I. VIETNAM STOCK MARKET WEEK 16-20/06/2025

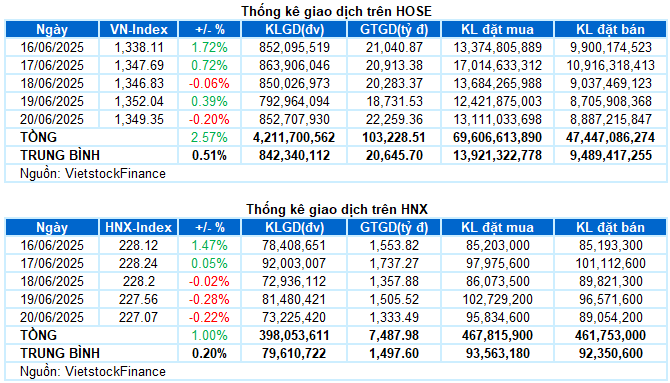

Trading: The main indices edged lower in the final trading session of the week. The VN-Index fell by 0.2% from the previous session, ending the week at 1,349.35 points; the HNX-Index also retreated to the 227.07-point mark with a similar decline. However, for the week, the VN-Index still gained a total of 33.86 points (+2.57%), while the HNX-Index added 2.25 points (+1%).

Vietnam’s stock market closed the week with cautious gains. After a strong two-day recovery at the start of the week, the indices eased in the remaining three sessions with alternating gains and losses. Trading volume consistently remained below the 20-day average throughout the week, indicating that investor sentiment was still cautious. The VN-Index ended the week at the 1,349.35-point level, a 2.57% increase from the previous week.

In terms of impact, the duo of VIC and VHM exerted the most pressure, taking away nearly 10 points from the VN-Index in the final session. Meanwhile, MBB, VCB, and CTG attempted to narrow the index’s decline with a contribution of nearly 3 points.

Sector performance remained mixed. On the downside, utilities and energy were the worst-performing sectors, ending the week nearly 2% lower. This was largely due to significant declines in stocks such as GAS (-3.2%), DNH (-13.83%), VSH (-2.77%), TDM (-1.94%), AVC (-1.43%), and BWS (-5.04%); as well as BSR (-2.13%), PVS (-2.25%), PVD (-1.17%), PVC (-2.42%), NBC (-1%), and MGC (-2.82%).

The real estate sector also lost over 1% as red dominated a series of stocks, including VIC (-2.91%), VHM (-2.09%), KSF (-1.06%), NLG (-3.38%), SIP (-2.44%), CEO (-1.65%), and DXS (-2.14%)…

On the upside, consumer staples emerged as a bright spot in the otherwise lackluster market, rising nearly 1%. Buying interest returned in force to many stocks, notably ANV and IDI, which hit the daily limit-up, along with VHC (+6.67%), DBC (+2.17%), KDC (+4.42%), HNG (+1.69%), NAF (+4.68%), PAN (+1.89%), and ASM (+3.82%).

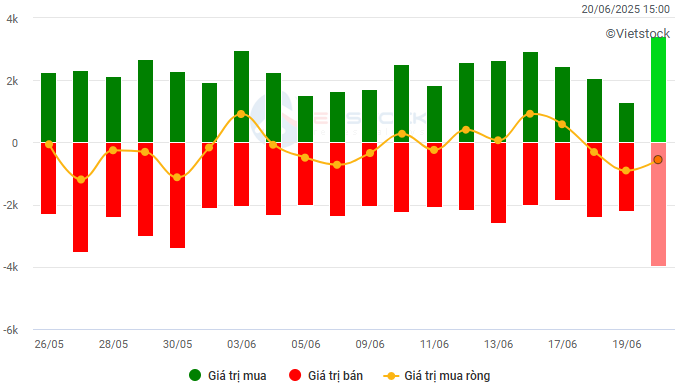

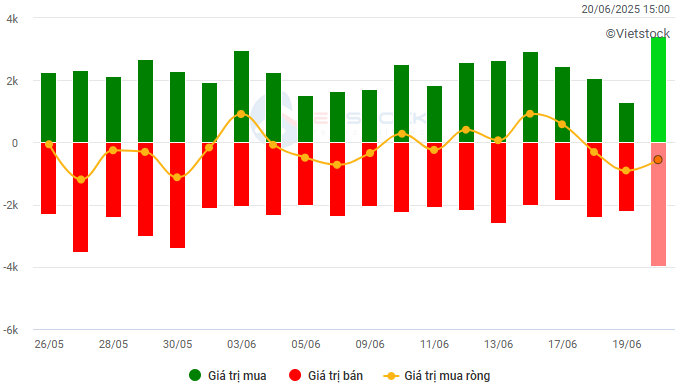

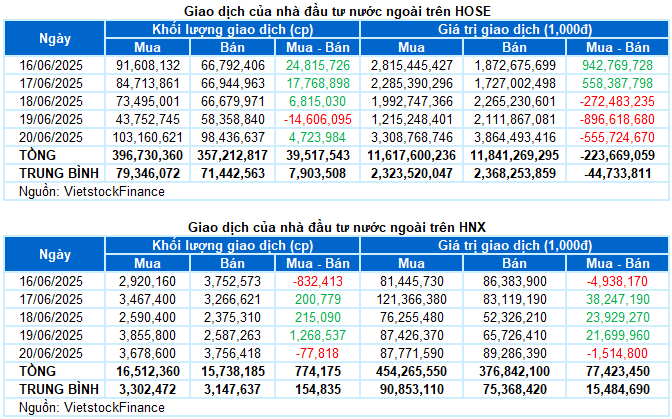

Foreign investors net sold VND 146 billion on both exchanges during the week. Specifically, they net sold over VND 223 billion on the HOSE and net bought over VND 77 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

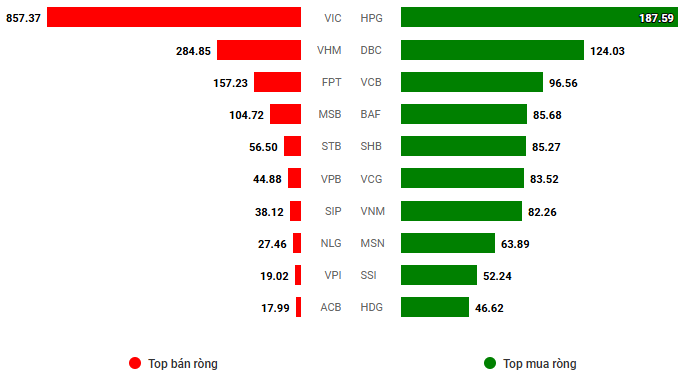

Net trading value by stock code. Unit: VND billion

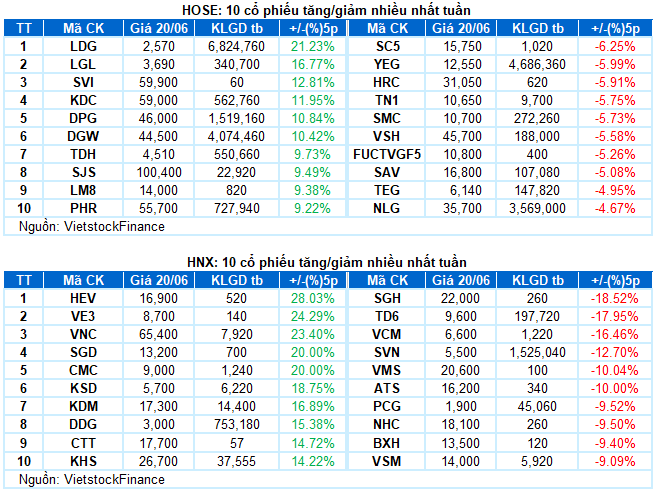

Stocks with notable gains during the week include KDC

KDC rose 11.95%: KDC experienced a vibrant trading week with 4 out of 5 positive sessions. The stock price successively surpassed the SMA 50-day and 100-day lines, while trading volume maintained above the 20-session average, reflecting a very optimistic investor sentiment.

Currently, the Stochastic Oscillator and MACD indicators continue to trend upward after generating buy signals. This suggests that the positive short-term outlook will likely persist.

Stocks with significant declines during the week include YEG

YEG fell 5.99%: YEG faced considerable selling pressure during the week after failing to test the SMA 100-day line. Moreover, trading volume fluctuated around the 20-day average, indicating investor sentiment lacked stability.

At present, the Stochastic Oscillator continues to trend downward after producing a sell signal, suggesting that the short-term downward trend may extend.

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economics & Market Strategy Division, Vietstock Research Team

– 17:18 20/06/2025

The Stock That Brokerages Suddenly Sold en Masse: A 700 Billion Surprise

The domestic securities companies turned net sellers on the Ho Chi Minh Stock Exchange (HoSE), offloading a total of VND466 billion ($20.1 million) worth of shares.

Market Pulse June 20: Foreign Investors’ Surprise Sell-Off of VIC, VN-Index Stuck in the Red

At the market close, the VN-Index witnessed a decline of 2.69 points (-0.2%), settling at 1,349.35, while the HNX-Index dipped 0.49 points (-0.22%) to 227.07. The market breadth tilted towards decliners, with 377 tickers in the red versus 337 in the green. However, the large-cap universe painted a slightly different picture, as 16 stocks in the VN30 basket advanced, outpacing 12 decliners, while 2 remained unchanged.

Market Beat on June 20: Banks Strive to Keep VN-Index Above 1,350 Mark

The intense tug-of-war continues, with major indices taking a breather mid-session below reference levels. The VN-Index strives to hold onto the 1,350-point mark, while the HNX-Index pauses at 227.15 points. A growing number of decliners were observed, with 335 falling issues versus 306 advancing ones in the morning session.

“Technical Analysis for June 20: A Prevailing Pessimism”

The VN-Index and HNX-Index both opened lower, with increased trading volume in the morning session, indicating a prevailing sense of pessimism among investors.