The domestic gold market recorded a slight dip in prices for both SJC gold bars and rings on the morning of June 20. According to updates from gold trading enterprises, SJC gold bars were listed at 117.4 million VND per tael for buyers and 119.4 million VND per tael for sellers, a decrease of 200,000 VND per tael compared to the previous day.

Following the downward trend, the price of 99.99% pure gold rings and jewelry was adjusted, trading at around 113.5 million VND per tael for buyers and 116 million VND per tael for sellers. The reduction in this group of products was more significant, at 300,000 VND per tael.

Thus, gold rings are currently trading at their lowest price in almost a month, while SJC gold bars maintain their lowest level within the week. The gap between the prices of raw gold and gold bars has now exceeded 3 million VND per tael.

Domestic gold prices have been on a downward trend in recent days, but the market remains relatively quiet. Many investors are closely monitoring price movements, anticipating a further narrowing of the gap between domestic and global gold prices to calculate their buying point.

Domestic gold prices declined this morning

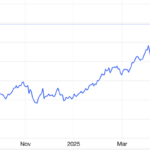

In the international market, gold prices stood at $3,357 per ounce this morning, a decrease of about $20 from the previous trading session. Despite staying above the $3,300 per ounce mark, gold prices have struggled to break out due to a lack of strong supportive information from global financial markets.

Since the beginning of the year, global gold prices have risen by nearly 30%, continuing the strong upward momentum from 2024. However, the decision by the US Federal Reserve (Fed) to maintain interest rates in the range of 4.25% – 4.5% is exerting significant pressure on the gold market, as the precious metal is typically sensitive to monetary policies.

Additionally, the ongoing tensions between Israel and Iran are not considered to have a substantial impact on the global economy at this point. Consequently, after a strong rally driven by safe-haven demand, investors are now taking profits, causing international gold prices to retreat to around $3,350 per ounce.

Some experts even predict that if geopolitical and trade tensions ease, gold prices could drop sharply, falling below the $3,000 per ounce mark by the end of this year.

Specifically, in its latest update, Citigroup lowered its short-term (0-3 months) gold price target to $3,300 per ounce, down from its previous forecast of $3,500. For the 6-12 month time frame, the bank also reduced its prediction from $3,000 to $2,800 per ounce.

At present, the global gold price converted at the listed exchange rate is only about 106.4 million VND per tael, which is about 13 million VND per tael lower than the domestic SJC gold bar price.

The Afternoon of June 20: Gold Ring Prices Plummet

The gold market witnessed a significant shift in the afternoon trading session, with prominent gold businesses slashing their prices for gold rings. The reduction reached a peak of one million VND per tael, marking a substantial adjustment.

Gold Prices Falter Despite SPDR Gold Trust’s Buying Spree

“Gold prices are finding support from escalating geopolitical tensions in the Middle East. The ongoing aerial assaults between Israel and Iran, now in their seventh day, have heightened concerns about potential supply disruptions in the oil-rich region. This has triggered a flight to safety among investors, driving up the demand for gold as a traditional safe-haven asset. The precious metal is widely regarded as a hedge against economic and political uncertainty, making it an attractive investment during times of heightened global tensions.”