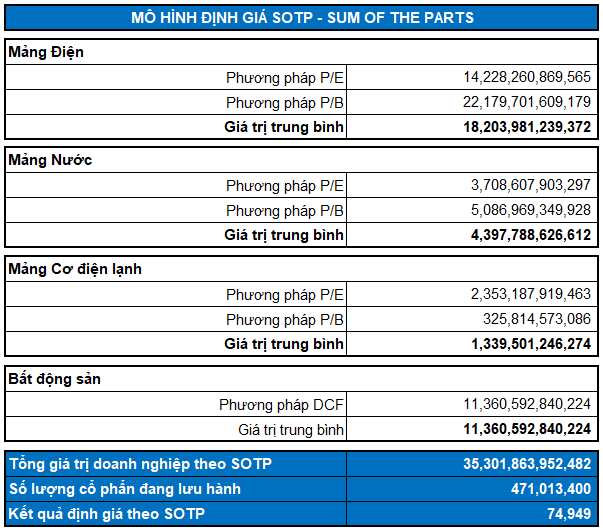

Domestic peers in the same industry are used as a basis for determining the fair value of each business segment (electricity, water, MEP, and real estate).

The Sum of The Parts (SOTP) valuation method is employed, resulting in a valuation of VND 74,949 per share. The current market price of REE shares presents an attractive opportunity for long-term investment goals.

Enterprise Analysis Department, Vietstock Consulting

The Ultimate Guide to Land Investment in the South: Unveiling the Second Half of the Year’s Opportunities

“With 2025 upon us, it’s clear that land investment is not a get-rich-quick scheme. Rather, it’s a long-term game, a marathon, not a sprint. This shift in perspective is key to understanding the evolving landscape of real estate investment.”

What Keeps the Real Estate Market Hot Post-Merger?

The Vietnam Real Estate Brokerage Association’s (VREBA) June 2025 report on the real estate market paints an optimistic picture of recovery for Ho Chi Minh City and its surrounding provinces. The market is witnessing a transformative phase, bouncing back with positive momentum after a period of stagnation.

BNP Global Fails to Redeem Over VND 1.2 Trillion in Bonds: A Troubling Turn of Events

Let me know if you would like me to make any changes or adjustments to the title. I can also provide suggestions for the body text if needed.

“In a recent disclosure dated June 5, 2025, BNP Global Real Estate JSC (BNPC) announced its inability to repay the BNPCH2123002 bond tranche, valued at VND 2,100 billion, by the due date of June 4, 2025.”