I. MARKET ANALYSIS OF JUNE 17, 2025

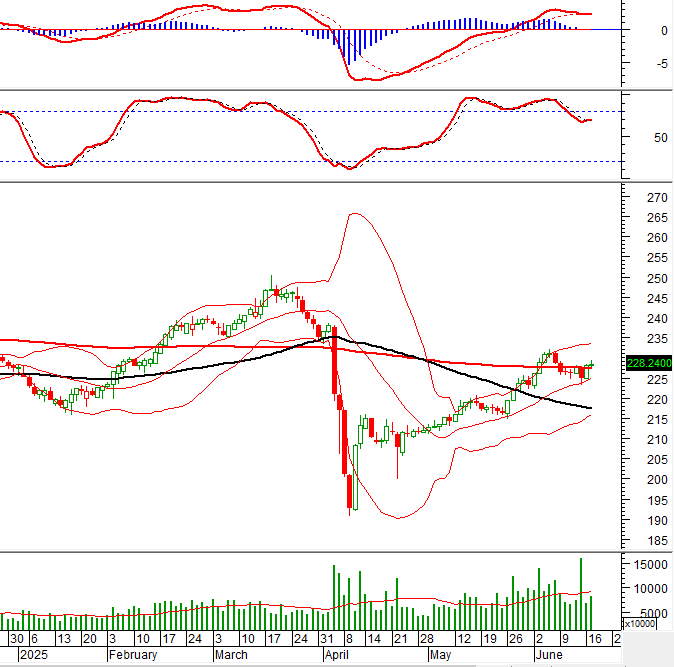

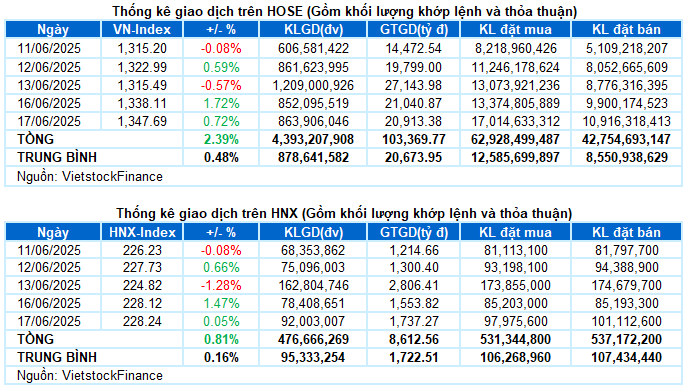

– Indices continued to rise during the trading session on June 17. The VN-Index increased by 0.72%, reaching 1,347.69 points; while the HNX-Index gained 0.05% to close at 228.24 points.

– Matching volume on the HOSE rose slightly by 1.4%, reaching nearly 864 million units. Meanwhile, the HNX recorded a volume of 92 million units, a 17.3% increase compared to the previous session.

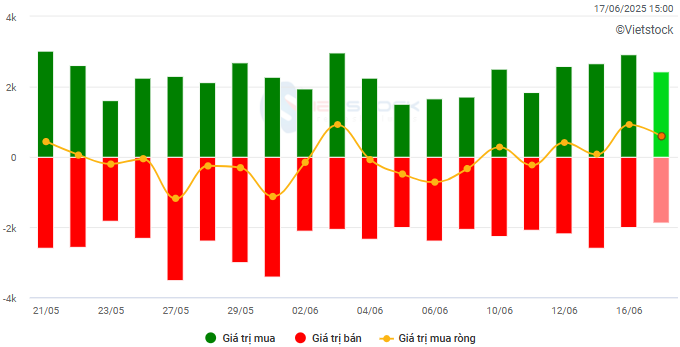

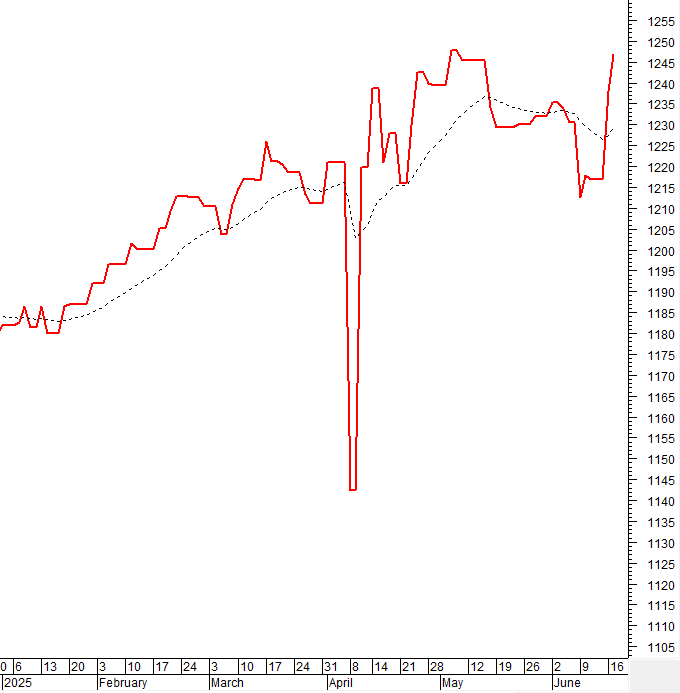

– Foreign investors net bought over VND 558 billion on the HOSE and VND 38 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: VND billion

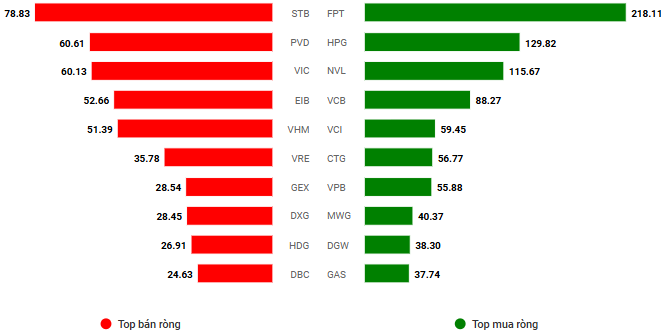

Net trading value by stock. Unit: VND billion

The market maintained its upward momentum on June 17, building on the positive sentiment from the previous session. Buyers dominated the market from the start, and the support of many large-cap stocks helped the VN-Index surpass the 1,350-point threshold after just over an hour of trading. However, profit-taking pressure increased as stocks approached their highs, causing the index to narrow its gains and enter a volatile period. The VN-Index even plummeted towards the reference price in the early afternoon session. Nonetheless, cash flow returned in time to help the index recover towards the end of the session. The VN-Index closed with a gain of 9.58 points, ending the day at 1,347.69 points.

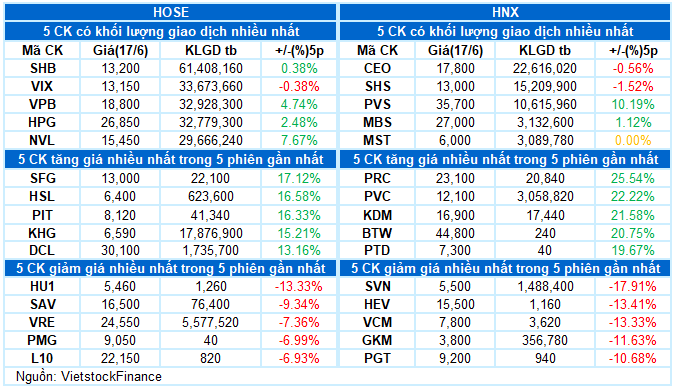

– In terms of impact, VHM and VIC made the most positive contributions, with each stock adding over 2 points to the index. They were followed by VCB and GVR, which contributed an additional 2 points to the overall index. On the other hand, PLX and BSR were the two stocks with the most negative influence, but they only took away half a point from the VN-Index.

– The VN30-Index closed 0.78% higher at 1,431.39 points. The market breadth was positive, with 19 gainers, 8 losers, and 3 unchanged stocks. VHM and GVR led the gains, rising over 3%. In contrast, PLX faced profit-taking after two consecutive strong gains, closing 3.1% lower. The remaining stocks in the red also witnessed mild losses of less than 0.5%.

Most sectors closed in positive territory. Real estate stocks rebounded to lead the market, surging more than 2%. This rally was mainly driven by VIC (+2.69%), VHM (+3.26%), KDH (+1.02%), NVL (+3.69%), NLG (+1.58%), PDR (+4.36%), and VCR, which hit the upper limit.

Additionally, the materials sector also recorded a gain of over 1%, with notable buying interest in GVR (+3.21%), DCM (+3.12%), DPM (+5.5%), DDV (+3.2%), BMP (+2.12%), HSG (+1.2%), NTP (+2.27%), and others.

On the other hand, energy stocks lagged, falling 2.43% as broad-based profit-taking weighed on the sector. Notable decliners included BSR (-2.56%), PVS (-2.99%), PVD (-2.52%), and PVB (-3.56%).

The VN-Index narrowed its gain and failed to completely surpass the previous peak formed in late May 2025 (corresponding to the 1,330-1,350-point range). Moreover, trading volume remained below the 20-day average, indicating that investors remained cautious. In the upcoming sessions, the index needs to break above this level to maintain its short-term uptrend. Currently, the MACD indicator continues to trend upward after generating a buy signal. If this status is maintained in the following sessions, the positive outlook will be supported.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Trading volume remains below the 20-day average

The VN-Index narrowed its gain and was unable to completely surpass the previous peak formed in late May 2025 (corresponding to the 1,330-1,350-point range). Additionally, trading volume remained below the 20-day average, indicating that investors remain cautious. In the upcoming sessions, the index needs to break above this level to maintain its short-term uptrend.

At present, the MACD indicator continues to trend upward after generating a buy signal. If this status is maintained in the following sessions, the positive outlook will be supported.

HNX-Index – Stochastic Oscillator indicates a buy signal

The HNX-Index formed a candle pattern resembling a High Wave Candle, and trading volume remained below the 20-day average, reflecting investor indecision.

Currently, the Stochastic Oscillator has generated a buy signal. The MACD indicator is also likely to produce a similar signal as the gap with the Signal Line narrows. If this is confirmed in the upcoming sessions, the short-term outlook will become more optimistic.

Analysis of Cash Flow

Changes in Smart Money Flow: The Negative Volume Index of the VN-Index crossed above the 20-day EMA. If this status continues in the next session, the risk of a sudden downturn (thrust down) will be limited.

Changes in Foreign Cash Flow: Foreign investors continued to net buy during the trading session on June 17, 2025. If foreign investors maintain this action in the coming sessions, the situation will become more optimistic.

III. MARKET STATISTICS FOR JUNE 17, 2025

Economic and Market Strategy Division, Vietstock Research

– 5:15 PM, June 17, 2025

Market Beat: Foreigners Resume Net Selling, VN-Index Hangs on at 1,345 Points

The market closed with the VN-Index down 0.86 points (-0.06%), settling at 1,346.83, while the HNX-Index dipped 0.04 points (-0.02%) to 228.2. The sell-side dominated with 381 declining tickers against 300 advancing ones. However, the VN30 basket painted a balanced picture with 15 gainers, 13 losers, and 2 flat liners.

Tomorrow’s Stock Market Outlook: Four Sectors to Watch

The stock market analysts predict an upward trend for the VN-Index, but investors should closely monitor the supply-demand dynamics at the resistance level to gauge the market’s true state.

The VN-Index Struggles at Former Peak, Selling Pressure Intensifies on the Green Zone

The Vietnamese stock market witnessed a robust upward momentum during the morning session, largely driven by the strong performance of the Vin group’s stocks. The VN-Index soared to a high of 1353.01 points, surpassing the peak reached earlier in June. However, this upward trajectory was short-lived as the index began to retreat…