The market continues to exhibit hesitancy as the VN-Index once again attempts to breach new highs without the necessary breakout. Today’s peak of 1353.99 marks the highest point the index has reached in its struggle to surpass the previous peak encountered earlier this month. The lack of increased trading volume indicates that investors are also not betting heavily on the success of this attempt.

Profit-taking sentiment even dominated today’s session. While the VN-Index reached its intraday high around 10:13 AM with a positive market breadth of 185 gainers and 81 losers, the situation reversed by the closing bell with 103 gainers and 182 losers. This suggests that sellers were largely in control, pushing prices down and causing a majority of stocks to close in negative territory.

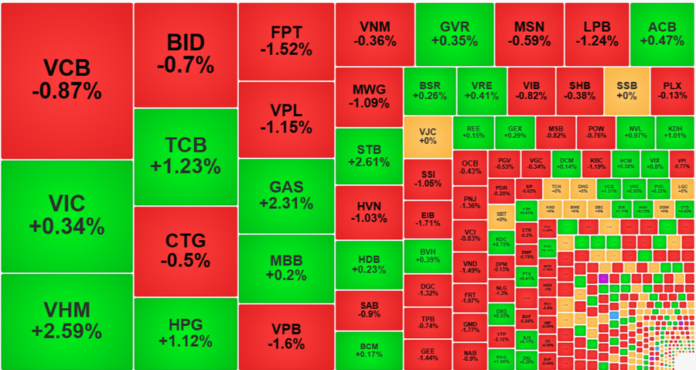

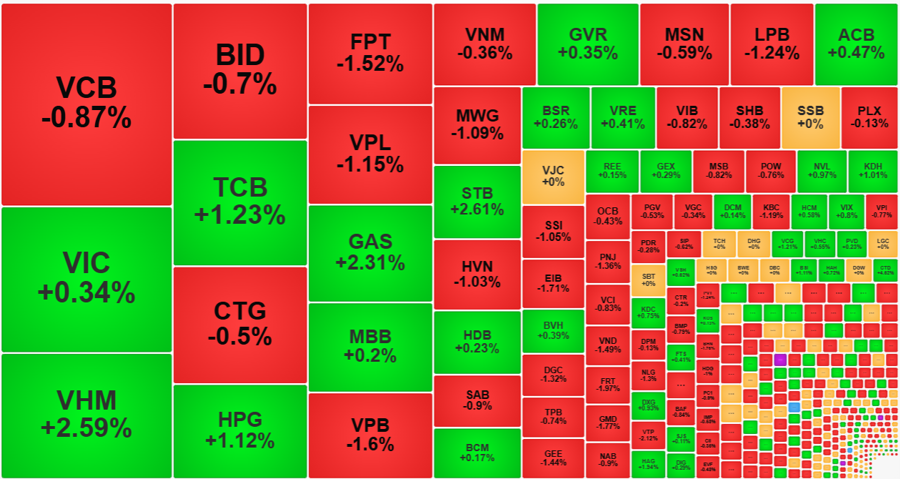

The VN-Index was supported by a handful of large-cap stocks. Notably, VHM rose by 2.59%, GAS gained 2.31%, TCB increased by 1.23%, HPG climbed 1.12%, and STB surged 2.61%. These five stocks alone contributed 4.2 points to the index, preventing a steeper decline as the index still closed 0.86 points lower. Among the top 10 largest caps on the VN-Index, VCB fell by 0.87%, BID lost 0.7%, CTG decreased by 0.5%, FPT dropped 1.52%, and VPL declined by 1.15%. The strength of the majority of declining stocks negated the impact of the large-cap gainers, demonstrating that large-cap stocks don’t always dictate the direction of the index.

Even the strongest stocks within the blue-chip group faced significant selling pressure, causing their prices to retreat. VHM was the only pillar stock that managed to close at its intraday high, while GAS fell by approximately 0.56% from its peak, TCB dropped by 1.65%, STB slipped by 1.26%, and VIC declined by 1.12%. Some stocks faced intense pressure, causing them to reverse their gains, such as MWG, which fell by 2.45% to close 1.09% lower than its reference price. PLX dropped by 2.99% but managed to limit its loss to 0.13%. VPB tumbled by 2.37% and closed 1.6% lower.

Extending our analysis to the entire HoSE floor, the selling pressure during the majority of today’s session resulted in a considerable widening of the downward range. Statistics show that 53% of stocks on the HoSE (excluding stocks without transactions) fell by at least 1% from their intraday highs. This aligns with the shift in market breadth at the close of the market. In other words, investors are still opting to take profits when the market approaches peak levels.

On a positive note, this pressure did not result in a widespread sharp decline. Out of the 182 losers on the VN-Index, only 76 stocks fell by more than 1%. While this group is small in number, they still accounted for 26.4% of the total matching order value on the HoSE due to their large trading volumes. Blue-chip stocks made up a significant portion of this group, including FPT, SSI, MWG, and VPB, which were among the top positions. Additionally, we can mention VIX, which fell by 4.17% with a value of 287.7 billion; VND, which declined by 1.49% with a value of 262.4 billion; EIB, down 1.71% with a value of 243.5 billion; and DGC, falling 1.32% with a value of 218.8 billion. This can be attributed to the fact that only a small number of stocks witnessed substantial increases in trading volume during the upward trend.

From a liquidity perspective, the upward T+ cycle has extended into the fourth session since the bottom-fishing day on June 13, characterized by high trading volume. On the one hand, this could indicate that investors who successfully bottom-fished have not yet offloaded their positions on a large scale. On the other hand, it is also possible that a cautious and targeted profit-taking strategy is being employed, as evidenced by the presence of individual stocks experiencing significant selling pressure over the last two days.

Foreign investors are also exhibiting a short-term trading mindset, with net positions fluctuating on a daily basis. Up until yesterday, this group of investors had been net buyers for four consecutive sessions, accumulating approximately VND 2,052 billion. However, today they turned into net sellers, offloading nearly VND 272 billion. While some stocks continued to attract strong foreign buying interest, such as HPG (+VND 192.2 billion), MBB (+VND 103.1 billion), SHB (+VND 51.7 billion), NVL (+VND 43.6 billion), VCG (+VND 31.8 billion), HVN (+VND 29.1 billion), and CTG (+VND 26.6 billion), the selling pressure outweighed the buying, with a larger number of stocks experiencing net selling. Notable stocks on the selling side include FPT (-VND 153.5 billion), STB (-VND 75.9 billion), VCI (-VND 59.6 billion), VNM (-VND 44.1 billion), HHS (-VND 38.2 billion), FRT (-VND 35.5 billion), PVD (-VND 29.6 billion), and NLG (-VND 26.9 billion).

The Foreign Block: Investing with a Vision

The market is buzzing with positive sentiment as tax-related news takes center stage. Today’s trading volume across the three exchanges surged compared to yesterday, with a total trading value of over VND 23,000 billion. Foreign investors continued their buying spree, with a net buy value of nearly VND 582.6 billion, of which VND 569.8 billion was net bought in matched orders alone.

Stock Market Insights: Still a Short-Term Game

Today’s profit-taking pressure was not significantly higher than yesterday’s, but the stock price performance was less favorable. The issue is not that the VNI lacks momentum at the current peak – as the index does not represent the stock’s resistance level – but rather, the breadth of selling indicates a widespread profit-taking mentality. The T+ trading trend remains dominant.

The Stock Market Soars to its Highest Peak in Over 3 Years

The VN-Index soared by almost 10 points today (June 17th), closing at 1,347 points – the highest level in over three years. Since hitting a low on April 9th due to market jitters over US tax policy news, the index has staged an impressive recovery, climbing more than 250 points, equivalent to a roughly 23% gain.