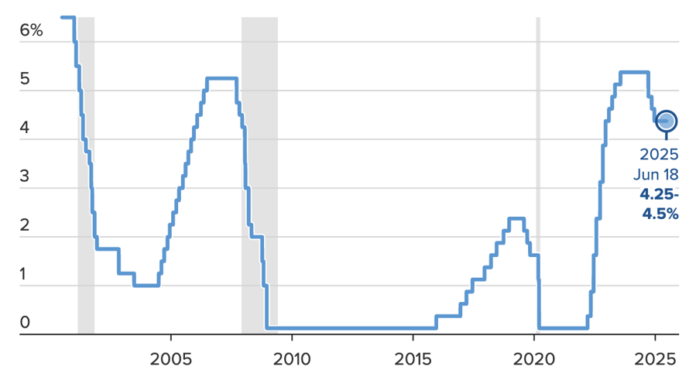

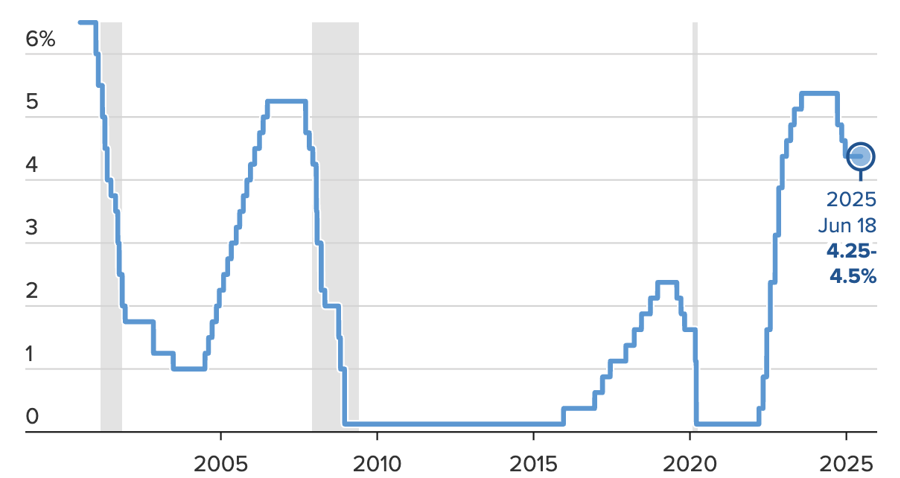

The Federal Open Market Committee (FOMC), the Federal Reserve’s monetary policy-setting body, kept the benchmark interest rate unchanged at a range of 4.25-4.5% in a widely anticipated decision. This rate has been maintained by the Fed since last December following three consecutive cuts totaling a full percentage point.

The Fed’s quarterly updated “dot-plot” interest rate forecast indicated that the central bank still expects to cut rates twice this year. For 2026 and 2027, the Fed projected a single rate cut each year.

However, these are average forecasts, and a closer look at the individual FOMC member forecasts reveals a high degree of uncertainty. As many as 7 out of 19 committee members did not want to cut rates this year, up from 4 members with this view in March.

On economic growth, the Fed’s quarterly update projected a slower growth for the US gross domestic product (GDP), forecasting a 1.4% increase this year, down 0.3 percentage points from the March forecast.

Regarding inflation, the Fed predicted that the core personal consumption expenditures (PCE) price index, which excludes volatile energy and food prices and is the Fed’s preferred inflation measure, would rise 3.1% this year, up 0.3 percentage points from the previous forecast.

The unemployment rate for the year is projected to increase to 4.5%, up 0.1 percentage points from the March forecast and 0.3 percentage points higher than the current level.

Compared to the May meeting, the Fed’s statement remained largely unchanged. The FOMC continued to assess the economy as growing solidly, with low unemployment and somewhat elevated inflation. However, the committee also expressed slightly reduced concerns about economic fluctuations and uncertainties surrounding President Donald Trump’s trade policies.

“Uncertainty about the economic outlook has diminished but remains elevated. The committee is closely monitoring the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion,” the statement read.

The Fed’s statement did not elaborate on why they believed the uncertainty had diminished, but analysts suggested it could be related to Trump’s recent reduction in trade-related rhetoric.

At a press conference following the Fed meeting, Chairman Jerome Powell signaled that the Fed had time to wait for clarity before making any policy adjustments. “We are now in a position… to see how things are going to evolve before we have to make any kind of judgment about, about changes in policy,” Powell stated.

This Fed meeting took place amid continued pressure from Trump for the Fed to lower interest rates. On June 18, the President once again criticized Powell and his colleagues for not cutting rates, arguing that the federal funds rate should be lowered by at least 2 percentage points and that Powell was “naïve” for not doing so.

For their part, Fed officials have consistently expressed the view that Trump’s tariffs could push up inflation in the coming months. “Everyone I know is forecasting that inflation will move up significantly over the next six months because of the tariffs,” Powell stated at the press conference.

The conflict between Israel and Iran was another factor the Fed had to consider, as the risk of higher energy prices could complicate any rate cut plans. However, the Fed’s post-meeting statement made no mention of the ongoing Middle East hostilities.

A slowing economy could lead the Fed to cut rates later this year. Recent employment data showed an increase in layoffs, a slight uptick in the unemployment rate, and lower consumer spending. Retail sales for May declined by nearly 1%, and the housing market weakened, with housing starts falling to a five-year low.

“The Fed wants to wait and see if tariffs cause inflation and unemployment to rise. Which leg of the Fed’s dual mandate is affected first will determine what the Fed does with rates. But the bias will be to cut, or at least hold, rates, not raise them,” said Chris Zaccarelli, chief investment officer at Northlight Asset Management, in a statement to CNBC.

Zaccarelli said he was not surprised by the Fed’s decision to hold rates steady, but the market was surprised that the Fed suggested uncertainty had “diminished.”

For Trump, lower interest rates are significant as they would reduce the US government’s borrowing costs at a time when the federal government is facing a massive $36 trillion national debt. It is projected that interest payments on the debt will reach $1.2 trillion this year, surpassing all other budget items except for Social Security and Medicare spending. The US budget deficit is expected to near $2 trillion this year, equivalent to over 6% of GDP.

Gold and Oil Prices Surge Following Trump’s Remarks

The global gold price today (June 17th) experienced fluctuations, inching up to $3,393.05 per ounce after a sharp decline earlier in the session. This movement reflects a tug-of-war between profit-taking and concerns stemming from the Middle East conflict. Investors are also keenly focused on the Fed’s meeting and other central banks, which are expected to maintain interest rates amid global economic uncertainties.

A Proposal for Regional Minimum Wage Increase from July

The representative cited that since 2023, electricity prices have surged four times, amounting to a 17% increase, while the minimum wage for workers has only been adjusted once, with a mere 6% increment. The proposal urges an immediate review and adjustment of the regional minimum wage, effective from July onwards. This is deemed a pressing necessity to address the practical needs of the working population.