America Real Estate Joint Stock Company has submitted to the Hanoi Stock Exchange (HNX) a resolution of the bondholders regarding the extension of the payment period for the AME.BOND.06.2020.17 bond lot by a maximum of two years, with a new maturity date of June 12, 2027. In June alone, the company sent HNX six disclosure documents on bondholders’ resolutions.

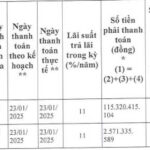

All bond lots were issued in 2020 and were expected to mature in 2025. However, after negotiations and consultations, the company has been granted an extension of up to two years by the bondholders. The interest rate for the entire extension period is fixed at 8.4%/year.

In June, America Real Estate JSC sent HNX six disclosure documents on bondholders’ resolutions to extend bond payments.

The extension comes amid a series of bond maturities in 2025, totaling thousands of billions of VND. According to data from HNX, America Real Estate JSC is currently circulating all or part of 116 bond lots. The company was formerly known as VID Winter Real Estate JSC, established in 2007.

Other real estate businesses have also extended their bonds. Crystal Bay Joint Stock Company extended the payment period for the VND 450 billion CBGCB2124001 bond lot by 56 days to June 30, 2025. This bond was issued on November 5, 2021, with a term of 36 months and a fixed interest rate of 9.5%/year. Previously, due to financial difficulties, the bondholders agreed to extend the maturity to May 5, 2025.

Sunbay Ninh Thuan Joint Stock Company also extended the SBPCB2225001 bond lot (with a circulating value of VND 2,000 billion) to June 30, instead of maturing on May 17 as initially planned.

Hai Phat Investment Joint Stock Company extended the HPXH2123008 bond lot from April 28 to June 30 to pay the remaining VND 150 billion principal.

Novaland Investment Real Estate Group Joint Stock Company announced a resolution on seeking bondholders’ opinions for the NVLB2123012 (NVL122001) bond lot to amend and supplement the document content and change the maturity date.

According to statistics from Vietnam Investment Credit Rating Joint Stock Company (VIS), in the second half of 2025, 474 bond lots with a total outstanding balance of VND 150,000 billion will mature. The real estate sector alone accounts for more than 50%, making it the industry facing the highest bond maturity pressure.

Worryingly, 26 bond lots worth VND 19,000 billion from 15 real estate enterprises are being warned of the risk of delayed repayment for the first time due to difficulties in cash flow, collateral, and financial credibility. In addition, 148 bond lots, valued at VND 25,800 billion, have officially fallen into a state of delayed payment. This indicates the increasing presence of credit risks.

In May alone, four bond lots were delayed in repayment for the first time by three real estate companies related to Hung Thinh Group and a large corporation.

These companies had previously experienced repayment delays, and their weak credit profiles, low profitability, and high financial leverage persist. Statistics show that all bonds issued by the Hung Thinh group and related companies have fallen into a state of delayed repayment…

Corporate Bonds: Back on the ‘Fast Track’

The corporate bond market is finding its feet again, with a surge in capital raising and much-needed debt restructuring from previous issuances. The market supply is heating up with a diverse range of issuances across different corporate structures. However, bond buyers, especially individual investors, still face significant risks.