The Middle East tension did not negatively impact the Vietnamese stock market. After a brief panic in the last trading session of the previous week, the VN-Index surged nearly 23 points to approach the 1,340 mark in the first session of this week.

WHAT DOES THE MARKET EXPECT?

Commenting on the market psychology, Mr. Nguyen Viet Duc, Director of Digital Business at VPBank Securities Company, stated that according to statistics, geopolitical events do not significantly affect the stock market.

In the past 50 years of geopolitical tensions, if conflicts are limited and do not escalate, their impact on the stock market usually lasts only 1-2 sessions. A few months ago, the impact of the Israel-Houthis conflict on the market lasted only one session.

Even if the conflict escalates into a war but remains confined to a specific region, the impact is still minimal. This is why the stock market recovered in the latest session, as investors believed that the conflict between Israel and Iran would be contained within the Middle East. The impact would only be felt in oil prices, without significant global repercussions.

Currently, the global market assumes that the conflict between Israel and Iran will remain regional and only affect oil prices, with the US unlikely to engage in the war. Hence, the impact of this war on the global market is mainly confined to the energy sector. Oil prices are currently around $70 per barrel, lower than the average in 2024.

In a worse-case scenario, if sanctions are imposed, the impact would be more significant. Overall, despite the apparent tension, the global stock market has historically overcome such adjustments.

“The periods when the stock market experienced the most significant declines were usually not related to wars but rather to macroeconomic factors, such as the 2008 debt crisis in the US or the 2022 bond crisis in Vietnam. Macroeconomic factors, asset bubbles, and economic issues are more likely to cause sharp market corrections, while wars are just an additional factor that may coincide with macroeconomic fluctuations and have less direct impact on the stock market,” emphasized Mr. Duc.

Sharing the same view, Mr. Nguyen The Minh, Director of Research and Analysis for Retail Customers at Yuanta Securities, stated that historically, geopolitical tensions might negatively affect the stock market in the short term, within one month, but the market usually recovers and is no longer affected after three, six, and twelve months. Therefore, investors need to manage risks in the short term to avoid sharp declines.

WHAT ABOUT THE PROSPECTS FOR ENERGY STOCKS?

Regarding the prospects for energy stocks, according to Mr. Duc, the rise in energy stocks is timely. About two weeks before the war broke out, VPBankS anticipated that the energy sector had many plans, undervalued stocks, and excellent cash flow. Investors who bought at that time would have already profited about 10-15% with most energy stocks.

According to JPMorgan’s scenario, in the worst-case scenario: sanctions on Iran, US involvement in the war, etc., oil prices could reach $120 per barrel. In the base case scenario, oil prices will peak at over $80 per barrel, with minimal market impact.

Currently, most market participants believe that JPMorgan’s base case scenario will unfold.

Israel and Iran are major economies and populous countries in the region. Although the images of conflict are shocking, both countries are still exercising restraint considering their scale and capabilities. Additionally, President Donald Trump’s encouragement for both parties to engage in negotiations could help de-escalate the situation quickly.

The market’s strong rally is also attributed to investors’ expectations of a de-escalation in tensions. Secondly, the market comprises various stocks. Therefore, whether the market goes up or down, investors can always find benefiting sectors, except in cases of macroeconomic fluctuations. With the context of rising oil prices, in addition to the surge in energy stocks, marine transportation stocks also rose today. Investors anticipate that if the energy transportation route through the Middle East is restricted, demand in other regions will increase.

Mr. Minh stated that energy stocks are typically considered a safe haven during geopolitical risks due to expectations of rising oil prices.

Regarding the energy stock group in the US, an important factor is valuation. Energy stocks are slightly undervalued in absolute terms and extremely undervalued relative to the index, making them an inexpensive hedge against geopolitical risks. However, as the chart below shows, the allocation of investor holdings in energy stocks is at a record low.

Nevertheless, the energy group is closely correlated with Brent oil price movements, and Brent oil prices are still affected by trade tensions and weak global economic growth in recent years.

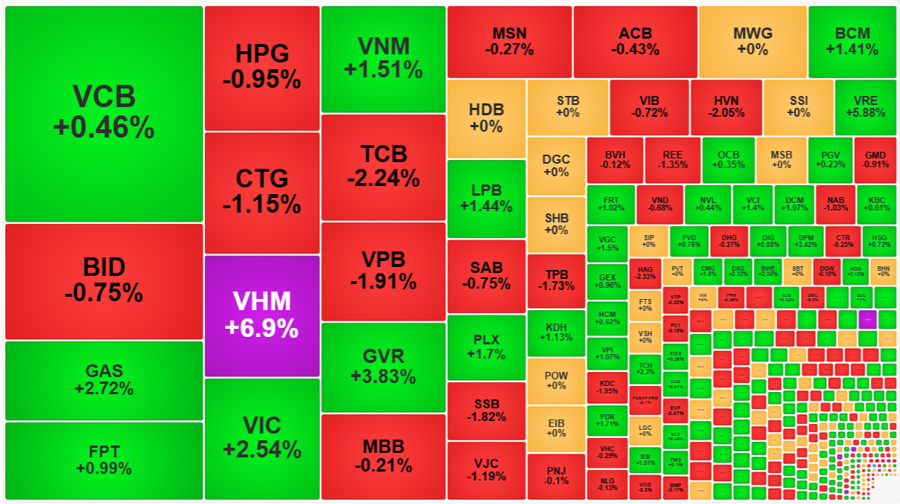

The Big Guns Fail to Lift VN-Index, Stocks Tumble Again

The market continues to exhibit hesitancy as the VN-Index once again attempts to breach new highs without the necessary momentum. Today’s peak of 1353.99 marks the highest point the index has reached in its struggle to surpass the resistance level encountered earlier this month. The lack of increased trading volume indicates that investors are also not confident in the success of this breakthrough attempt.

The Golden Dilemma: Can Gold Prices Break the $3,400/oz Mark Ahead of the Fed Meeting?

“The ‘Shark’ SDPR Gold Trust continues its buying spree, maintaining the fund’s buying trend over the past three weeks. This voracious appetite for gold investments showcases a strategic move by the trust, indicating a potential shift in the market and highlighting the precious metal’s enduring appeal as a safe-haven asset.”

Gold and Oil Prices Surge Following Trump’s Remarks

The global gold price today (June 17th) experienced fluctuations, inching up to $3,393.05 per ounce after a sharp decline earlier in the session. This movement reflects a tug-of-war between profit-taking and concerns stemming from the Middle East conflict. Investors are also keenly focused on the Fed’s meeting and other central banks, which are expected to maintain interest rates amid global economic uncertainties.

“Global Markets: Oil and Gold Prices Dip Over 1%”

The commodities market witnessed a mixed bag of results on June 16th. Oil and gold prices dipped by over 1%, while copper and iron ore prices rose, buoyed by positive data from China.