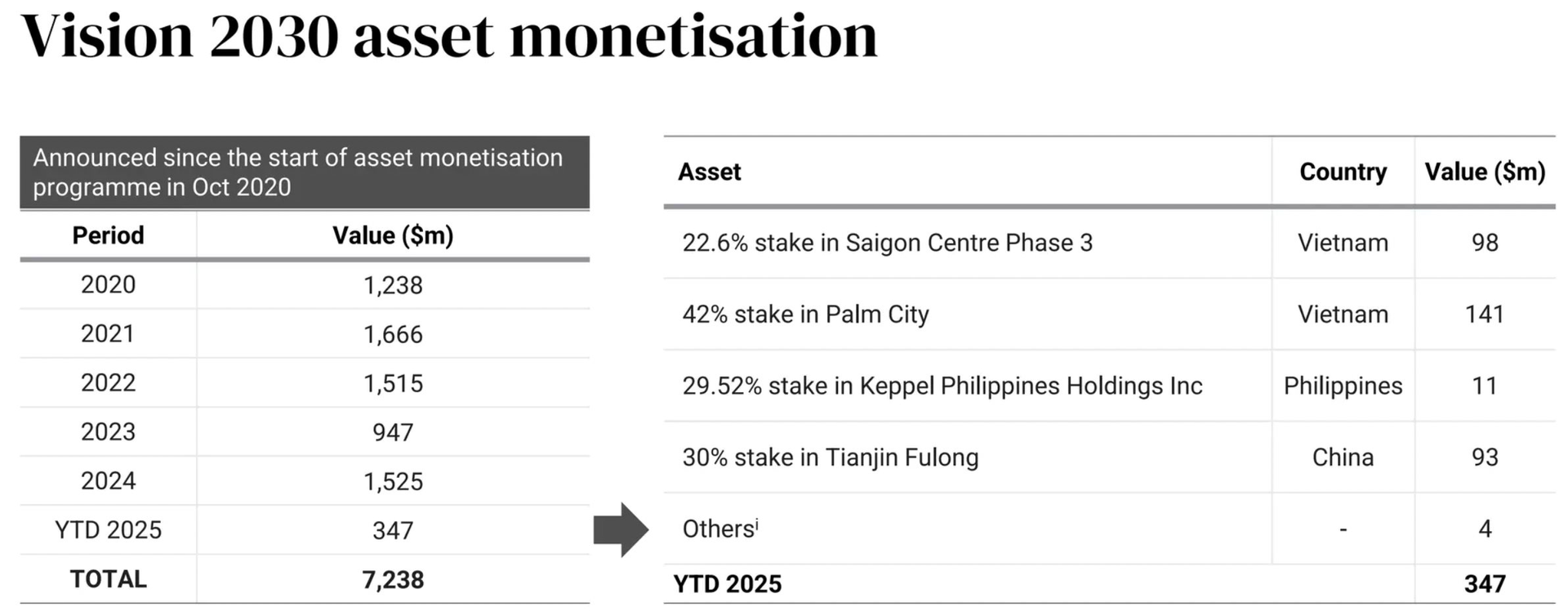

In Q1 2025, Keppel Group (Singapore) reported earning approximately SGD 98 million, equivalent to VND 1,930 billion, from selling 22.6% of its shares in the Saigon Centre Phase 3 project – a mixed-use development comprising offices, commercial spaces, and hotels located in District 1, Ho Chi Minh City.

Total divestment proceeds from the Saigon Centre project exceed VND 3,000 billion

Saigon Centre Phase 3 is a component project of the Saigon Centre located at 92-94 Nam Ky Khoi Nghia, District 1, Ho Chi Minh City. The project covers a total area of 2 hectares, including:

+ Phase 1 has a land area of 2,688 sq. m, comprising 25 floors located at 65 Le Loi, which was completed in 1996. The building offers office and apartment rentals, along with other services.

+ Phase 2 of the project was completed and put into operation in 2016. It stands at 43 stories tall, featuring 47,000 sq. m of Grade A office space, 44,000 sq. m of retail space, and 195 premium serviced apartments.

+ Phase 3 of the project has a total land area of 8,623 sq. m but has not been developed yet due to site clearance issues.

Keppel Group owns 84% of the shares in the Saigon Centre project through its two subsidiaries. In September 2024, Keppel announced that through its subsidiary, Himawari VNSC3, it had issued 46.3 million new ordinary shares of Saigon Centre Phase 3 to Toshin Development (Japan). In its 2024 year-end report, Keppel disclosed that it had sold 16% of its stake in this project, earning SGD 62.2 million (equivalent to VND 1,279 billion).

In total, the Singapore-based Group has retrieved VND 3,296 billion from divesting its stake in this project. Currently, they still hold approximately 41.4% of the shares in Saigon Centre Phase 3.

Continuous Divestment from Major Projects

Recently, Keppel also divested its entire 42% stake in Nam Rach Chiec Company (SRC), the developer of Palm City in Thu Duc City, Ho Chi Minh City. The transaction value was estimated at SGD 141 million (nearly VND 2,900 billion), with the buyer being Gateway Thu Thiem JSC.

At that time, Mr. Louis Lim, CEO of Keppel Land’s real estate business, stated that the divestment from Palm City was a step in the company’s “ambitious plan” to retrieve a total of SGD 10-12 billion (equivalent to USD 7.4-8.9 billion) from its assets by the end of 2026.

Palm City is a 30-hectare integrated urban area located on the parallel road at the beginning of the Ho Chi Minh City – Long Thanh – Dau Giay Highway. The first two residential phases of the project, Palm Residence and Palm Heights, were handed over in 2017 and 2019, respectively.

Prior to that, Keppel also divested 70% of its stake in Saigon Sports City (a 64-hectare project in Thu Duc City) for a maximum amount of nearly VND 7,500 billion.

Singapore’s Top Corporations Vow to Invest in Vietnam

During his official visit to the Republic of Singapore, Chairman of the National Assembly Tran Thanh Man met with leading Singaporean corporations and businesses that have investments in Vietnam.